Strong US ISM services PMI, ADP jobs rebound slightly

US equity indices delivered a mixed performance as investors weighed a robust ISM Services PMI against signs of softening in the labour market. Despite a contraction in weekly EIA inventories, crude oil prices recorded a second consecutive session of losses, driven by oversupply concerns. Elsewhere, the Australian Dollar faced downward pressure following a significant deceleration in domestic inflation data.

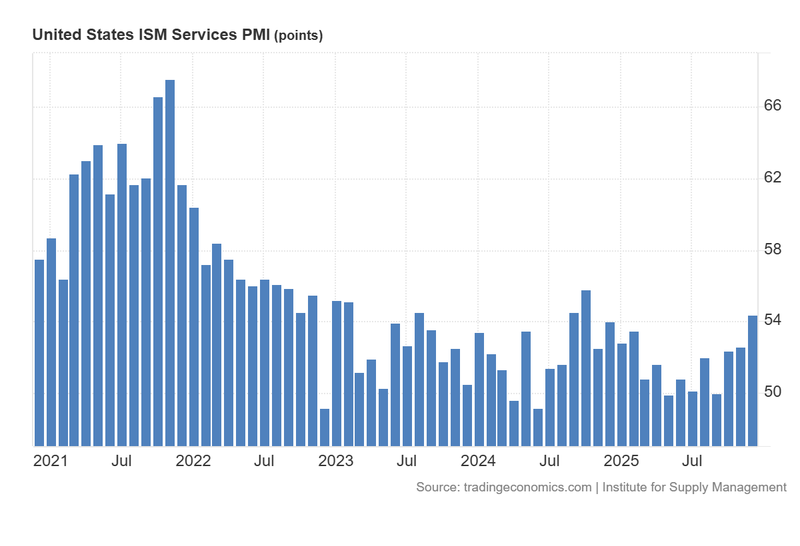

The US ISM Services PMI climbed to 54.4, its highest level since November 2024, signaling resilience in the services sector.

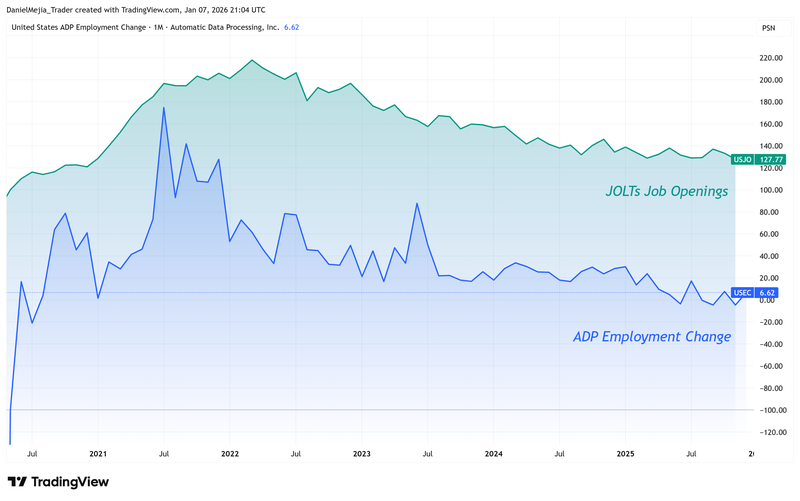

ADP Employment Change reported a modest increase of 41,000 private-sector jobs in December, missing market expectations; in turn, JOLTS Job Openings fell by 303,000, indicating a cooling trend in unfilled vacancies.

US EIA Crude Oil Inventories decreased by 3.83 million barrels; however, Brent and WTI prices declined on expectations of increased Venezuelan output.

Australian Inflation cooled to 3.4% in November, tempering fears of aggressive monetary tightening by the RBA.

US ISM services PMI outperforms expectations, signalling economic resilience

Data released by the Institute for Supply Management (ISM) revealed that the US Services PMI rose from 52.6 in November to 54.4 points in December. This figure comfortably exceeded the consensus forecast of 52.3, marking the highest reading since November 2024. As the index remains above the 50-point threshold, it continues to indicate a sustained expansion within the sector.

The ISM report highlighted broad-based strength across several key metrics, including business activity, new orders, employment, and trade volumes (both imports and exports). Notably, the real estate, rental, and leasing sector—the largest component of the services industry—stabilised following a period of contraction.

The buoyancy of the services sector stands in stark contrast to the manufacturing PMI released earlier this week, which fell below estimates to its lowest level since late 2024. While the services data reflects underlying economic resilience, qualitative feedback within the report suggests lingering executive caution. Managers cited concerns regarding the phased implementation of tariffs and heightening geopolitical tensions as primary sources of uncertainty.

Despite the positive PMI data, major US stock indices closed the session mixed. The S&P 500 declined by 0.34% to 6,920 points, while the Dow Jones Industrial Average retreated 0.94% to 48,996. Conversely, the Nasdaq-100 edged up 0.06% to 25,653 points. The US Dollar Index (DXY) also saw a modest appreciation of approximately 0.12%, reaching 98.71.

Figure 1. United States ISM Services PMI (2021-2025). Source: Data from the Institute for Supply Management; Figure obtained from Trading Economics.

ADP employment gains miss forecasts as JOLTS openings decelerate

US labour indicators from both the ADP report and the JOLTS Job Openings report suggested a loss of momentum, with both prints falling short of analyst expectations. Automatic Data Processing (ADP) reported that private payrolls expanded by 41,000 in December. While this represents a recovery from November’s contraction of 29,000, it failed to reach the 47,000 positions anticipated by the market.

Simultaneously, the Bureau of Labour Statistics (BLS) published the JOLTS Job Openings report—a measure of unfilled vacancies across the private and public sectors— that fell by 303,000 in November to 7.15 million. This marks the lowest level since October 2024 and sits significantly below the consensus estimate of 7.6 million.

Both indicators have maintained a discernible downward trajectory since 2021, reflecting a gradual cooling in both job creation and vacancy offerings. A granular look at the ADP report shows that the Services sector remained the primary driver of growth, led by Education and Health Services (+39,000) and Leisure and Hospitality (+24,000). Conversely, Professional and Business Services saw the sharpest decline, shedding 29,000 positions.

The JOLTS data further illustrated this divergence; significant vacancy reductions were noted in Accommodation and Food Services (-148,000) and Transportation and Utilities (-108,000). In contrast, the Construction sector showed resilience, adding 90,000 new vacancies.

Figure 2. US JOLTs Job Openings and ADP Employment Change (2021-2025). Source: Data from the Bureau of Labour Statistics and the Automatic Data Processing; Own analysis conducted via TradingView. Note: The indicators analysed in the figure are indexed to 100 for comparison purposes.

Oil prices slide on oversupply fears despite drawdown in US inventories

The primary crude benchmarks, Brent and WTI, extended their losing streak to a second day, ignoring a larger-than-expected drawdown in US domestic supplies. According to the Energy Information Administration (EIA), weekly crude inventories fell by 3.83 million barrels, contrary to analyst expectations of a 1.1 million-barrel build.

Typically, such a substantial decrease in inventories—often a proxy for rising demand—would bolster prices. However, market sentiment was dominated by supply-side risks. Brent crude futures (BRNH26) settled 1.22% lower at $59.96 per barrel, while WTI futures (CLG26) dropped 1.98% to $56 per barrel. Investors are increasingly pricing in the potential for US-led initiatives to tap into Venezuelan oil reserves, a move that could significantly increase global supply and maintain downward pressure on prices.

Australian inflation decelerates sharply, missing consensus estimates

In the Asia-Pacific region, the Australian Bureau of Statistics reported that the year-on-year inflation rate cooled from 3.8% in October to 3.4% in November. This was lower than the 3.7% forecast by economists and marks a three-month low. The data has effectively mitigated immediate fears of a secondary spike in prices, a concern that had been mounting since mid-2025.

The currency markets reacted swiftly to the news. The AUD/USD pair depreciated by 0.22% as traders are possibly considering that the deceleration would allow the Reserve Bank of Australia (RBA) to adopt a more neutral policy stance in the coming months, reducing the likelihood of further interest rate hikes.