US markets fall amid employment and consumption worries

US equity indices closed the week lower amid growing concern over the absence of official employment data, elevated valuations in technology stocks and a deterioration in consumer confidence.

The US government shutdown has prevented publication of official employment statistics, increasing uncertainty ahead of the Fed’s December meeting.

Market participants are re-rating highly valued technology firms amid questions over the sustainability of AI-driven earnings expectations.

The University of Michigan’s consumer-sentiment index fell to a three-year low, compressing near-term consumption prospects.

Chinese trade data weakened: year-on-year exports and imports below expectations.

Markets slide as official employment data remain unavailable

US equity markets extended their weekly losses against a backdrop of political and macroeconomic uncertainty. The federal funding impasse has resulted in the delayed publication of official labour statistics — notably non-farm payrolls and the unemployment rate — depriving market participants of critical inputs for the Federal Reserve’s deliberations. In the absence of those data, investors have been forced to rely on private indicators and surveys, increasing the scope for divergent interpretations and heightened volatility.

Persistent questions over the valuation of technology companies, particularly those with significant exposure to artificial intelligence (AI), have compounded the risk-off mood. Elevated multiples — including price-to-earnings and PEG ratios — have prompted some investors to take profits, concentrating selling pressure in the mega-cap technology cohort.

By the close, indices were notably weaker for the week: the Dow Jones fell c. 1.9 per cent; the S&P 500 declined c. 2.5 per cent; and the Nasdaq-100 dropped c. 4.0 per cent. Implied volatility rose: the VIX was up roughly 2 per cent on the day and increased by c. 10 per cent over the week.

Figure 1. US stock indices’ performance (current week). Source: Data from the NYSE and Nasdaq Exchanges. Own analysis conducted via TradingView.

US consumer sentiment falls to a three-year low

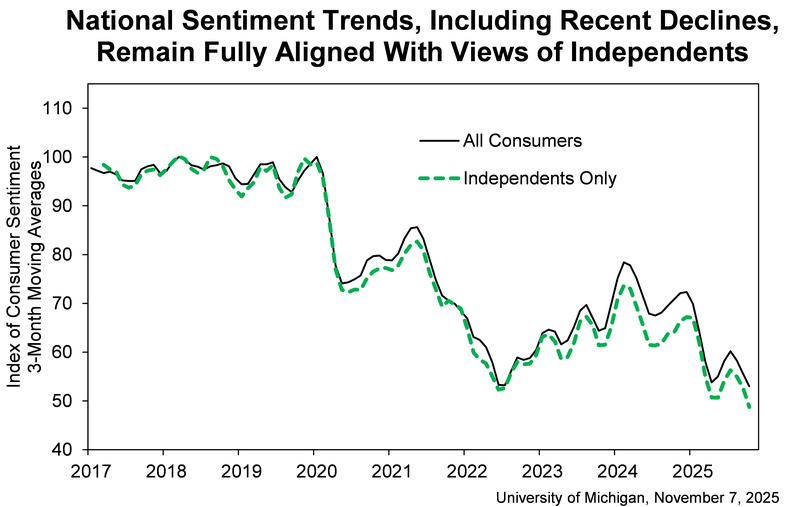

The University of Michigan’s Survey of Consumers reported a marked deterioration in sentiment for November. The headline index fell to 50.3 (versus a consensus 53.2 and a prior reading of 53.6), representing the lowest level in approximately three years and approaching the historical low recorded in June 2022. The decline was broad-based: respondents cited a 17 per cent deterioration in assessments of personal finances and an 11 per cent deterioration in expectations for economic conditions over the coming year.

Although consumer-sentiment measures capture expectations rather than realised consumption, prolonged weakness in sentiment can presage lower household spending, especially if it is sustained. The index is down around 30 per cent year-on-year and has exhibited a downward trajectory since its 2017 average.

Figure 2. US Michigan consumer-sentiment index (2017–2025). Source: University of Michigan.

Inflation expectations remain elevated amid tariff concerns

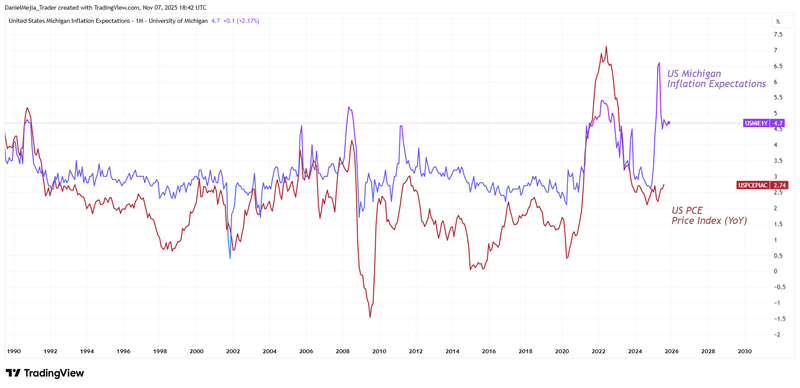

The University of Michigan’s one-year inflation-expectations measure ticked up slightly to 4.7 per cent from 4.6 per cent. Survey participants continue to cite tariffs as a source of upward price pressure. Empirically, Michigan inflation expectations have exhibited a positive correlation with the Personal Consumption Expenditures (PCE) price index; historically, divergences between expectations and realised PCE tend to narrow over time, with expectations sometimes anticipating future developments in the official data.

The current PCE price index stands at c. 2.74 per cent — above the Fed’s 2 per cent objective — suggesting that inflation remains a central concern for policymakers, even as labour-market indicators soften. The persistence of elevated inflation expectations complicates the Fed’s path to a clear easing cycle, underscoring the importance of forthcoming official releases.

Figure 3. US Michigan inflation expectations versus PCE price index (1990–2025). Source: University of Michigan and Bureau of Economic Analysis. Own analysis conducted via TradingView.

Chinese exports and imports show surprising weakness

Chinese external-trade data disappointed expectations this month. According to the General Administration of Customs, exports were down 1.1 per cent year-on-year (consensus +3.0 per cent), marking the weakest exports reading in eighteen months. Imports rose only 1.0 per cent year-on-year (consensus +3.2 per cent), also well below the prior month’s +7.4 per cent.

Market commentators attribute part of this softening to ongoing US–China commercial tensions and a strong year-earlier base, although the scheduled meeting between Presidents Trump and Xi Jinping in October could, if constructive, improve commercial flows.