Oil prices climb as markets weigh US–Iran geopolitical risks

Crude oil prices advanced by more than 1% following renewed concerns regarding US-Iran relations. The US Department of Transportation (DOT) issued a maritime advisory urging US-flagged vessels to avoid transiting Iranian territorial waters, signaling that bilateral tensions remain unresolved. Concurrently, market participants are shifting their focus to the release of critical economic indicators this week, most notably US employment and inflation data.

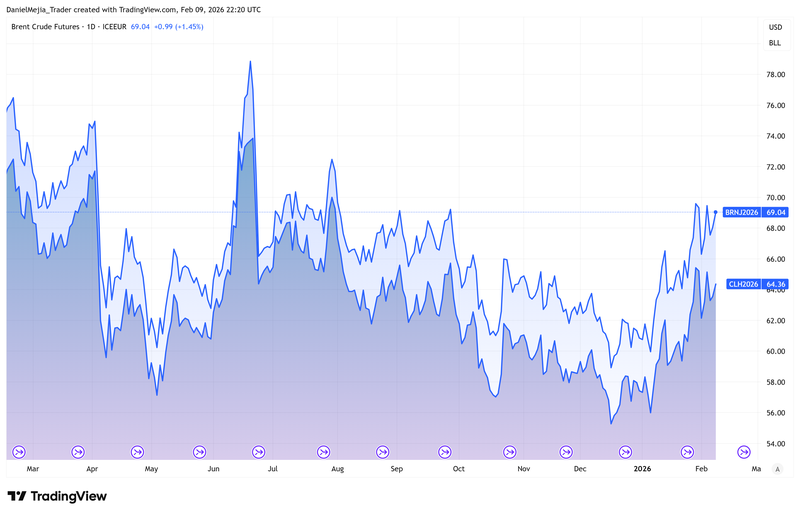

Brent crude futures rose by 1.45%, while WTI futures gained 1.27%, driven primarily by a widening geopolitical risk premium.

The US DOT’s recommendation for commercial vessels to avoid the Strait of Hormuz has heightened fears of potential supply chain disruptions in the Middle East.

Investors are awaiting key US labour market and inflation figures, both of which have experienced minor reporting delays due to the recent partial government shutdown.

Oil prices increase as US-Iran tensions intensify

Global oil benchmarks—Brent and WTI—rose in tandem as geopolitical friction between Washington and Tehran persists. The Brent futures contract (BRNJ26) climbed 1.45% to $69.04 per barrel, while the West Texas Intermediate (WTI) contract (CLH26) appreciated by 1.27% to reach $64.36 per barrel. Although high-level discussions in Oman last Friday were initially characterised as a "constructive start," the subsequent advisory from the US Department of Transportation (DOT) has tempered optimism. The DOT’s Maritime Administration issued a formal recommendation via its official portal, advising US-flagged commercial vessels to stay as far from Iranian territorial waters as possible, inclusive avoiding to transit the Strait of Hormuz if possible. This cautionary stance suggests that the underlying conflict remains a significant threat to regional stability.

Furthermore, the president Donald Trump intensified economic pressure on Friday by signing an executive order to establish a framework for a 25% tariff on imports from any nation that continues to trade with Iran, directly or indirectly—according to Reuters’ information. This shift in commercial policy further strains a bilateral relationship that has been fraught with challenges over recent years. Historically, such geopolitical risk premiums exert upward pressure on oil prices due to the persistent threat of supply disruptions at critical energy chokepoints.

Market participants are also evaluating the potential impact on global supply chains if India were to cease Russian crude imports following the recently signed trade agreement with the US. Should this occur, the outlook for oil prices would likely remain bullish as Asian supply chains undergo a structural realignment. Additionally, significant uncertainty remains as to whether Venezuelan crude production could sufficiently offset the loss of Russian supply to the Indian market.

Figure 1. Brent and WTI Futures Contracts (2025-2026). Source: Data from the COMEX and ICE-EUR Exchanges; Figure obtained from TradingView.

Quarterly US financial results

The fourth-quarter earnings season continues this week. The following key institutions are scheduled to report, which may contribute to further volatility in US and UK equity markets:

Tuesday

- Coca-Cola Company (KO)

- Gilead Sciences (GILD)

- AztraZeneca PLC (AZN)

- Barclays PLC (BARC)

Wednesday

- Cisco Systems (CSCO)

- McDonald’s Corporation (MCD)

Thursday

- Airbnb Inc. (ABNB)

- Unilever PLC (ULVR)

Friday

- Moderna Inc. (MRNA)

Key economic events this week

During this week, several key economic indicators will be released. Some of the most important are the following:

Monday

- Australia: NAB Business Confidence

Tuesday

- US: Retail Sales

- China: Inflation Rate

Wednesday

- US: Non Farm Payrolls

- US: Unemployment Rate

- US: EIA Crude Oil Stocks Change

- United Kingdom: GDP Growth Rate

Thursday

- US: Existing Home Sales

Friday

- US: Inflation Rate

- US: Core Inflation Rate