Why central banks are quietly fueling the global gold rally

A historic gold-buying spree by central banks is reshaping global reserves, signaling a broader shift away from the US dollar amid rising geopolitical and economic uncertainty.

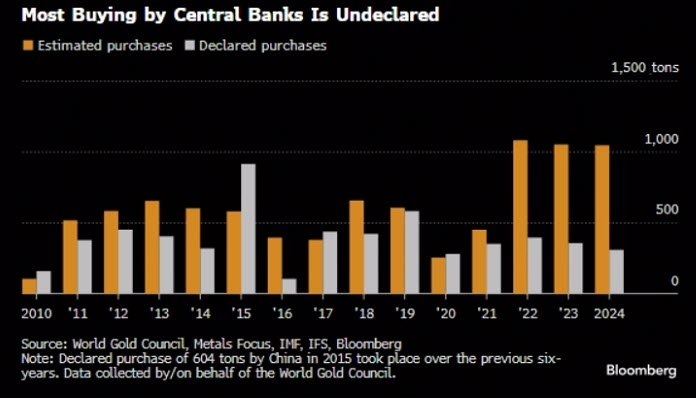

Central banks are purchasing over 1,000 metric tons of gold annually, with much of the buying going unreported.

Heightened fears over dollar weaponization, inflation, and geopolitical tensions are driving diversification into gold.

China’s opaque purchases, routed through intermediaries, suggest its gold holdings are larger than officially disclosed.

Strategic demand for gold is expected to push prices to $3,700 by year-end, and possibly $6,000 by 2029.

A silent reshuffling of reserves

In the backdrop of economic fragmentation and currency uncertainty, central banks are leading a quiet revolution in global reserve management. Gold—once sidelined as a historical relic—is regaining its central role as a strategic asset. Recent estimates show central banks are accumulating nearly 80 metric tons of gold per month, equal to about a quarter of global mine output.

What makes this trend even more striking is its opacity. A significant portion of this accumulation is not declared to international agencies. Trade data suggests that a large volume of gold is being routed through Switzerland and the UK, two key refining and storage hubs, before reaching its ultimate destination. These footprints indicate official sector involvement, but identities remain obscured.

The growing appeal of neutrality

This surge in gold demand reflects a broader shift in central bank priorities. The freezing of foreign exchange reserves in recent geopolitical conflicts raised alarms about the reliability of the US dollar as a neutral reserve asset. For many countries, gold now appears as the safer hedge—free from policy decisions, sanctions, or external control.

Alongside these concerns, high inflation, fiscal imbalances, and rising interest rate divergence have added to the appeal. Unlike bonds, gold is not someone else’s liability. Its ability to hold value during crises has transformed it into both an insurance policy and a strategic asset.

Data from 2024 shows that only one-third of gold purchases by official institutions were publicly disclosed. The rest were inferred through discrepancies in trade balances, particularly exports of 400-ounce bars (typically used by central banks) from London to Asia. Even when market conditions made these trades seemingly unprofitable, shipments continued—signaling that the motives were not commercial but monetary.

Outlook: A rally with deeper roots

With many emerging market central banks holding just 5–6% of reserves in gold, there is room to grow toward the global average near 20%. Gradual rebalancing toward that target could keep demand strong without shocking the market.

At the same time, limited supply growth and hidden demand offer structural support to prices. Analysts suggest that a modest reallocation of global foreign assets into gold—just 0.5%—could drive the metal above $6,000 an ounce in the coming years. For now, the year-end price target of $3,700 reflects strong underlying fundamentals.

Gold’s comeback isn’t just about price—it’s about power, risk management, and independence. In an age where financial alliances are increasingly political, the yellow metal is becoming a neutral ground for global monetary strategy.