Meta stock weakens amid technical hurdles and cost worries

Meta spent the past few months under pressure, caught between a heavy investment cycle and a wave of uncertainty surrounding tech valuations. Beneath the noise, the company is quietly preparing the foundations for what could become one of the most powerful growth phases. The recent pullback is more likely to be correction than reversal, and traders are beginning to reassess whether the market has priced Meta AI potential.

Meta saw a sharp cooldown after the tax earnings distortion.

Meta does not need a new product to unlock value.

Technical view still looks bullish for Meta.

Meta new AI-infrastructure

The core business of Meta hasn’t changed, however the scale of investment changed.

Meta is pushing aggressively into AI-Infrastructure, new data centers, more computes and a long list of new AI tools to improve ad performance and new product verticals. In short term these costs created a margin problem, but historically Meta huge spending cycles have preceded meaningful expansions in revenue. For traders who look beyond the short-term view, the current environment resembles the early stages of another structural AI upgrade.

Technical view

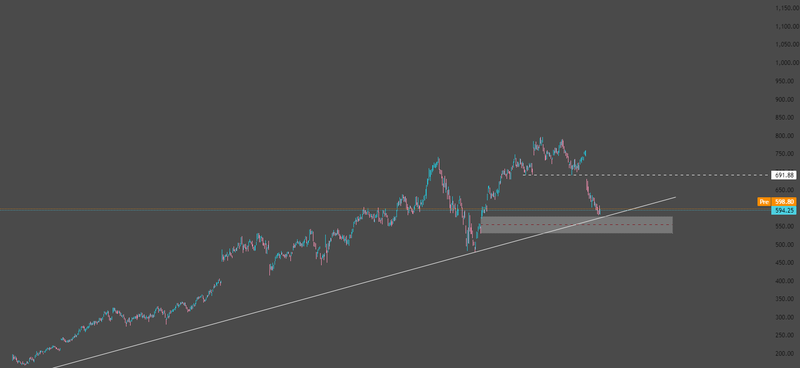

The technical picture supports the changing that Meta is doing, While the stock saw a sharp cooldown after the tax earnings distortion, price action has started to stabilize around support key zone 577.21 - 531.10.

Momentum indicators that were deeply stretched to the downside have started to level off, suggesting selling pressure may be losing strength after controlling the stock for more than 3 months.

If Meta continues to hold above the support zone we mention, traders could begin positioning for an upside extension toward the next resistance cluster 691.88.

Strong volume appears on green days hints that long-term buyers are already stepping in to accumulate, the tone around Meta isn’t dominated by fear it dominated by anticipation. Traders understand that AI spending today is about securing competitive advantage in the future, every major platform is racing to build the best recommendation engine, the most effective ad system, and the most efficient infrastructure. Meta is playing this game with more users, more data, and more monetization channels than anyone else.

Source: Trading View

Breakout attempt of the resistance zone

What the market has yet to fully price in is how quickly these systems can translate into higher ad yields, better engagement, and new sources of top line growth. Meta doesn’t need new product line to unlock value, it only needs to make its existing ecosystem smarter, faster, and more personalized. The company has done it before and every time it did, revenue followed.

If the broader tech sector stabilizes and earnings guidance in the current and next quarter offers even a hint of confidence regarding AI returns, the stock could be primed for a breakout attempt of the resistance zone. For now, the bias leans to be bullish, Meta long-term structure remains intact, the market may still be digesting the size of the investment cycle, but the story is slowly shifting back toward growth.