US PCE inflation edges higher; global stock markets gain

The US Personal Consumption Expenditures (PCE) price index accelerated slightly in November, aligning with market expectations. Concurrently, global equity markets rallied following a de-escalation of trade and diplomatic tensions between the US and the EU during the World Economic Forum in Davos, Switzerland. Furthermore, the Chinese government announced a significant treasury bond issuance aimed at financing industrial equipment upgrades and stimulating domestic consumption.

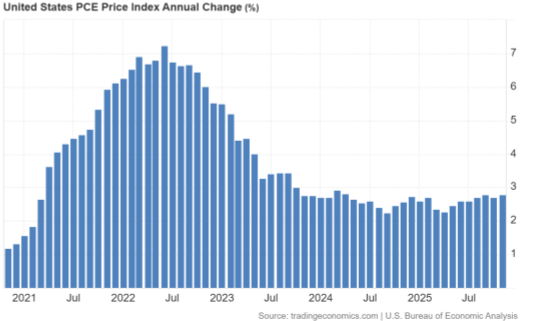

The US PCE price index rose from 2.7% in October to 2.8% in November 2025, highlighting the persistent challenges in returning to the Federal Reserve’s 2% target amidst global geopolitical and commercial volatility.

Major indices across the US, Europe, and Asia advanced in tandem as trade tensions between Washington and EU eased.

The FTSE China A50 and the Hang Seng indices climbed 0.51% and 1.02%, respectively, following Beijing’s announcement of sovereign bond issuance to support 2026 modernisation efforts and consumer demand.

US PCE price index accelerates slightly, meeting analyst expectations

According to data released by the US Bureau of Economic Analysis (BEA), the year-on-year (YoY) PCE price index—the Federal Reserve’s preferred inflation metric—rose from 2.7% in October to 2.8% in November, matching consensus forecasts. While this marginal acceleration remains within the range observed over the past two years (averaging 2.6% during that period), the rate remains notably above the Federal Reserve’s 2% mandate. Progress toward the target appears to be hampered by tariff-related pressures and broader geopolitical uncertainty. Data from Trading Economics further reveals a bifurcation in price pressures: the cost of goods increased by 1.4% YoY, while service-sector inflation rose more sharply by 3.4% in November.

Figure 1. US PCE Price Index YoY (2021-2025). Source: Data from the US Bureau of Economic Analysis; Figure obtained from Trading Economics.

Global stock markets rise amid de-escalation of US-EU tensions

Global equity markets recovered after US President Donald Trump stated at the World Economic Forum in Davos that the United States would not impose new tariffs on European nations. He further clarified that the US does not intend to acquire Greenland by force, noting that details regarding a bilateral agreement over the territory would be disclosed upon the conclusion of negotiations. In an interview with Fox Business Network, as reported by Reuters, President Trump indicated that the US anticipates full access to Greenland, including for strategic military purposes.

Market sentiment reacted positively to these developments, with gains recorded across US, European, and Asian indices:

- United States: The S&P 500 rose 0.46% to 6,907 points, the Dow Jones Industrial Average gained 0.59% to reach 49,362, and the Nasdaq 100 appreciated by 0.76% to 25,517.

- Europe: Germany’s DAX 40 climbed 1.20% to 24,856, the French CAC 40 increased 0.99% to 8,148, and the Spanish IBEX 35 rose 1.28% to 17,663.

- Asia: The Japanese Nikkei 225 surged 1.73% to 53,688, while the Hang Seng index in Hong Kong rose 1.02% to 26,917.

China issues treasury bonds to support equipment modernization

As reported by Reuters, China’s National Development and Reform Commission (NDRC) has announced the issuance of an initial 93.6 billion yuan ($13.44 billion) in treasury bonds. This capital is earmarked for equipment upgrades scheduled for 2026, with sovereign investment targeting critical sectors including manufacturing, energy, education, healthcare, and residential infrastructure. Additionally, the Chinese administration aims to bolster domestic consumption through the implementation of new federal policies for the 2026–2030 period, intended to drive long-term economic momentum.

In response to the stimulus news, the FTSE China A50 index rose 0.51% to 15,054 points, while the Hang Seng index appreciated by 1.02% to close at 26,917 points.