US jobless claims mixed; precious metals pull back

US jobless claims have yielded mixed results relative to analyst expectations prior to the official employment update from the Bureau of Labor Statistics (BLS). Meanwhile, precious metals and crude oil prices are exhibiting significant volatility amid geopolitical uncertainty involving the United States, Latin America, and Europe.

Initial and continuing jobless claims in the US rose marginally ahead of the BLS employment report.

Precious metals retrace due to potential profit-taking as investors await the unemployment rate and Non-Farm Payroll (NFP) data.

Oil prices recover following an escalation in US-Russia frictions triggered by the seizure of a Russian oil tanker.

US jobless claims yield mixed results ahead of official employment data

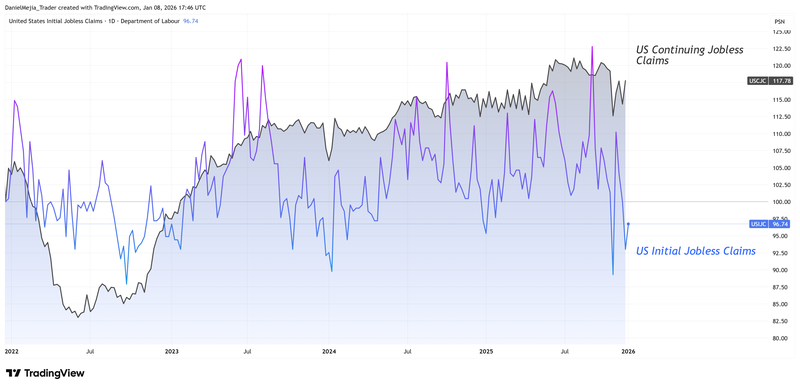

According to data from the United States Department of Labour, weekly jobless claims have produced mixed results in the latest assessment. On one hand, initial jobless claims saw a slight increase from 200,000 to 208,000, yet remained below the consensus forecast of 210,000. Conversely, continuing jobless claims—which track individuals receiving unemployment benefits for at least two consecutive weeks—rose from 1.86 million to 1.91 million, surpassing analyst projections. Consequently, the upward trajectory of continuing claims appears correlated with the rising unemployment rate, which currently stands at 4.6%—its highest level since October 2021.

This information is released on the eve of the official employment figures to be updated by the Bureau of Labor Statistics (BLS). For tomorrow’s report, the consensus expects the unemployment rate to moderate from 4.6% to 4.5% for December. Meanwhile, analysts forecast that Non-Farm Payrolls will decelerate from 64,000 to 60,000. These figures will be critical for the Federal Reserve’s upcoming policy stance, as the central bank has maintained a strictly data-dependent framework. Should the employment data indicate underlying weakness, the Fed may consider a more dovish pivot for 2026; in contrast, robust data may prompt the US central bank to maintain a neutral-to-hawkish stance supported by economic resilience.

At market close, major US stock indices closed mixed, while the US Dollar Index (DXY) has appreciated by approximately 0.20%, hovering around the 98.92 level.

Figure 1. US Initial and Continuing Jobless Claims (2022-2025). Source: Data from the US Department of Labour; Own analysis conducted via TradingView. Note: The indicators analysed in the figure are indexed to 100 for comparison purposes.

Precious metals correct as market participants await official US employment data

Precious metals have undergone two days of modest corrections, likely driven by profit-taking following sharp price appreciation in recent weeks. This previous rally was fueled by the marked escalation of geopolitical tensions between the United States and various counterparts in Latin America and Europe.

Furthermore, market participants are looking ahead to the official US employment report scheduled for release tomorrow, Friday, 9 January—specifically the unemployment rate and Non-Farm Payrolls. This data will be pivotal for the Federal Reserve's imminent policy decisions and the subsequent projections for precious metals. In an environment of expansionary monetary policy and interest rate cuts, non-yielding assets such as gold typically gain value as the US Dollar weakens. Conversely, a restrictive monetary policy generally exerts downward pressure on the sector.

Over the last two trading sessions, gold has recorded a cumulative loss of approximately 0.91%, while silver has retraced by 8% following its recent surge. Platinum and palladium have also faced corrections, declining by approximately 9% and 5%, respectively.

US seizes Russian oil tanker; oil prices surge

The primary Brent and WTI crude benchmarks rose sharply today following an escalation in tensions between the United States and Russia. According to reports from Reuters, the United States seized a Russian-flagged oil tanker on Wednesday as part of a maritime blockade imposed on Venezuelan supply networks.

In response, diplomatic sources from Russia and China condemned the seizure of Venezuelan-linked vessels, accusing Washington of violating international norms regarding national sovereignty. Russia has denounced the US actions, particularly given Venezuela’s status as a key Latin American ally. Simultaneously, China—the primary importer of Venezuelan crude—remains a critical stakeholder, as these disruptions could impact supply chains across the Asian continent.

Near the market close, the Brent futures contract (BRNH26) rose by approximately 3.39% to $61.99 per barrel. Similarly, the WTI futures contract (CLG26) appreciated by 3.16% to $57.76 per barrel. As geopolitical tensions persist, oil prices remain subject to high volatility, which continues to be a defining factor for the energy sector.