Government shutdown impact shows as US ADP jobs shrink

Today’s report focuses on several key economic data points. Private payrolls measured by ADP showed a contraction in the latest assessment. Eurozone inflation recorded a slight uptick. Meanwhile, crude-oil inventories rose more than expected, pressuring prices lower. All this occurred as the US government shutdown materialised amid disagreement in Congress.

The change in ADP employment showed a contraction of 32,000 private positions, below the forecast.

The government shutdown was made public, generating uncertainty about the impact on government jobs that may be affected.

Eurozone inflation rebounded towards 2.2%. The data raise expectations that the ECB will keep the rate unchanged at its next meeting.

Crude-oil inventories came in above expectations. Oil prices declined in the face of further accumulation.

Employment data from the ADP agency showed contraction

According to the ADP National Employment Report, there was a contraction of 32,000 private jobs versus the creation of 50,000 jobs expected by analysts. While ADP is not the official employment indicator, it often serves as a prelude to the Bureau of Labor Statistics’ non-farm payrolls (NFP) report, published on the first Friday of each month. Although not directly correlated, the ADP and NFP reports can reflect similar trends, as both track US private-sector job creation—though the NFP also includes public-sector payrolls. However, it is important to note that official employment data will probably not be published this week owing to the US government shutdown; accordingly, the ADP print takes on particular relevance by signalling weakness in new private hiring.

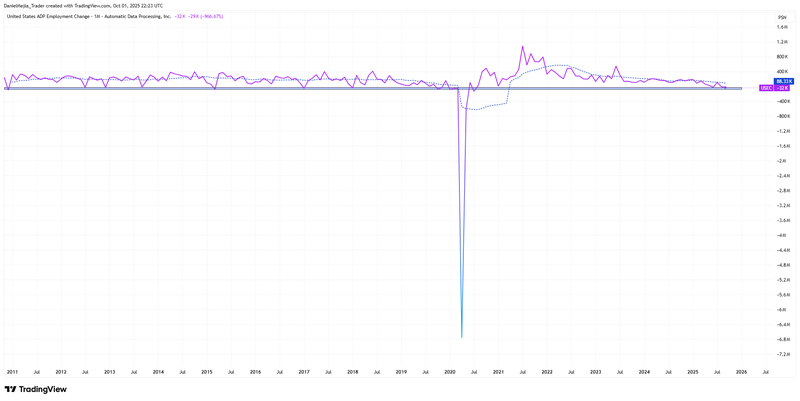

Figure 1 shows the historical behaviour of the ADP series. The chart suggests that the latest deterioration (−32,000 positions) sits near a kind of support area that could represent a lower bound of relevance. In addition, the current observation is below the 12-month year-on-year moving average, which in turn reflects softness in the indicator.

Figure 1. Change in ADP US Employment (2011–2025)

Source: Automatic Data Processing, Inc. Own analysis conducted via TradingView.

Why is the ADP indicator relevant in the current economic situation?

The ADP index measures the monthly change in private-sector payrolls in the United States, excluding government employment. A positive value (greater than zero) implies job creation; a negative value (less than zero) indicates job losses in private payrolls.

During 2025, the ADP indicator has trended lower, including negative readings in June, August, and September. This pattern signals notable weakness in new private hiring. By comparison, the NFP headline has not yet exhibited the same degree of weakness, but it could do so if public-sector payrolls are reduced after operations resume (a possibility in the context of a shutdown). Such a development could affect the unemployment rate and, by extension, investor confidence in the health of the US economy. Market attention now centres on the potential duration of the shutdown, and on how the Federal Reserve will justify its next decision scheduled for 29 October in the event of a data vacuum.

US government shutdown materialises due to disagreement in Congress

The federal government has entered a shutdown, implying a staged impact on public employment, partial agency closures, and delays in key economic data. Although the duration is uncertain, markets are focused on the implications of missing employment data for the Fed’s 29 October policy decision.

Another point of concern is the potential effect on public-sector employment should the shutdown be prolonged, given pressure from the White House to reduce government spending through cuts to the public payroll. According to Reuters, Vice President J.D. Vance stated that the administration would be forced to resort to layoffs if the shutdown lasts more than a few days, reiterating earlier intentions to curb government expenditure.

Eurozone inflation picks up

Eurozone inflation edged up to 2.2% (previous 2.0%), broadly in line with expectations. Core inflation remained unchanged at 2.3%. Services prices were the principal driver on the upside, offsetting subdued energy prices that have not yet exerted sufficient pressure on the headline.

The print is significant because it reinforces the likelihood that benchmark interest rates will remain unchanged at the ECB’s next meeting, with the Governing Council viewing current readings as broadly balanced. On one hand, further inflation could erode purchasing power; on the other, sub-target inflation would signal weakness in demand. The ECB therefore remains aligned with the current assessment of price dynamics.

Crude-oil inventories presented above expectations: oil down

The Energy Information Administration (EIA) reported a larger-than-expected crude-oil inventory build in the latest weekly reading. Analysts looked for +1.5 million barrels, while the update was +1.792 million barrels. As a result, Brent and WTI weakened into the close, consistent with the signal of softer demand amid accumulation. Brent fell 1.03% to US$65.35 per barrel, while WTI declined roughly 1.05% to US$61.80.

The stock build compounds growing expectations for additional OPEC+ supply increases that traders anticipate could be announced at the forthcoming meeting.

Gold closes with new record as dollar weakens

The gold futures contract (GCZ5) reached a new all-time high at US$3,895 per ounce, a daily rise of 0.64%. Investors and hedgers continue to accumulate exposure to the precious metal as a safe-haven asset. The US government shutdown adds uncertainty because several agencies will not publish key releases, including the employment report scheduled for this Friday. Meanwhile, markets remain focused on signs of weakening US employment amid domestic political instability.

In parallel, the Dollar Index (DXY)—which tracks the US currency against six major counterparts—slipped 0.10% to one-week lows near 97.70, following the ADP release and the onset of the shutdown.