IonQ stock gains attention as quantum computing progress sparks new links to crypto

IonQ has become one of the most talked tech stocks this year as investors shift their focus toward industries that could reshape the digital economy. The company’s strong revenue growth, new technical milestones, and rising institutional interest have pushed quantum computing back into the spotlight. But another trend is emerging around IonQ: more investors are now linking the future of quantum computing with the future of crypto.

Quantum computing could eventually reshape how blockchain networks are built.

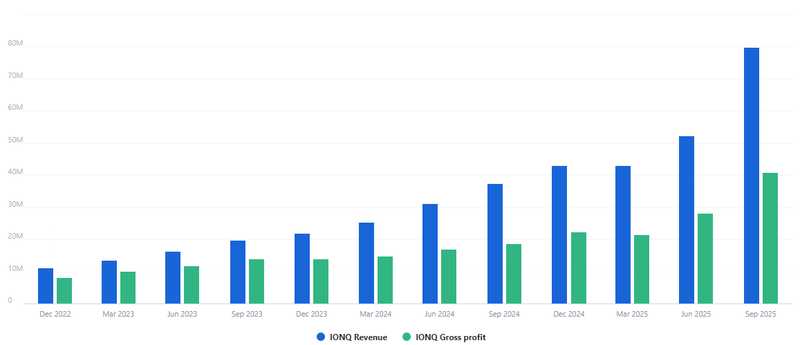

The gross profit has soared by 118% YoY and by 45% QoQ.

Powerful future quantum computers could theoretically break some of these encryption methods much faster.

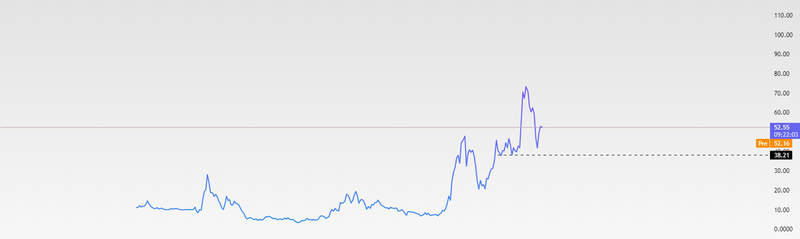

Technical outlook

As IonQ continues to improve its quantum computing technology, more people in the crypto community are starting to take notice. Many believe that quantum computers could eventually change how blockchain networks are built, secured, and scaled. Because of this, IonQ is becoming an important name not only in traditional tech, but also in conversations about digital assets and long-term security. IonQ’s stock had strong rallies before, and recently the momentum slowed after several days of gains. This suggests that short-term traders may be stepping back while long-term investors take a closer look at the company’s future. Despite the ups and downs, IonQ remains one of the few companies fully focused on quantum computing, which gives it a unique position in the market. Quantum stocks in general such as IonQ, Rigetti, and D-Wave are showing early signs of forming bullish patterns. Some analysts think these companies could be setting up for another breakout. This rising interest is happening even as the broader tech market faces pressure, which shows that many investors see quantum computing as a long-term growth opportunity rather than a short-lived trend. Even with the recent pullback, IonQ is still trading above the key support level at $38.21, which is seen as a bullish sign. Holding above this zone may give investors more confidence about re-entering the stock at current levels.

Source: Trading View

Gross profit soared by 118%

IonQ’s latest financial results surprised many on the upside. The company reported that the gross profit has soared by 118% YoY and by 45% QoQ, bringing in close to $40 million for the quarter well above expectations. The strong results allowed IonQ to raise its full year revenue estimates, sending a positive message to investors who believe quantum computing could become commercially viable sooner than expected. However, one of the issues facing IonQ is the high costs of scaling quantum hardware, building new systems, and expanding research programs. Quantum computing remains extremely expensive, and IonQ is still far from profitability. For investors, this means the stock may continue to be volatile, especially as the company ramps up spending to stay ahead in the race toward fault-tolerant quantum machines.

Source: fullratio

Investor overlaps between IonQ and Crypto

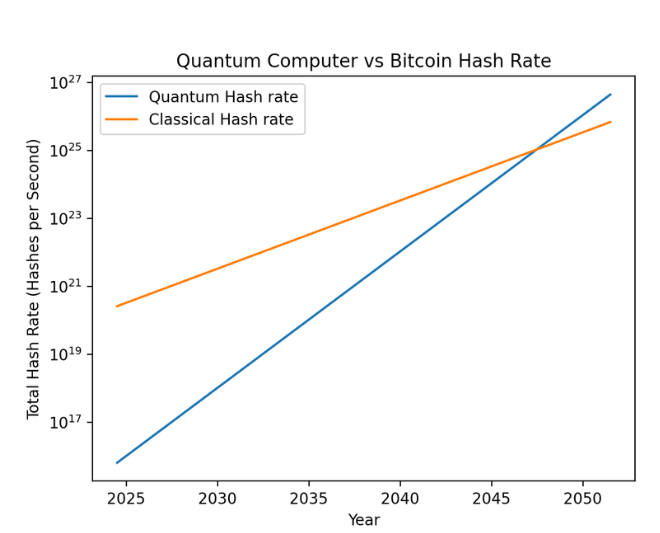

One of the most interesting things happening around IonQ is the growing conversation about how quantum computing could impact the crypto world. People in the crypto space are paying close attention not because they all want to buy IonQ stock, but because the company’s progress could influence how future blockchains are built and protected. Today’s cryptocurrencies rely on very strong encryption that regular computers can’t break, but a powerful quantum computer someday might be able to crack some of these protections much faster. IonQ is still far from creating a machine that can do this, but its fast progress is pushing blockchain developers to get ready for a “post-quantum” world. Some networks, like Ethereum, are already looking into quantum-resistant signatures to stay secure in the future. There’s also real overlap between people who invest in IonQ and those who invest in crypto. Both groups are usually comfortable with big price swings, think long-term, and believe early-stage technologies can reshape the future. Quantum stocks and cryptocurrencies also tend to react to the same market forces, like innovation trends, interest-rate changes, and shifts in overall tech sentiment. This connection becomes even clearer when looking at comparisons such as the Bitcoin network hash rate versus the potential strength of a future quantum computer, showing how both classical and quantum technologies could grow if current trends continue.

Source: ResearchGate