US stocks fall on weak home sales and AI return concerns

US equity markets declined in unison following the release of weak existing home sales data and a sharp sell-off in software and technology shares. The downturn in the tech sector was driven by intensifying investor scepticism regarding the return on investment (ROI) for artificial intelligence (AI). Furthermore, certain industries are facing increased volatility as AI tools emerge as potential direct competitors to traditional service models.

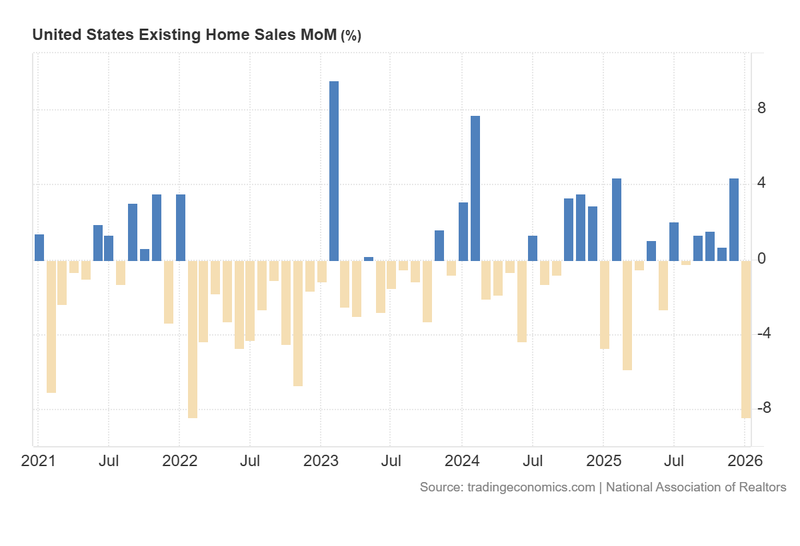

Existing home sales fell by 8.4% in January, marking the most significant monthly decline since March 2022.

The seasonally adjusted annualised rate for existing home sales retreated from 4.27 million in December to 3.91 million in January.

Industries including software, legal services, and wealth management have seen cumulative depreciations due to fears of direct displacement by advanced AI capabilities.

Technology firms are under pressure as market participants increasingly question whether the high capital expenditure required for AI infrastructure will yield the anticipated financial returns.

US existing home sales record worst month since March 2022

According to data released by the National Association of Realtors (NAR), US existing home sales fell by 8.4% in January 2026, representing the sharpest monthly decline in nearly four years. At a seasonally adjusted annualised rate, sales dropped from 4.27 million in December to 3.91 million in January, the lowest level recorded since October 2024. While economists are still assessing whether this observation constitutes a temporary anomaly or a broader trend, the figures notably missed market expectations of approximately 4.16 million units.

The downturn may signal a cooling in domestic housing demand, potentially linked to heightened consumer anxiety regarding political instability, economic performance, and the impact of trade tariffs. Analysts suggest that for this to indicate a more critical systemic impact on domestic consumption, the annualised rate would need to consistently settle below the 3.80 million threshold. Despite a deceleration in home price growth and mortgage rates sitting at three-year lows, the January contraction suggests that underlying demand may be more fragile than previously estimated if it do not recover.

Figure 1. United States Existing Home Sales MoM (2021-2026). Source: Data from the National Association of Realtors; Figure obtained from Trading Economics.

US markets retreat as investors weigh AI returns against competitive risks

Equity markets are exhibiting growing apprehension regarding AI investment returns ahead of the next quarterly earnings cycle. Massive capital outlays for data centres and AI-specific infrastructure are being scrutinised for their actual productivity gains and bottom-line contributions. Although many US firms have reported earnings above analyst expectations, the growth estimates for the remainder of 2026 are increasingly viewed as insufficient to justify current valuations. This has led an environment where companies are being penalised despite reporting positive financial results and growth outlooks.

Simultaneously, while some sectors view AI as a productivity catalyst, others perceive it as a disruptive threat capable of displacing specialised products and services. Industries such as software development, legal services, and wealth management are particularly vulnerable. A prominent example of this disruption is the Claude CoWork tool developed by Anthropic. Through advanced plug-ins, Claude CoWork can autonomously execute multi-step workflows, including the creation of complex reports, document reviews, and specialised analysis. This capability places the technology in direct competition with traditional software suites and professional service firms.

Consequently, several major corporations have experienced sustained retracements as investors recalibrate the implications of AI integration. Notable decliners over last days include Cisco Systems, Intuit Inc., Salesforce Inc., and The Charles Schwab Corporation. Meanwhile, in today’s trading session, the S&P 500 fell 1.57% to 6,832, the Dow Jones declined 1.34% to 49,451, the Russell 2000 dropped 2.01% at 2,615, while the Nasdaq 100 slid 2.04% to 24,687.