Oil slides on OPEC+ output surge, all eyes on Fed and BoE

WTI crude dropped sharply as OPEC+ accelerated production increases, raising fears of oversupply. Meanwhile, global markets brace for Fed and BoE decisions, plus a barrage of key economic data.

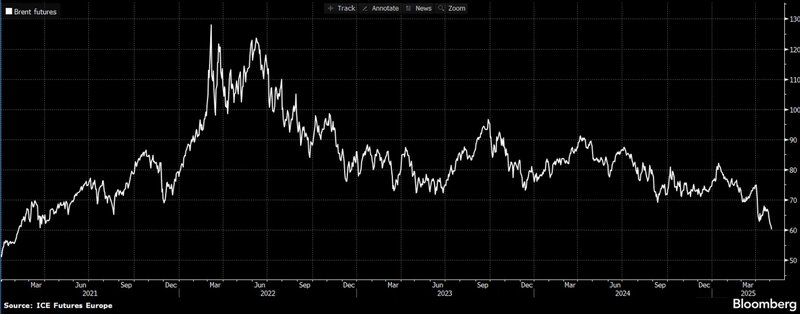

Oil prices opened the week sharply lower as traders reacted to OPEC+’s decision to ramp up production for a second consecutive month. The cartel will increase output by 411,000 barrels per day in June, bringing the total additional supply since April to nearly one million barrels daily. This represents a significant 44% rollback of the 2022-era voluntary cuts and has fueled concerns that global markets may tip into surplus.

WTI crude is now approaching the $55.20 level, a four-year low last seen in early April, reflecting bearish sentiment on both the supply and demand fronts. Market fears are growing that unless member compliance improves, OPEC+ may fully unwind its production curbs by October—just as demand outlooks remain clouded by geopolitical friction and weakening global trade momentum.

The timing is especially precarious given persistent worries over US-China trade negotiations. While the two sides remain in a 90-day truce, signs of a final breakthrough remain elusive, keeping market participants wary of demand degradation from prolonged tensions.

Fed to stay put, BoE poised to cut

This week’s macro spotlight shifts to two major central bank decisions. The Federal Reserve is widely expected to hold interest rates at 4.25–4.50%, a scenario already priced into futures markets with a 97% probability. The recent solid US non-farm payroll report has tempered expectations of a rate cut in June, with those odds falling to just 35%.

While no change is expected in the Fed's target range, markets will be laser-focused on Chair Jerome Powell’s press conference for any shift in tone. The central bank is likely to maintain a cautious, data-dependent approach, especially with inflation expectations still elevated and labor market conditions robust. The ongoing tariff truce and the possibility of escalations in July further complicate the timing of any policy move.

In contrast, the Bank of England is expected to proceed with a 25 basis point cut, lowering its Bank Rate to 4.25%. Governor Andrew Bailey has sounded increasingly concerned about the downside risks from deteriorating global trade conditions. The IMF recently revised down its UK and global growth forecasts, further reinforcing the dovish shift.

That said, markets will be watching the BoE’s updated economic projections to see if policymakers believe the softening rhetoric justifies a full easing cycle or a more measured, quarterly pace.

A heavy macro data week ahead

Beyond the central banks, global investors face a packed calendar of high-impact data releases, many of which will shed light on how the recent surge in tariffs and policy uncertainty is feeding into real economic performance.

Among the highlights:

- Tuesday: UK PMI, and trade data from Canada and the US

- Wednesday: German factory orders, Eurozone retail sales, and the FOMC decision

- Thursday: BoJ meeting minutes, BoE rate decision, and US jobless claims

- Friday: China’s trade balance, Canadian employment report