US markets rebound as US–EU tensions ease in Davos talks

US equity markets recovered by the close of trading as geopolitical tensions between the United States and the European Union moderated. During the World Economic Forum in Davos, President Donald Trump announced a framework agreement with NATO regarding the status of Greenland and rescinded previously proposed tariffs on European nations.

US President Donald Trump announced a framework agreement with NATO concerning the ongoing debate over Greenland.

The President Trump retracted his proposed imposition of tariffs and clarified that military force would not be employed to acquire Greenlandic territory.

US pending home sales fell by 9.3% in December (MoM), marking the most significant decline in over five years.

The UK inflation rate rose to 3.4% in December (YoY), up from 3.2% in November, driven by price pressures in transport, food, and tobacco.

US stock markets recover amid easing US-EU geopolitical tensions

Wall Street indices staged a recovery by the closing bell following President Donald Trump’s announcement that the United States had reached a framework agreement with NATO regarding Greenland. These remarks followed high-level discussions between President Trump and NATO Secretary General Mark Rutte. Concurrently, the US President retracted the imposition of tariffs on European countries that had been signaled in preceding days.

These developments occurred during the World Economic Forum in Davos, Switzerland. Although specific details of the aforementioned agreement remain undisclosed, the shift has significantly de-escalated geopolitical tensions between the US and the EU, which had been on an upward trajectory. Notably, President Trump further stated that the US would not resort to military force to obtain Greenlandic territory.

In response to this easing of friction, US equity markets closed with gains. The S&P 500 rose 1.16 per cent to 6,875 points; the Dow Jones Industrial Average climbed 1.21 per cent to 49,077; the Nasdaq 100 appreciated 1.36 per cent to 25,326; and the Russell 2000 surged 2 per cent to 2,698 points.

US pending home sales suffer sharpest decline in five years

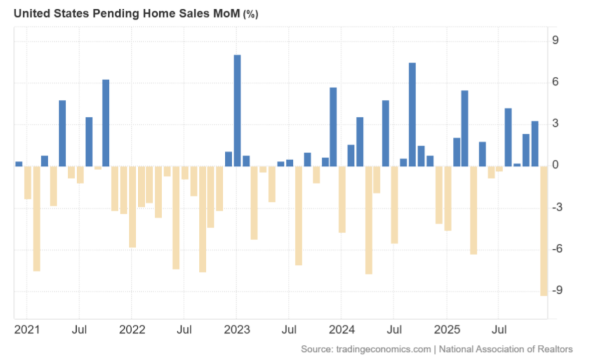

According to data released by the National Association of Realtors, US pending home sales (MoM) plummeted by 9.3% in December, representing the sharpest contraction in more than five years. Consequently, year-on-year pending home sales declined by 3%, falling well below the previous reading of +2.6%.

Reports from CNBC suggest that stagnant mortgage rates, diminishing housing supply, and persistent economic uncertainty were the primary catalysts for the December downturn. Throughout the December month, the 30-year fixed-rate mortgage average in the US remained at 6.25%, an elevated level relative to the last five years. Furthermore, a lack of inventory acted as a disincentive for prospective buyers; given the significant nature of such investment decisions, consumers appear to be awaiting a broader range of alternatives before committing.

Figure 1. US Pending Home Sales MoM (2021-2025). Source: Data from the National Association of Realtors; Figure obtained from Trading Economics.

UK inflation rate rebounds above analysts' expectations

According to the UK Office for National Statistics, the annual inflation rate rose to 3.4% in December, exceeding both the market forecast of 3.3% and the November figure of 3.2%. This rebound places renewed pressure on the Bank of England to curb rising prices amidst volatility in the labour market and a broader consolidation in economic growth.

Data from Trading Economics indicates that the most significant price increases were recorded in alcohol and tobacco (rising from 4% in November to 5.2% in December), transport costs (increasing from 3.7% to 4%), and food and non-alcoholic beverages (rising from 4.2% to 4.5%).