Alphabet cloud growth and financial strength

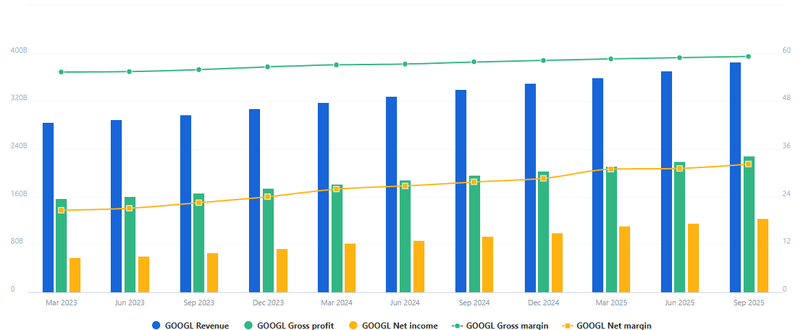

Alphabet recently reached a new all-time high of $342, signaling strong market confidence in the company’s earnings trajectory and long-term strategy. Margins are also moving in the right direction. Net margin improved 16% year over year, while gross profit climbed 16% annually and 4.2% quarter over quarter.

Revenue went up 14% over the first nine months of 2025.

Cloud profits to approach $20 billion in 2026.

Net income rose 32% year over year and 8% compared with the previous quarter.

Institutional confidence and stock growth

Large investors continue to show confidence in Alphabet’s long-term outlook. Ferguson Wellman Capital Management modestly increased its position in the company during the third quarter, according to its latest SEC filing, signaling ongoing institutional support rather than short-term trading activity. Alphabet’s core business remains on a solid growth path, with revenue rising 14% over the first nine months of 2025, supported by steady demand across advertising, YouTube, and cloud services. This institutional backing suggests expectations for continued earnings stability rather than a sharp slowdown. As long as digital advertising remains resilient and cloud revenue continues to scale, Alphabet is positioned to maintain consistent top-line growth into 2026.

Stock growth

Market sentiment has mirrored this fundamental progress. Alphabet shares recently reached a new all-time high near $342, underscoring investor confidence in the company’s earnings trajectory and strategic direction. Consistent earnings beats, resilient revenue growth, and continued institutional accumulation have helped support the stock’s valuation as of January 20, 2026. If Alphabet continues to meet or exceed expectations in upcoming quarters, the stock could remain well supported even at elevated valuation levels. While short-term consolidation is possible after such a strong run, the broader signal from current price action is that investors are increasingly viewing Alphabet as a long-term compounder rather than a cyclical technology play.

Source: Trading View

Google cloud becomes a key profit driver

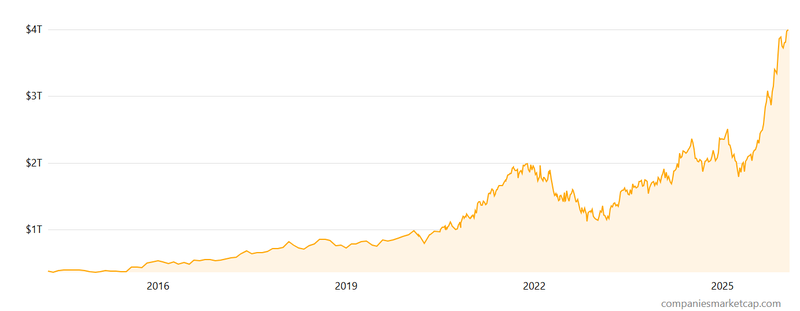

Google Cloud is no longer viewed as a side business it is becoming a major pillar of Alphabet’s earnings story. The division continues to gain traction with enterprise customers, benefiting from rising demand for data analytics, AI infrastructure, and cloud-based productivity tools. Analysts now expect cloud profits to approach $20 billion in 2026, a sharp improvement from previous years when the segment focused primarily on scale rather than profitability.

This shift is important because it diversifies Alphabet’s revenue mix and reduces dependence on advertising cycles. As cloud margins improve, Alphabet gains a more balanced business model one that can support earnings growth even if ad spending slows. This evolution is a key reason the company’s market capitalization recently reached the $4 trillion level, reflecting investor confidence in both growth and earnings durability.

Source: Companiesmarketcap

Financial performance

Alphabet’s financial results point to a company becoming more efficient while still growing. Net income rose 32% year over year and 8% compared with the previous quarter, highlighting strong bottom-line momentum. Operating income increased 18% year over year, showing that revenue growth is translating into real profits rather than being absorbed by higher costs.

Margins are also moving in the right direction. Net margin improved 16% year over year, while gross profit climbed 16% annually and 4.2% quarter over quarter. These gains suggest better cost control, stronger pricing power, and higher profitability across core segments. Taken together, Alphabet’s financial performance shows a business that is not just growing larger but becoming more productive with its capital, an important factor for sustaining valuation at elevated levels.

Source: Full ratio