Gold prices rebound amid Fed-policy uncertainty

Gold has stabilised close to US$4,000 per ounce after a sharp run-up and subsequent retracement. Prices were supported by a combination of central-bank demand, an easing of geopolitical and trade tensions, and the Federal Reserve’s shift towards a potential easing cycle — albeit with uncertainty about the timing of any further cuts.

Gold reached a record high of US$4,350 per ounce two weeks ago and has since retraced by roughly 10 per cent to stabilise near US$4,000.

Persistent central-bank demand, easing geopolitical risk and signs of Fed policy looseness supported the earlier rally.

The ADP private payrolls report surprised on the upside (42,000 jobs), reducing the market probability of a December Fed cut and helping to cap gold’s advance.

Key official employment data (Bureau of Labour Statistics non-farm payrolls and the unemployment rate) remain critical; their availability depends on the resolution of the US government shutdown.

Gold: year-to-date performance and recent drivers

Gold recorded an exceptional year-to-date performance, culminating in a peak of US$4,350 per ounce on 20 October. The rally was underpinned by several factors: persistent purchases by central banks, heightened geopolitical tensions stemming from the Russia–Ukraine conflict, elevated trade-policy risk between the United States and China, and an expectation that the Federal Reserve might enter an easing cycle as employment indicators softened.

Since that peak, a combination of easing geopolitical tensions, signs of a thaw in US–China relations, and renewed uncertainty over the Fed’s December decision have prompted a partial profit-taking phase. Gold has retraced by approximately 10 per cent from its high and has settled around US$4,000 per ounce. Market participants attribute part of the pullback to traders locking in gains after an extraordinary c. 64 per cent year-to-date return.

Current economic data and implications for gold

The ADP private-sector employment report showed an increase of 42,000 jobs, above the consensus expectation of 25,000. Following the release, the CME Group’s FedWatch Tool reduced the implied probability of a 25-basis-point Fed cut in December from c. 69 per cent to c. 62 per cent. Stronger labour-market signals tend to raise the opportunity cost of holding non-yielding assets such as gold, which can cap price advances.

Investors are now awaiting official Bureau of Labour Statistics data — notably non-farm payrolls and the unemployment rate — later this week. The release of those statistics is contingent on the resolution of the US government shutdown; if the shutdown persists and official data are delayed, gold may consolidate as markets price uncertainty about the Fed’s information set and subsequent policy actions.

At the time of writing, gold was trading up c. 0.8 per cent at US$3,990 per ounce.

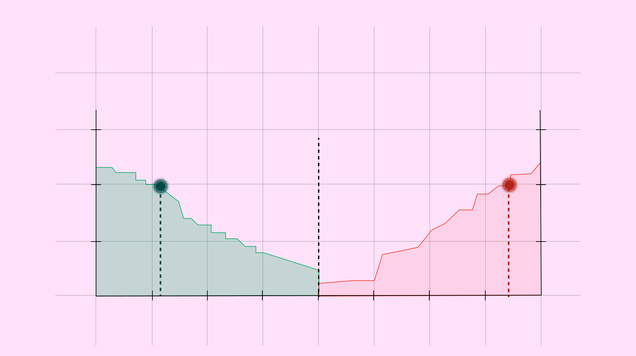

Technical outlook

From a technical perspective, the US$4,000 level is psychologically and structurally important. It also coincides with the Volume Profile’s Point of Control (POC) in recent trading — a zone representing a high volume of matched trades and a plausible short-term fair-value area. The 50-day moving average is providing additional support in the same vicinity.

Momentum indicators signal waning strength: the Average Directional Index (ADX) suggests the bullish trend has lost momentum, and both the MACD and the RSI have retreated from elevated readings. A consolidation between roughly US$3,900 and US$4,350 appears likely in the near term. However, if the nearer support around US$3,950 is breached, the next meaningful technical support combines a high-volume node with the 100-period moving average around $3,660 per ounce.

Figure 1. Future gold contract (GCZ2025). Source: Data from the COMEX Exchange. Own analysis conducted via TradingView.