U.S. CPI rises as expected; ECB keeps rates steady

U.S. inflation ticked up in August broadly in line with forecasts, and markets largely held to expectations for upcoming Fed cuts. The ECB left policy unchanged, crude slipped on supply/inventory signals, and Washington moved to reset ties with New Delhi.

The US CPI showed a rebound for the August assessment, but the investing public sees it at reasonable levels as it discounts interest rate cuts.

The ECB kept its benchmark interest rates unchanged as they see stability in the economies of the European bloc.

Crude oil benchmarks declined on expectations of higher global supply and inventory buildup.

The White House proposed a new ambassador to India with the aim of improving diplomatic relations between the two countries.

U.S. inflation picks up, but as expected

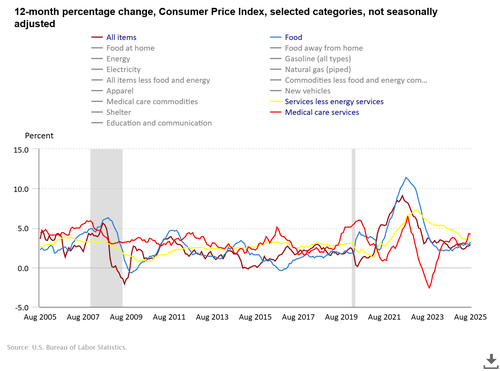

The Consumer Price Index (CPI) rose 0.4% m/m in August (slightly above consensus) and 2.9% y/y in line with expectations. Core CPI increased 0.3% m/m and 3.1% y/y, matching estimates. The breakdown pointed to firmer prices in housing, services, medical care, and food—with these categories running above the headline pace (see figure below as reference).

Despite the modest uptick, investors largely maintained the view that a Fed cut remains likely given labor-market softness and overall disinflation progress. After the release, equity futures held gains, Treasury yields edged lower, and the U.S. dollar slipped intraday.

Source: Chart from the U.S. Bureau of Labor Statistics (September 2025).

ECB keeps rates unchanged

The European Central Bank left its policy rate unchanged at 2.15%, as expected. President Christine Lagarde characterized the stance as appropriate amid generally stable conditions across the bloc, while the Governing Council monitors the impact of global tariffs and manufacturing headwinds. The ECB nudged its outlook for 2027 inflation to 1.9% (from 2.0%).

European bonds rallied modestly on the statement, and the euro appreciated about 0.30% against the dollar as markets interpreted the message as steady but flexible.

Oil falls on higher-supply expectations

Brent and WTI fell roughly 1.48% and 2.04%, respectively. The pullback followed a larger-than-expected EIA crude inventory build (+3.9 million barrels vs. −1.1 million expected) and fresh signals that OPEC+ will raise production starting in October, reinforcing a higher-supply narrative. Traders remain alert to geopolitical risks in Ukraine and the Middle East, which could still disrupt energy flows.

U.S.–India relations: cautious progress

The White House’s ambassador-nominee to India, Sergio Gor, told the Senate the two countries are “not that far away” from a tariff understanding, aligning with broader efforts to cool tensions after recent trade frictions. The U.S. previously announced tariffs on India of roughly 50% aimed at curbing Russian oil imports, while India responded by restricting certain U.S. agricultural shipments. The new nomination is intended to help re-open diplomatic and commercial channels.