US markets on record highs amid inflation below forecasts

Major US equity indices reached record highs after inflation data in the United States came in below consensus, increasing the probability of Federal Reserve rate cuts. Both headline and core inflation were reported at 3.0 per cent year-on-year, softer than many market participants had expected.

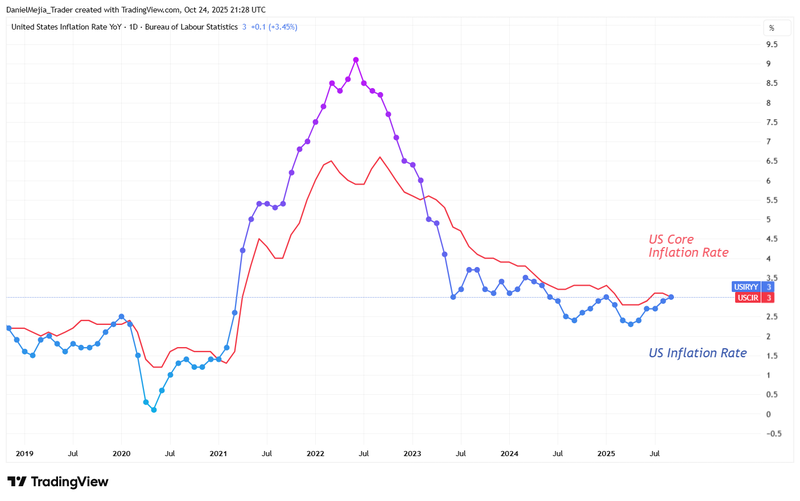

US headline and core inflation both printed at 3.0 per cent year-on-year, below consensus and supportive of Fed easing expectations.

US equity benchmarks reached all-time highs as markets priced a higher probability of imminent rate cuts.

Japan’s inflation accelerated to 2.9 per cent year-on-year, complicating the policy outlook amid rising stimulus expectations.

UK retail sales and PMIs surprised on the upside, while weaker labour-market and inflation dynamics continue to complicate the recovery.

Eurozone services PMI improved to 52.6, with manufacturing at the neutral 50-point level.

US inflation prints below estimates, lifting equities

The US Bureau of Labour Statistics reported that headline inflation rose modestly to 3.0 per cent year-on-year (from 2.9 per cent), with a monthly increase of 0.3 per cent. Core inflation, which excludes food and energy, eased slightly to 3.0 per cent year-on-year from 3.1 per cent, with a monthly rise of 0.2 per cent.

Trading Economics’ breakdown indicates notable increases in energy (year-on-year +2.8 per cent) and new vehicles (+0.8 per cent), while food inflation moderated (from 3.2 per cent to 3.1 per cent) and transportation services and used cars & trucks decelerated. The softer readings materially strengthened market probabilities for a 25-basis-point cut by the Fed: CME Group’s FedWatch Tool assigns a c. 97 per cent chance of a cut at next week’s meeting and c. 94 per cent for a further 25-basis-point reduction in December.

Investors responded to the shift in the expected policy path by lifting equity valuations. The S&P 500 rose 0.79 per cent to 6,791 points, the Dow Jones rose 1.01 per cent to 47,207, and the Nasdaq-100 advanced 1.04 per cent to 25,358.

Figure 1. US headline and core inflation rate (2019-2025). Source: Data from the US Bureau of Labour Statistics. Analysis conducted via TradingView.

Japan: inflation accelerates again

Japan’s Ministry of Internal Affairs and Communications reported that headline inflation accelerated to 2.9 per cent year-on-year, up from 2.7 per cent; core inflation also rose to 2.9 per cent. According to Trading Economics, price pressures were broad-based, with communications (+6.7 per cent), transportation (+3.0 per cent) and clothing (+2.5 per cent) among the largest contributors, while education costs fell by c. 5.6 per cent.

These data complicate the narrative surrounding prospective stimulus under the new political leadership: although market participants anticipate expansionary fiscal policy from Prime Minister Sanae Takaichi, the Bank of Japan faces a trade-off between supporting growth and containing inflation above its target. Despite the acceleration in prices, the yen weakened slightly, trading around ¥152.81 (-0.18 per cent), as markets continue to price the potential for more aggressive fiscal stimulus.

UK: retail sales and PMIs surprise to the upside

UK retail sales exceeded expectations, rising 1.5 per cent year-on-year against a consensus of +0.6 per cent, and increased 0.5 per cent month-on-month versus an anticipated −0.2 per cent. S&P Global data showed the UK manufacturing PMI at 49.6 (improved from 46.2), still below the 50 threshold but signalling material month-on-month improvement, while the services PMI rose to 51.1, indicating expansion.

Although these demand indicators were encouraging, structural challenges remain: headline and core inflation are materially above the Bank of England’s 2 per cent target (3.8 per cent and 3.5 per cent respectively), and unemployment has risen to 4.8 per cent. Market participants interpreted the combination of improving activity and still-elevated inflation as supportive of a gradual approach to policy easing; sterling weakened modestly to US$1.3309 (-0.10 per cent), while the FTSE 100 rose 0.70 per cent to a fresh high of 9,645.

Eurozone: services outperform, manufacturing at neutral

S&P Global’s euro-area release showed a manufacturing PMI at the neutral 50-point mark — a slight improvement on the prior 49.8 — while the HCOB services PMI strengthened to 52.6, signalling a healthier services sector. The euro appreciated c. 0.11 per cent to US$1.1626, reflecting both the PMI strength and the softer US dollar after the surprise US inflation print.

If you're interested in trading indices, foreign exchange, shares, or commodities, consider exploring the CFD contracts offered by Equiti Group. Please note that trading leveraged derivatives involves a high level of risk and may not be suitable for all investors.