Dow Jones retreats amid emerging signs of softer US spending

During the current week, relevant US consumption indicators have exhibited nascent signs of weakness, weighing on the Dow Jones Industrial Average. Despite the index having recently achieved new historical highs, it has retreated as broader economic and commercial anxieties begin to permeate the market sentiment.

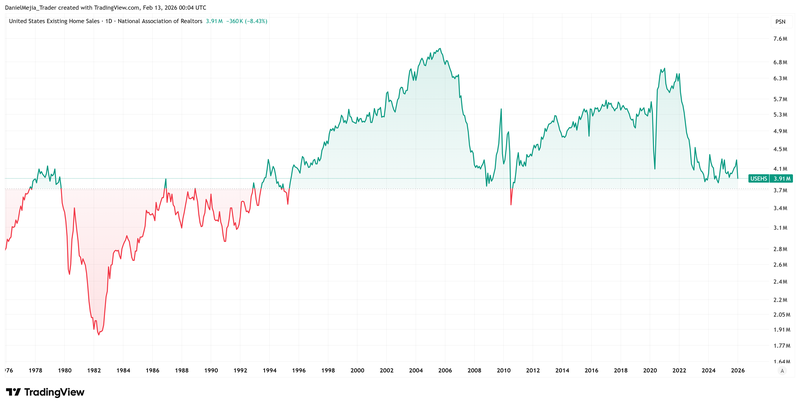

US existing home sales recorded their most significant monthly decline since March 2022, signalling a cooling in the residential sector.

December retail sales exhibited unusual stagnation, deviating from the typical seasonal increase in consumer spending patterns.

Heightened uncertainty regarding newly implemented tariffs, geopolitical tensions, and a significant reduction in the personal saving rate have collectively dampened domestic consumption.

The Dow Jones, which is notably sensitive to shifts in consumer demand, has pulled back from record levels; however, its long-term bullish trend remains technically intact.

US existing home sales and retail sales exhibit emerging signs of weakness in domestic spending

Emerging indications of a slowdown in domestic spending are becoming increasingly apparent as both the housing and retail sectors signal a cooling trend within the US economy. According to data from the National Association of Realtors, existing home sales plummeted by 8.4% in January 2026—the sharpest monthly decline since March 2022. This drop decreased the annualised rate from 4.27 million in December to 3.91 million in January, its lowest level since late 2024. While some economists suggest this volatility may be an anomalous observation, the downward trajectory persists despite 30-year mortgage rates hitting three-year lows and a deceleration in home price growth. This suggests an intrinsic hit to demand, likely fuelled by mounting political uncertainty and tariff-related anxieties.

This housing fatigue follows recent US Census Bureau data revealing that month-on-month retail sales growth stalled at 0% in December. This figure significantly missed the 0.4% expansion anticipated by analysts and dragged year-on-year growth down to 2.4% (since 3.3% in November). As reported by Reuters, this softening in consumption is being driven in part by higher prices stemming from recently implemented import tariffs, while a marginal rise in business inventories threatens to weigh on economic forecasts for the remainder of the year. Although domestic consumption has remained resilient despite waning consumer confidence, that strength was previously underpinned by a robust financial cushion. However, with the personal saving rate having cratered to 3.5% as of November 2025, the depleted surplus raises critical questions regarding the long-term sustainability of current spending levels.

Consequently, the Dow Jones Industrial Average fell by 1.34% to close at 49,451 points. This retreat highlights the industrial index's heightened sensitivity to shifts in domestic consumption and cooling demand expectations.

Figure 1. United States Existing Home Sales (1976-2026). Source: Data from the US National Association of Realtors; Figure obtained from TradingView.

Technical analysis of the Dow Jones index

From a technical perspective, the Dow Jones continues to adhere to a long-term bullish framework; however, immediate price action warrants a period of caution. Key observations include:

- Trend Context: Over the long term, the index maintains a classic market structure characterised by "higher highs" and "higher lows". Price action remains comfortably positioned above the 50, 100, and 200-period Simple Moving Averages (SMAs). Nevertheless, short-term momentum indicators are beginning to signal bearish divergences.

- Resistance Levels: Should the index achieve a decisive breach of the short-term resistance at 50,130 (the recent historical high), the market’s focus will likely shift toward the significant psychological threshold of 50,500. A sustained move above this level would signal an extension of the bull market into uncharted territory.

- Support Levels: On the downside, immediate support is identified at 48,000, a level that converges with the 100-day moving average and the floor of the medium-term bullish channel. A failure to maintain this floor would bring the structural support level of 45,000 into focus. A breach of the 45,000 zone would significantly increase the probability of a more profound structural correction.

- Momentum Indicators: Both the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) are signalling a short-term bearish divergence. This suggests that the coming sessions may see a period of consolidation or retracement.

Figure 2. Dow Jones index (2024-2026). Source: Data from the NYSE Exchange; Own analysis conducted via TradingView.