Lucid’s Saudi bet

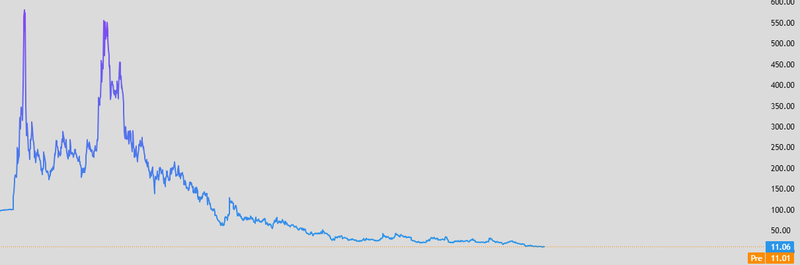

Lucid Group’s story has been defined by ambition, losses, and a stock chart that has punished patience. Since peaking at nearly $579 in 2021, Lucid shares have been in a persistent downtrend, sliding toward the low as investors questioned whether the company could ever scale production profitably.

Full-scale vehicle production in 2026.

Sales increased 46% year on year.

From $579 in 2021 to roughly $11 today.

Saudi manufacturing, from symbolic to strategic

Lucid opened its Saudi manufacturing facility in September 2023, but until now, the plant has been more symbolic than transformative. Vehicles were only partially assembled, limiting its economic impact. Those changes are starting this year.

According to CEO Marc Winterhoff, the facility is on track to begin full-scale vehicle production in 2026, with a planned ramp-up to 150,000 vehicles annually by 2029. If executed, this would be a meaningful step toward scale something Lucid has struggled to achieve in the US.

Saudi Arabia is not just another market. Under its Vision 2030 plan, the country is aggressively pushing EV adoption, building export hubs on the Red Sea, and offering incentives such as tax exemptions and zero import duties in Special Economic Zones. For Lucid, producing locally means avoiding future tariff risks and embedding itself early in a market that is still forming.

This strategy contrasts sharply with Tesla’s experience in India, where importing vehicles led to eye-watering prices and weak demand. Lucid appears to be learning from that mistaken production first, market expansion second.

Early signs of operational progress

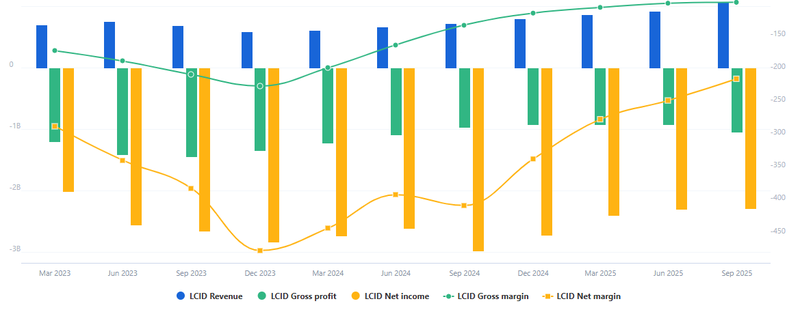

Beneath the weak stock performance, Lucid’s latest financial data shows early but notable improvement in its operating profile. The company’s net margin rose 47% year on year and 13% quarter on quarter, signaling that losses are narrowing as pricing, cost controls, and scale slowly improve. While Lucid remains unprofitable, the direction of travel matters more than the absolute level at this stage of its lifecycle.

Revenue growth supports that narrative. Sales increased 46% year on year and 15% from the previous quarter, indicating that demand is stabilizing and volumes are improving despite a highly competitive EV market. This suggests Lucid’s premium positioning is still attracting buyers, even as price pressure intensifies across the sector.

Operational leverage is beginning to show. Operating margin improved by 28% year on year and 8% quarter on quarter, reflecting tighter expense management and better utilization of existing production capacity. Meanwhile, gross margin rose 26% year on year, a key metric investor has been watching closely. Gross margin improvement implies Lucid is moving closer to covering its core manufacturing costs, an essential milestone before any credible profitability discussion.

These improvements do not mean Lucid is out of the woods. The company still burns cash, and margins remain negative. But the trend suggests Lucid is transitioning from survival mode toward gradual efficiency gains.

Source: Full ratio

Lucid stock between collapse and the Saudi bet

The stock tells a brutal story. From $579 in 2022 to roughly $11 today, Lucid has lost investor trust. This decline reflects chronic cash burn, limited volumes, and uncertainty over whether or if the company can reach profitability.

The Saudi expansion alone will not reverse this trend. Markets will demand proof: rising deliveries, controlled costs, and evidence that manufacturing scale actually improves margins. Until then, rallies are likely to be sold into, not chased.

That said, the Saudi plant introduces something Lucid has lacked a credible long-term path. If production ramps as planned and regional demand grows, Lucid could stabilize revenues and extend its runway without constant dilution. In that scenario, the stock may stop behaving like a collapsing startup and start trading more like a long-dated option on EV adoption in the Middle East.

Source: TradingView