US industrial output slows; Trump proposes tariffs to obtain Greenland

US industrial production growth eased slightly year on year but exceeded expectations on a month-on-month basis, highlighting resilience in the industrial sector. Meanwhile, President Donald Trump said he could impose tariffs on countries opposing his plans regarding Greenland. Separately, Novo Nordisk shares surged on positive expectations for US prescriptions of its anti-obesity drug.

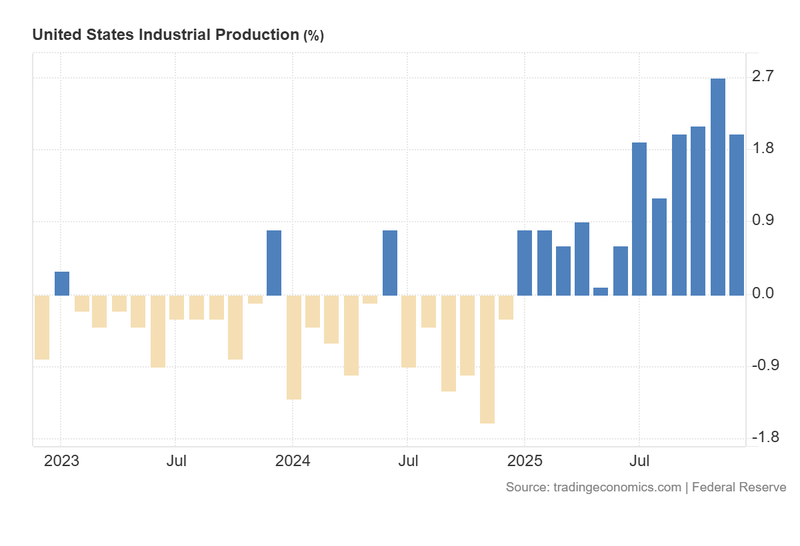

US year-on-year (YoY) industrial production slowed to 2.0% in December, though month-on-month (MoM) growth of 0.4% exceeded market expectations.

President Donald Trump has suggested the imposition of tariffs on nations opposing his acquisition plans for Greenland, heightening tensions with European allies.

Novo Nordisk shares appreciated by 9.12% following optimistic prescription data in United States for its anti-obesity medication.

US industrial production slows yearly but rises month to month

According to data released by the Federal Reserve, US industrial production (YoY) decelerated from 2.7% in November to 2.0% in December. Conversely, the month-on-month figure rose by 0.4%, outperforming the 0.1% growth projected by analysts. Despite the annual slowdown, the industrial sector continues to demonstrate a structural recovery, maintaining positive momentum following a period of contraction lasting approximately two years (see Figure 1).

While the production data suggests industrial fortitude, major equity indices closed with marginal losses. The S&P 500 retreated 0.06% to 6,940 points, the Dow Jones Industrial Average fell 0.17% to 49,359, and the Nasdaq-100 declined by 0.07% to 25,529. Market participants have now pivoted their focus toward the Personal Consumption Expenditures (PCE) Price Index scheduled for release next week, which will serve as a critical gauge for future monetary policy.

Figure 1. US Industrial Production YoY (2023-2025). Source: Data from the Federal Reserve; Figure obtained from Trading Economics.

Trump leverages tariff threats as leverage for pressuring about Greenland acquisition

As reported by CNBC, President Donald Trump has declared that he "could impose tariffs on countries if they do not accept his plans with Greenland." Although the President did not specify which nations or sectors might be targeted, the rhetoric has intensified geopolitical friction with European states supporting Denmark’s refusal to cede the territory. A fundamental difference in positions remains: while the Trump administration has proposed a financial settlement for the acquisition of Greenland, both the Greenlandic and Danish governments maintain that the territory is sovereign and "not for sale."

Furthermore, these statements coincide with a period of significant domestic legal uncertainty. The administration has frequently invoked the International Emergency Economic Powers Act (IEEPA) to bypass traditional legislative hurdles for tariff implementation. However, the US Supreme Court is nearing a verdict on the constitutionality of existing tariffs across various industries. A ruling against the administration could potentially trigger political destabilisation within the Republican executive and restrict its future trade-policy maneuvers.

Novo Nordisk surges following prescription of anti-obesity pill data in US

Novo Nordisk’s American Depositary Receipts (ADRs) closed 9.12% higher at $62.33 on the New York Stock Exchange. This valuation surge followed the release of early prescription data, which indicated robust market demand and high clinical expectations for the US launch of its GLP-1 pill.

Novo Nordisk maintains a first-mover advantage in the anti-obesity therapeutic sector, having pioneered the research and development of GLP-1 treatments. Nevertheless, the company faces intensifying competition from Eli Lilly, which is preparing to launch a rival drug in the same category. Consequently, strategic marketing and distribution efficiency will be paramount to maintaining brand dominance—factors likely to be reflected in forthcoming quarterly financial results. For the present, the optimistic sentiment surrounding the prescription data has provided a significant tailwind for the company's market capitalisation.