U.S. consumer confidence contracts, as U.K. production falls

The University of Michigan’s consumer sentiment index deteriorated for a second straight month, moving back toward prior lows as households flagged tariff concerns and higher price expectations. In the U.K., both industrial and manufacturing output undershot forecasts, signaling stagnation. Equity markets also digested a strong debut from Gemini Space Station, while crude benchmarks firmed after reported Ukrainian drone strikes on Russia’s Primorsk oil port.

The consumer confidence index came in below expectations as consumers see a possible increase in prices.

Industrial and manufacturing production in the United Kingdom was below expectations, showing levels of stagnation in activity.

Gemini Space Station shares managed a 16% increase in its stock market debut.

Oil benchmarks closed higher following Ukrainian drone attacks on the Russian port of Primorsk.

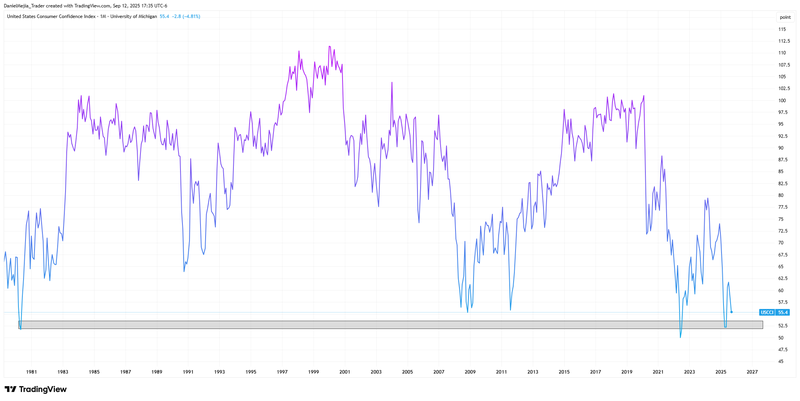

University of Michigan consumer confidence showed contraction

The University of Michigan’s consumer confidence index fell again in September, extending its decline to two consecutive months and approaching prior troughs (see figure below). The series briefly neared the 100 level in February 2020, then trended lower through the COVID period, reflecting weaker household sentiment.

Consensus expected 58.0, but the headline printed 55.4. The expectations component eased to 51.8, also missing estimates. According to Reuters, 60% of respondents cited concerns about tariffs. Long-run (5-year) inflation expectations rose to 3.9% (from 3.5%), while 1-year expectations held at 4.8%. Together, the readings point to more cautious views on employment and spending ahead of the upcoming Fed decision.

Source: Author’s analysis via TradingView portal (September 2025).

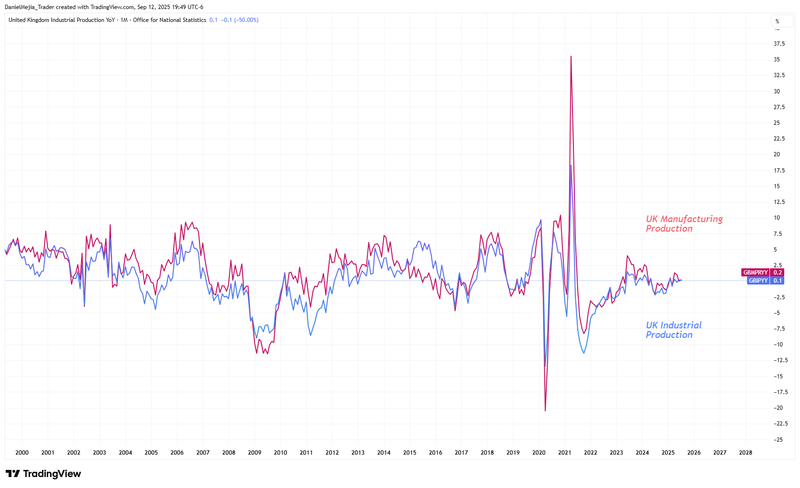

U.K. industrial and manufacturing production below expectations

U.K. production data surprised to the downside. Industrial production (y/y) rose just 0.1% (1.1% expected), while manufacturing production (y/y) printed 0.2% (1.6% expected). The negative surprise is notable given that forecasters anticipated firmer momentum. Year to date, the U.K. has not managed to sustain growth above roughly 0.4% y/y, underscoring a post-COVID pattern of stagnation in goods-sector activity. The British pound slipped 0.13% against the dollar following the release.

Source: Author’s analysis via TradingView portal (September 2025).

Gemini posts a strong stock-market debut

Citing Reuters and Yahoo Finance, Gemini Space Station achieved an IPO valuation near $4.4 billion. Shares were priced at $28 and closed around $32, implying a ~16% first-day gain. The outcome lifted sentiment across portions of the technology complex and drew attention from crypto-adjacent investors, although Bitcoin and Ethereum finished little changed.

Oil mixed on demand concerns and a higher geopolitical risk premium

Crude futures initially increased on reports of Ukrainian drone strikes at Russia’s Primorsk port—a key crude export hub—pushing intraday gains toward ~2%. The attack arrives amid elevated Russia-NATO tensions, while traders will monitor potential supply-chain impacts in the days ahead.

Gains moderated as demand concerns and a gradual supply increase reasserted themselves. U.S. EIA data earlier in the week showed a crude inventory build of 3.9 million barrels (vs. a 1.1 million draw expected), and prior OPEC+ guidance points to higher output beginning in October. By the close, Brent settled +0.93% and WTI +0.51%.