US stocks tumble after Trump announces new tariffs

US markets and the dollar index depreciated amid an escalation in trade tensions between the US and China. In turn, oil benchmarks fell, while gold reclaimed the $4,000 per ounce level.

US President Donald Trump announced an increase in tariffs on Chinese goods to 100%. As a result, the dollar and energy prices depreciated.

US equity markets fell by an average of 2.7% amid fears of the economic impact from a trade escalation.

Japan's producer inflation data came in above expectations, contrasting with forecasts of monetary easing.

Industrial production in Mexico contracted more than analysts had expected. As a result, the peso depreciated by 1.03% despite the dollar's weakness.

Donald Trump declared tariffs on China: equity markets plunge

The major US stock indices fell by an average of 2.7% after President Donald Trump announced he would raise tariffs on Chinese exports to 100%. According to Reuters, Trump's statement was made in response to China's recently announced export limits on rare earth minerals. At the market close, the S&P 500 fell 2.71% to 6,552 points, the Dow Jones depreciated 1.90% to 45,479, while the Nasdaq 100 decreased 3.49% to 24,221 points. The latter was the most affected because rare earth minerals are essential for the technology industry.

Regarding the impact on commodities, the Brent (BRNZ5) and WTI (CLX5) oil futures contracts experienced a significant contraction of 3.82% and 4.24%, reaching $62.73 and $58.90 per barrel, respectively. Traders are likely estimating a broad-based decline in demand if the tariffs are implemented. In contrast, the gold futures contract (GCZ5) saw an increase of 0.70%, reclaiming the $4,000 per ounce level. Gold remains the primary safe-haven asset. The risk of a global slowdown, triggered by a revival of the US-China trade war, could become a reality if these tensions escalate in the coming days or weeks.

Meanwhile, currencies also showed increased volatility amid the trade war comments. The dollar index (DXY) depreciated by 0.55% to 98.85 points. In contrast, the euro rose 0.45% to 1.1614, the British pound rose 0.43% to 1.3360, and the Swiss franc increased 0.74% to 0.7994. In turn, the Japanese yen appreciated 1.26% to 151.11 yen per dollar, supported by the dollar's weakness and higher-than-expected inflation data from Japan.

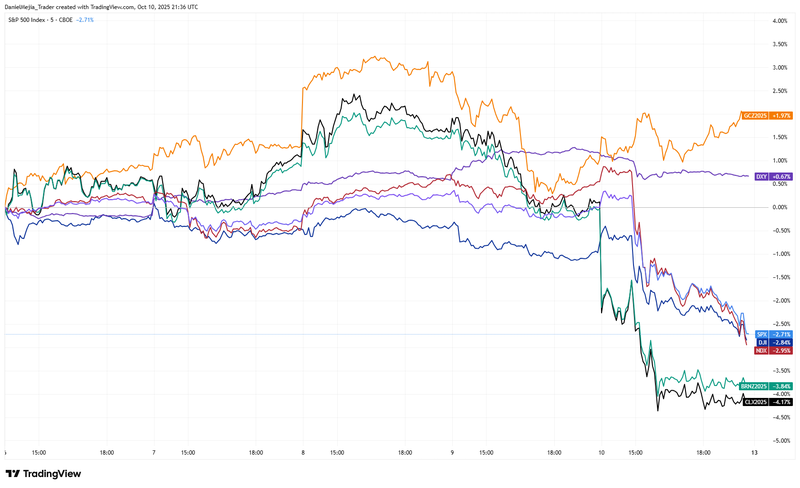

In their weekly performance, oil benchmarks depreciated by an average of 3.98%, and US stock indices posted one of their sharpest falls in recent months (down 2.83% on average). In contrast, the dollar index increased by 0.67%, while gold achieved a gain of 1.97% (see Figure 1).

Figure 1. Percentage changes in US markets, gold, oil and dollar index (week-on-week change). Source: data from NYSE Exchange, Nasdaq Exchange, Intercontinental Exchange (ICE), ICE Futures Europe, and CME Group. Proprietary analysis conducted on TradingView.

Japan's PPI exceeds estimates, prompting reassessment of BoJ stance

According to data from the Bank of Japan (BoJ), the producer price index (PPI) exceeded analysts' forecasts, holding steady at 2.7% year-on-year. The monthly PPI showed an increase of 0.3%, above estimates and the previous reading of –0.20%. Although the results do not represent a significant deviation from normal behaviour, the fact that they are above forecast puts pressure on the BoJ regarding its future monetary stance.

The inflation data contrasts with forecasts of monetary easing that have been discussed in various financial media following the rise of Sanae Takaichi as the new leader of Japan's ruling party. However, the pressure that the indicators exert on the BoJ is significant because containing prices is its primary mandate.

Industrial production in Mexico falls more than expected

According to data from Mexico's National Institute of Statistics (INEGI), industrial production contracted more than analysts had estimated. The year-on-year variation in the indicator showed a contraction of 3.6%, larger than the previous contraction of 2.7%. The monthly data showed a fall of 0.3%, missing analysts' estimates, which had forecast a 0.4% increase. The year-on-year trend has now shown two consecutive months of contraction, in turn accelerating the downward trend that began in February. This period coincides with the start of the US government's tariff implementation, which has negatively impacted the Mexican economy due to the high level of integration between the supply chains of Mexico and the US.

According to a year-on-year breakdown by Trading Economics, mining production fell 6.8%, construction decreased 4%, manufacturing contracted 3.1%, and utilities fell by 2.2%.

Regarding the market's reaction, the Mexican peso depreciated against the dollar by 1.03% at the close of the market, reaching 18.58 pesos per dollar. Meanwhile, the S&P/BMV IPC index decreased by 0.41%.