Oil prices rose amid expanding sanctions on Russian oil firms

Brent and WTI futures climbed sharply after the United States and the European Union intensified sanctions on Russian energy firms, lifting the geopolitical risk premium. At the same time, confirmation of a meeting between Presidents Trump and Xi Jinping reduced the commercial risk premium and supported US equity gains.

New Western sanctions on Russian energy firms elevated the geopolitical risk premium and supported a >5% rise in Brent and WTI futures.

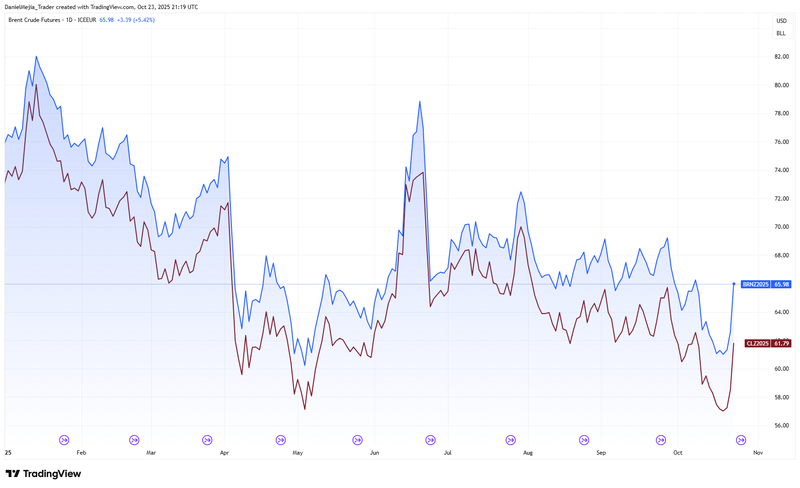

Brent futures closed at $65.96 per barrel and WTI at $61.71, while the Henry Hub natural-gas benchmark fell.

Confirmation of a Trump–Xi meeting eased trade tensions and helped US indices register concurrent gains.

Tesla reported third-quarter revenues above consensus, supporting a modest share-price advance despite mixed earnings metrics.

Markets are weighing the relative effects of geopolitical supply risks and easing commercial frictions on asset prices.

Sanctions on Russian oil companies intensify; oil prices rise

Brent and WTI futures advanced for a second consecutive session following the announcement of a fresh package of sanctions by the United States and the European Union. The sanctions form part of coordinated Western efforts to increase pressure on Russia in pursuit of a resolution to the Russia–Ukraine conflict and include restrictions affecting energy trade.

The prospect of curtailed Russian hydrocarbon exports heightened near-term over-supply concerns, contributing to a marked increase in oil prices. The Brent futures contract (BRNZ5) closed up c. 5.38% at US$65.96 per barrel, while the WTI futures contract (CLX5) gained c. 5.52% to US$61.71. By contrast, the Henry Hub natural-gas benchmark (NGX5) declined c. 2.78%.

Russian President Vladimir Putin denounced the measures as hostile but asserted they would not materially impair the Russian economy. Separately, reports that a planned meeting between US and Russian leaders had been cancelled added further to the geopolitical risk premium.

Figure 1. Futures contracts Brent and WTI (Year-to-Date). Source: Data from ICE-EUR Exchange and NYMEX Exchange. Analysis conducted via TradingView.

Commercial risk premium eases as Trump–Xi meeting confirmed

Major US equity indices closed higher after the White House confirmed a meeting between President Donald Trump and President Xi Jinping scheduled for next week. Markets appeared to ascribe greater near-term value to the prospects for de-escalation in US–China trade relations than to the intensifying tensions between Russia and Western states.

The S&P 500 closed up c. 0.58% at 6,738 points, the Dow Jones gained c. 0.31% to 46,734, and the Nasdaq-100 rose c. 0.88% to 25,097.

Tesla posts revenue beat amid mixed earnings metrics

Tesla reported third-quarter revenue of US$28.1 billion, above the consensus of US$26.22 billion, implying quarterly growth of c. 28.8% and year-on-year revenue growth of c. 11.5%. Despite the top-line beat, reported earnings per share (EPS) missed the consensus (reported US$0.50 versus an expected US$0.54), which the company characterised as reflecting margin pressures and timing of costs. The updated EPS implies a quarterly increase of 25% in the indicator, but a year-on-year decrease of 30%.

The revenue outperformance appears to have supported the share price; Tesla closed up c. 2.28% at US$448.98.

If you're interested in trading indices, foreign exchange, shares, or commodities, consider exploring the CFD contracts offered by Equiti Group. Please note that trading leveraged derivatives involves a high level of risk and may not be suitable for all investors.