Trump discusses spending cuts linked to Democrats

Today’s report focuses on salient economic and political developments. US President Donald Trump has stated that he will seek to eliminate jobs and institutions linked to the Democratic Party, citing the need to reduce government spending. Meanwhile, the unemployment rate in the European Union has risen slightly, and exports in Australia have contracted.

The investing public is awaiting the resumption of US government operations in order to access employment data.

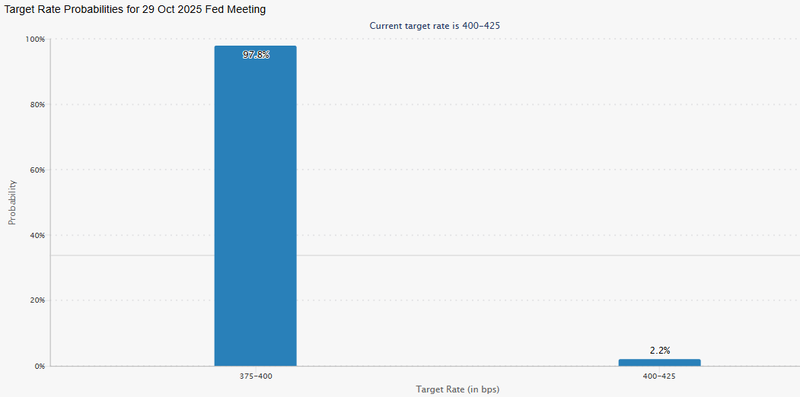

At present, the CME Group’s FedWatch tool indicates the 97% probability of a 25-basis-point cut at the Fed’s October meeting.

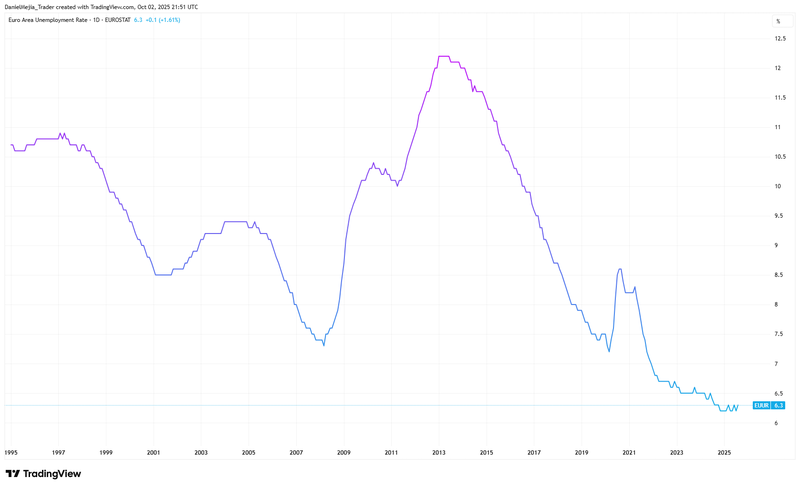

The unemployment rate in the European Union has risen to 6.3%, although this level is close to the indicator's historic lows.

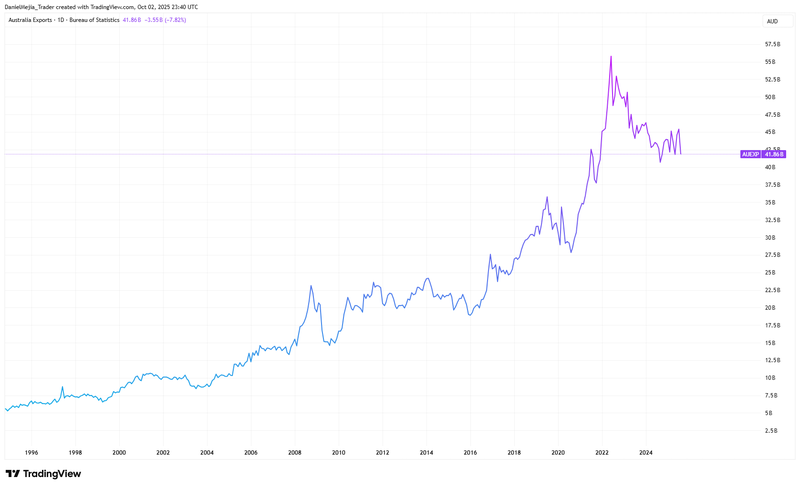

Exports in Australia decreased by 7.8%, although the long-term upward trend for the indicator remains in place.

Trump seeks to reduce expenses linked to the Democratic Party

The US government shutdown continues as President Donald Trump’s statements create uncertainty. According to information from Reuters and CNBC, Trump stated that he will meet with his budget director, Russell Vought, to determine which “Democratic Agencies” to cut. The statement is notable because the White House has previously threatened to make federal employees redundant on the grounds of cutting government spending. However, if such a plan were to be executed, there could be legal consequences owing to the severity of the situation. In turn, the US president’s approval rating could be affected, since the impact of such redundancies would be significant.

The government shutdown has resulted in the furlough of approximately two million federal workers—many with no-work orders—while others in security and border agencies have been required to work without pay. Although affected federal workers are not being paid, retroactive pay is generally guaranteed once normal duties resume. The overriding question now centres on how long the government shutdown could last, because the longer it persists, the greater the impact on the US economy and political stability.

Another relevant aspect is the implication for the Federal Reserve’s next monetary policy decision. The absence of labour data could affect the Fed’s decision, as Jerome Powell, chairman of the Federal Open Market Committee, has been emphatic that the central bank will make its decisions by weighing incoming economic data, including employment figures that will not be released until further notice due to the US government shutdown. At present, the 97% probability of a 25-basis-point cut as measured by the FedWatch tool persists (see Figure 1), because the market is weighing the weakness in new hires presented by the ADP National Employment Report yesterday.

Figure 1. FedWatch tool Source: CME Group

What impact would a mass redundancy of government employees have?

The ADP index has shown that the trend of new hires in the private sector has been decreasing, even turning negative, which implies job losses. However, this trend has not significantly impacted the US unemployment rate. If mass redundancies are applied to public servants, there could be a materially negative impact on the unemployment rate, which in turn could erode consumer confidence and create an imbalance in the country’s economy.

Despite the political uncertainty, US stock indices continue to reach new record highs. The S&P500 rose 0.06% to 6,715 points; the Nasdaq100 advanced 0.37% to 24,892 points; while the Dow Jones increased 0.17% to 46,519 points. Meanwhile, the Dollar Index (DXY) of the Intercontinental Exchange (ICE) registered a slight increase of 0.13%, reaching 97.88 points.

European Union unemployment rate rose above forecast

According to Eurostat data, the unemployment rate in the European Union experienced a slight increase, standing at 6.3%, above the previous figure of 6.2%. Although, comparatively, the EU unemployment rate is above that of several other developed economies, the current value is close to historic lows over the last thirty years (see Figure 2).

Figure 2. European Union unemployment rate (1995–2025) Source: EUROSTAT. Chart obtained from TradingView.

Within the European bloc, the countries with the highest unemployment rates include Spain with 10.3%, France with 7.5%, and Germany with 6.3%. Meanwhile, the Netherlands stands out as one of the nations with the lowest unemployment rates, at 3.9%.

Regarding the market response, the euro closed with a slight depreciation against the dollar of 0.14%, to 1.1717.

Australia’s exports contracted to a three-month low

According to information from the Australian Bureau of Statistics, the country’s exports fell by 7.8% to A$41,860 million, reaching a three-month low. While the percentage decline is substantial, the long-term upward trend in Australian exports remains intact (see Figure 3). Regarding the market response, the Australian dollar closed with a slight depreciation of 0.31% against the US dollar, reaching 0.6591.

Figure 3. Exports of Australia (1995–2025) Source: Australian Bureau of Statistics. Chart obtained from TradingView.