Oil rises as US–Iran tensions escalate; Copper at records

The primary oil benchmarks, Brent and WTI, advanced by more than 3% following an escalation in tensions between the United States and Iran. Market participants expressed heightened concern regarding potential energy supply disruptions should Tehran move to blockade the strategic Strait of Hormuz. Concurrently, copper futures reached a new record high, driven by a confluence of demand and hedging factors.

Oil futures appreciated by over 3%, as the risk of a regional conflict in the Middle East introduced a significant geopolitical risk premium to crude prices.

Copper surged 4.7% to $6.19 per unit, supported by a weakening US dollar and long-term demand projections linked to the energy transition and artificial intelligence infrastructure.

Apple Inc. surpassed Wall Street expectations, reporting year-on-year revenue and earnings per share (EPS) growth of 15.6% and 18.3%, respectively.

Oil benchmarks Brent and WTI increase considerably amid escalating US–Iran tensions

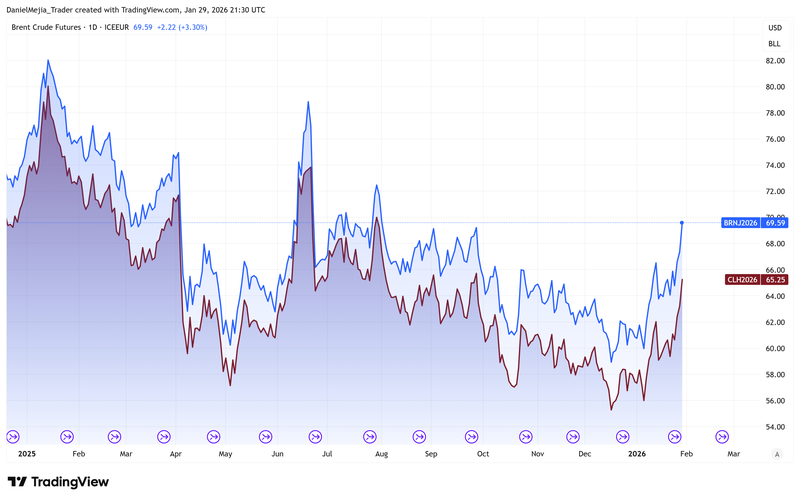

Brent and WTI crude prices rose to multi-month highs as fears intensified regarding a possible US military attack to Iran, which could jeopardise Middle Eastern supply chains. The Brent futures contract (BRNJ26) climbed 3.30% to $69.59 per barrel, its highest level since August 2025. Similarly, West Texas Intermediate (WTI) futures (CLH26) gained 3.53% to reach $65.44 per barrel, a peak not seen since late September 2025.

According to reports from Reuters, US President Donald Trump is currently evaluating options against Iranian security forces and leadership. In response, Iranian officials have stated that negotiations are impossible under the duress of military threats. Tehran has subsequently announced large-scale military exercises in strategic corridors, including the Strait of Hormuz, while enhancing its operational capabilities with new drone acquisitions.

Consequently, investors are increasingly wary of a potential blockade of the Strait of Hormuz. According to the US Energy Information Administration (EIA), approximately 20 million barrels of oil transit this narrow seaway daily—accounting for roughly 20% of global consumption. Furthermore, EIA data identifies Iran as the third-largest producer within the Organization of the Petroleum Exporting Countries (OPEC) as of 2025; thus, any regional hostilities would likely trigger a profound shock to global supply chains.

The rally was further supported by a significant drawdown in US crude inventories and a softening US dollar. The EIA’s weekly status report revealed that commercial crude stocks fell by 2.3 million barrels, reversing the previous week’s 3.6 million-barrel build. Simultaneously, the US Dollar Index (DXY) has declined by approximately 2%, rendering dollar-denominated commodities more attractive to international buyers.

Figure 1. Brent (BRNJ26) and WTI (CLH26) futures contracts (2025–2026). Source: Data from the NYMEX and ICE-EUR Exchanges; Figure obtained from TradingView.

Copper reaches historical highs amid a confluence of demand and hedging factors

Copper futures (HGH26) surged 4.7% to close at an unprecedented $6.19 per unit. This historic performance is attributed to a combination of powerful catalysts: robust demand forecasts tied to artificial intelligence (AI) data centres, renewable energy infrastructure, and traditional industrial growth. Additionally, geopolitical instability and a weaker US dollar have further incentivised bullish positioning. However, some analysts have issued warnings regarding a potential technical retracement, suggesting that current price levels may begin to dampen physical demand from industrial consumers if the rally is perceived as being driven more by speculation than by immediate physical fundamentals.

Apple surpasses forecasts in quarterly earnings release

Apple Inc. released its latest financial results, comfortably exceeding analyst projections for both revenue and profitability. The technology giant reported total quarterly revenue of $143.76 billion, surpassing the consensus forecast of $138.39 billion. Furthermore, the firm achieved an EPS of $2.84, ahead of the $2.67 estimate. These figures represent a year-on-year (YoY) revenue increase of 15.6% and an 18.3% expansion in earnings per share. Despite the strength of this financial performance and the underlying growth in revenue and income, the company’s share price remained relatively stable during the post-market session.