Crude Oil mixed as inventory data, OPEC+ policy and Russia supply cloud outlook

Crude oil prices were mixed as traders balanced higher stockpiles in U.S. inventories with geopolitical tensions in Eastern Europe and the Middle East. OPEC+ messaging on production plans added uncertainty over supply trends, while ongoing Russia–Ukraine peace talks and Russia’s crude flows to Europe continued to shape sentiment. Market participants also weighed the possibility of rising global stocks heading into early 2026.

Unexpected build in crude inventories damped bullish momentum.

Tension around peace talks and continued Russian supply kept traders cautious.

Broader supply concerns as OPEC+ output increases versus slowing demand.

Prices have struggled to build sustained momentum in either direction.

U.S. inventories disappoint despite crude draw

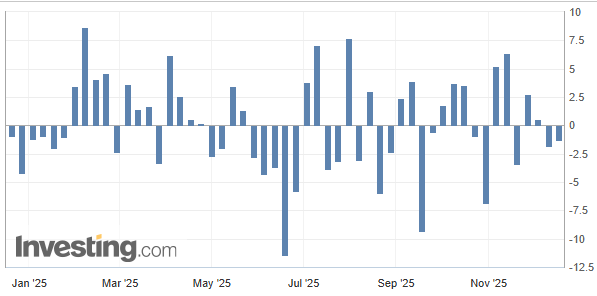

The latest U.S. crude inventory report showed a smaller draw than expected, weighing on WTI prices. According to the data released on December 17, 2025, crude stocks fell by 1.274 million barrels, well below market expectations for a 2.400-million-barrel draw. The previous week had already shown a larger decline of 1.812 million barrels, which raised hopes for a stronger tightening trend that ultimately did not materialize. This weaker-than-expected draw signaled that supply remains comfortable in the U.S. market. While inventories did decline, the slowdown in the pace of stock reductions suggests demand is not strong enough to absorb supply as aggressively as traders anticipated. In oil markets, expectations matter as much as direction, and missing forecasts often pressure prices even when inventories move lower. The data also reinforced concerns that refinery demand and end-user consumption may be softening heading into year-end. With crude draws losing momentum and refined product inventories remaining elevated, traders reassessed bullish positions, limiting upside for WTI. As long as inventory declines continue to fall short of expectations, oil prices are likely to struggle to build sustained upward momentum.

Source: Investing.com

Russia–Europe supply and peace talks

Geopolitical developments remain central to oil pricing. Russia and Ukraine peace talks have seen moments of optimism followed by setbacks, keeping the market on edge. Recent Russian statements about reviewing negotiating positions after alleged attacks dampened hopes of a swift deal, which in turn supported crude prices modestly as traders brace for prolonged conflict and potential supply risks. At the same time, Russia continues to supply crude to Europe despite sanctions and attempts by Western nations to curb those flows. Recent reporting indicates that Russian oil still reaches European markets through indirect channels, including via Turkey’s terminals. This means Russian crude remains in the system, reducing the sharp supply shock some had expected from sanctions enforcement. Periods of uncertainty around peace negotiations often produce price swings rather than a clear trend — markets react to headlines about talks one day and geopolitical disruptions on another. With no significant breakthrough yet, traders are pricing a continued supply presence from Russia mixed with geopolitical risk.

Global supply dynamics and oversupply risks

Beyond inventory and geopolitical stories, global supply dynamics continue to weigh on oil prices. OPEC+ producers have shown a clear willingness to increase output modestly, partly to regain market share and prevent prices from rising too aggressively. Several production quota increases have already been agreed, although the exact volumes vary by country and meeting. These increases come at a time when demand growth is slowing as markets look ahead to 2026, raising concerns that additional barrels could tip the balance toward oversupply. These concerns are reflected in price performance. WTI is now down nearly 20% this year, putting it on track for its steepest annual decline since 2020. The selloff highlights how expectations of ample global supply dominate market sentiment, even when short-term factors such as geopolitical risk or temporary inventory draw provide brief support. Analysts are also watching signs of an emerging global oil surplus for next year. Data from shipping and storage trackers show rising volumes of crude held on tankers and longer storage periods worldwide, suggesting that supply is accumulating faster than demand. This trend points to weaker consumption growth and reinforces fears that the market may struggle to absorb additional output in the coming quarters. As a result, even supportive headlines around geopolitical tensions or supply disruptions have had limited impact. Oversupply concerns continue to cap rallies, keeping prices under pressure. WTI’s trading range around $57–$58 per barrel reflects this ongoing tug-of-war, with supply growth and inventory builds offsetting geopolitical risk. Unless inventories begin to draw down more consistently or peace negotiations lead to meaningful supply changes, prices are likely to remain rangebound, with downside risks toward the low $50s and resistance near the $60 level.

Momentum indicators show cooling price pressure

WTI remains trapped in a broad consolidation range, reflecting uncertainty around supply, demand, and geopolitics. Prices have struggled to build sustained momentum in either direction, with recent trading clustered around the $57–$58 per barrel area. This zone has acted as a balance point where buyers and sellers repeatedly reassess market conditions. On the downside, the low $50s continue to draw attention as a key area where prices have previously stabilized. These levels have limited selling pressure during past declines, suggesting that market participants are watching them closely. On the upside, the $60 area remains a notable barrier, where rallies have repeatedly slowed as supply concerns resurface. Momentum indicators show cooling price pressure, consistent with a market that is digesting oversupply fears rather than reacting to a single dominant driver. Volatility has narrowed compared to earlier in the year, reinforcing the view that the market is waiting for clearer direction from fundamentals such as inventories, OPEC+ policy, or geopolitical developments.

Source: Trading View