DAX retreats on escalating US–European trade and geopolitical risks

The German DAX-40 index has declined following a surge in US–European trade tensions sparked by the Greenland dispute. Potential US tariff impositions have prompted the European Union to consider robust commercial retaliatory measures.

US President Donald Trump has proposed a graduated tariff schedule on several European nations, ranging from 10% to 25%.

The German DAX-40 index fell by 1.34% to 24,959 points, driven by rising geopolitical friction.

While the DAX maintains a primary long-term bullish trend, technical momentum indicators suggest the market is currently in overbought territory.

European stock indices decline amid concerns over US–European trade stability

European equity markets closed lower after US President Donald Trump announced potential tariffs targeting Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland. The proposed measures would take effect at 10% on 1 February, rising to 25% by 1 June, and would be imposed in addition to existing duties of 10% on the United Kingdom and 15% on the European Union.

In response, the European Union signaled readiness to activate its Anti-Coercion Instrument (ACI). According to CNBC, the framework could enable the bloc to bar US suppliers from participating in public tenders, alongside possible restrictions on the import and export of goods and services, as well as limitations on US foreign direct investment.

Against this backdrop, the DAX 40 fell 1.34% to 24,959 points, as investors grew increasingly concerned about the potential impact on German corporates and their supply chains.

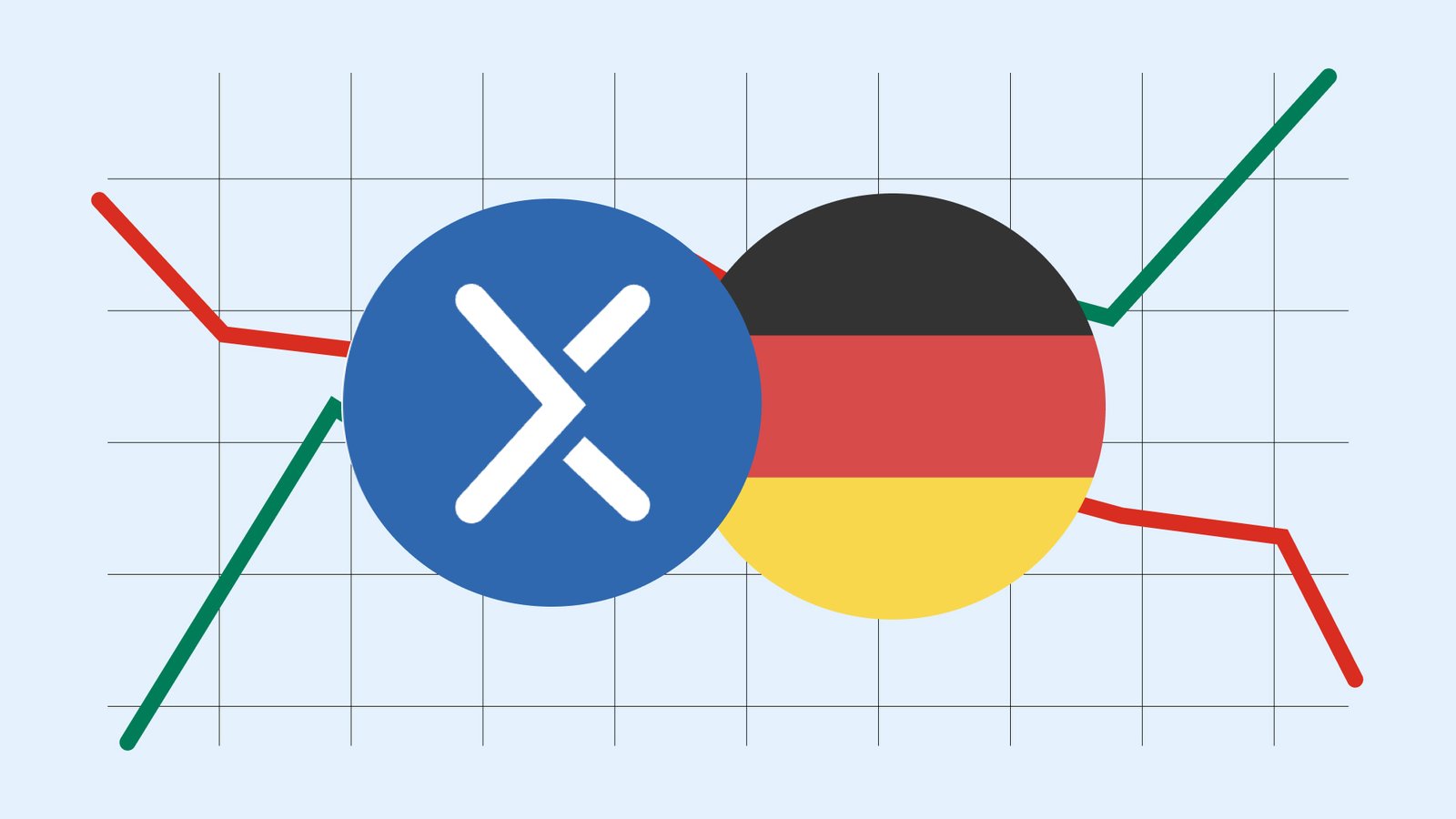

Technical analysis of the DAX-40 index

From a technical perspective, the DAX-40 remains embedded within a broader bullish trend, maintaining its position above key long-term moving averages. However, recent price action necessitates a more cautious outlook:

- Trend Context: Over the long term, the index has established a consistent bullish structure defined by higher highs and higher lows, trading comfortably above the 50, 100, and 200-period moving averages. Nevertheless, short-term momentum indicators have reached overbought levels, signalling the possibility for a temporary retracement.

- Resistance Levels: Should the index breach the immediate resistance at its record high of 25,415, the next significant ceiling is identified at 26,000 (a prominent psychological zone). A decisive daily close above this zone would signal a possible extension toward higher price targets.

- Support Levels: If the short-term support at 24,600 is compromised, the next critical floor is located at 23,100 (the base of the medium-term consolidation phase). A breach of 23,100 would significantly increase the probability of a deeper market correction.

- Momentum Indicators: The MACD (Moving Average Convergence Divergence) is currently exhibiting a bearish divergence, while the RSI (Relative Strength Index) remains in overbought territory, reinforcing the case for a period of cooling or consolidation.

Figure 1. DAX-40 Index (2024-2026). Source: Data from the Xetra Exchange; own analysis conducted via TradingView.