Oil gains amid US–Iran tensions and significant US inventory draw

Oil benchmarks Brent and WTI advanced in tandem as geopolitical friction between the United States and Iran intensified. Simultaneously, the Energy Information Administration (EIA) reported a sharp contraction in crude oil and gasoline inventories, providing further upward momentum to prices on expectations of tighter supply and robust demand. Concurrently, the US trade balance decreased as imports outpaced exports.

Oil prices rose as the US increased its military presence in the Middle East, heightening tensions with Tehran, during negotiations regarding Iran’s nuclear programme.

The EIA’s weekly assessment revealed a substantial draw in US stockpiles—significantly contradicted analyst forecasts—pointing to a potential acceleration in energy consumption.

The US trade deficit expanded beyond market estimates in December, driven by a surge in capital goods imports and a marginal decline in industrial supply exports.

Brent and WTI hit six-month highs on US–Iran tensions and inventory drawdown

The primary oil benchmarks, Brent and WTI, rose in parallel, propelled by a combination of escalating geopolitical risks and a significant depletion of US crude reserves. Brent futures (BRNJ26) climbed 1.86% to $71.66 per barrel, while West Texas Intermediate (WTI) futures (CLJ26) appreciated by 2.51% to settle at $66.65 per barrel. Both benchmarks reached their highest levels in approximately six months.

The United States has bolstered its military posture near Iran, deploying warships and increasing regional activity. While both nations remain engaged in negotiations over Tehran’s nuclear programme, regional stability remains precarious. Global observers, including Russia, have expressed concern over the implied risks, urging a continuation of diplomatic efforts to maintain peace. However, rhetoric remains sharp; President Donald Trump cautioned on Thursday that "Iran must reach a deal or bad things will happen," reportedly setting a 10-day window for a diplomatic resolution—according to Reuters’s information.

Traders and hedgers are increasingly pricing in the risk of a direct confrontation, which could disrupt the global energy supply chain. A primary concern is the potential closure of the Strait of Hormuz—a strategic maritime corridor controlled by Iran through which approximately 20% of the world’s oil supply transits.

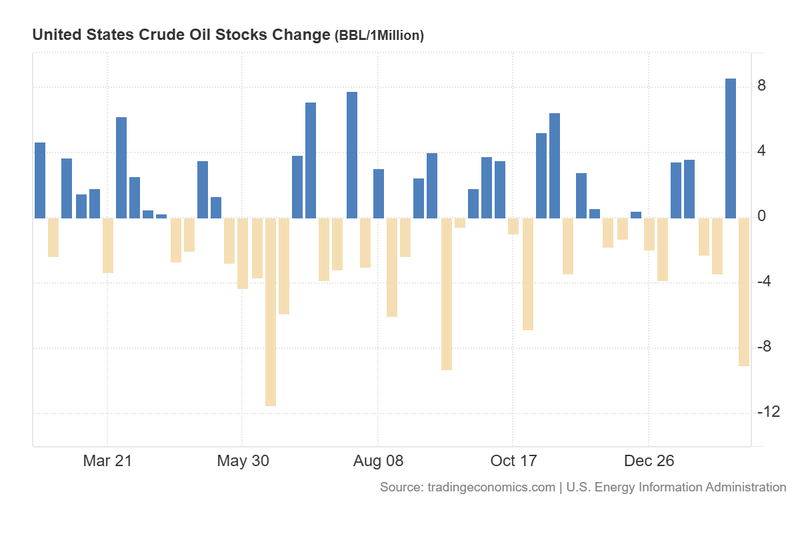

Furthermore, data from the US Energy Information Administration (EIA) showed that crude oil stocks plummeted by 9.014 million barrels last week, sharply contradicting analyst expectations of a 2.1 million-barrel build. Gasoline inventories also contracted by 3.213 million barrels, marking the first decline since November 2025. This simultaneous drop in crude and refined products suggests a tightening market where rising demand is outpacing supply, exerting upward pressure on prices.

Figure 1. US Crude Oil Stocks Change (2025-2026). Source: Data from the US Energy Information Administration; Figure obtained from Trading Economics.

US trade deficit widens amid surge in imports

According to the US Bureau of Economic Analysis (BEA), the trade deficit widened to $70.3 billion in December, a steeper contraction than the $53 billion recorded in the previous month and below consensus forecasts. This expansion was driven by a 3.6% increase in imports, contrasted by a 1.7% decline in exports. According to Reuters’ information, much of the import growth was concentrated in capital goods—specifically computers, accessories, and telecommunications equipment—reflecting robust business investment within the North American market. Conversely, exports of goods fell by 2.9%, primarily due to a downturn in industrial supplies and materials.

For the full year 2025, the US trade balance remained in significant deficit, closely mirroring 2024 levels despite various tariff measures aimed at rebalancing trade.

Market reaction to the trade data was largely negative, with US equity indices retreating as investors assessed the persistence of the deficit. The S&P 500 fell 0.28% to 6,861 points, the Dow Jones Industrial Average dropped 0.54% to 49,395, and the Nasdaq 100 depreciated by 0.41% to 24,797. In contrast, the US Dollar Index (DXY) saw a modest appreciation of 0.13%, reaching 97.82 points.