Nvidia at a tipping point

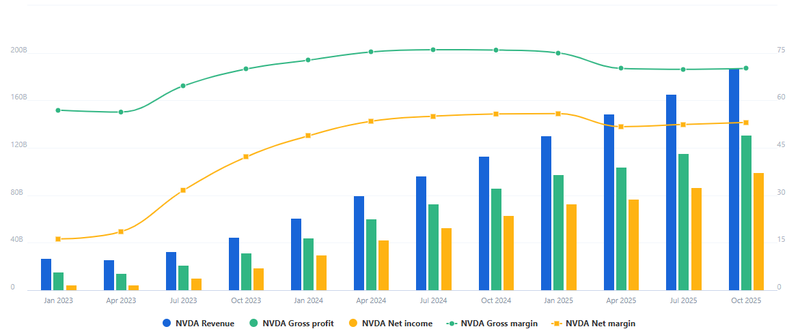

Nvidia’s growth story remains extraordinary on paper. Revenue is up 65% year-on-year, net income has jumped 57%, and operating income is climbing at a pace most companies can only dream of.

Nvidia could sell close to $400 billion worth of chips.

Suppliers of Nvidia’s H200 chips have paused production after Chinese customs blocked shipments.

Revenue surged 65% year on year and 13% quarter on quarter.

Demand vs. reality

Nvidia’s growth story remains extraordinary on paper. Revenue is up 65% year-on-year, net income has jumped 57%, and operating income is climbing at a pace most companies can only dream of. On a quarter-over-quarter basis, the company is still growing at double-digit rates across revenue, profit, and margins. These numbers explain why Nvidia has become the single most important stock in the AI trade, growing concern among more skeptical investors: Nvidia could sell close to $400 billion worth of chips this year, yet the application-layer use cases the software and real-world demand actually consuming this compute may be less than $100 billion. In other words, the hardware buildout may be racing far ahead of monetization.

That doesn’t mean demand is fake. It means the market may be pricing Nvidia not for what AI is today, but for what it hopes AI will become. This creates a timing problem. If application growth doesn’t catch up quickly enough, customers could slow orders, delay deployments, or renegotiate pricing none of which are currently reflected in Nvidia’s valuation.

Next risk markets are ignoring

Suppliers of Nvidia’s H200 chips have paused production after Chinese customs blocked shipments, despite recent US approval for sales into China. Nvidia had ramped up production expecting more than one million orders from Chinese clients, only to be caught off guard as early shipments stalled in Hong Kong.

First, the H200 is a China-specific compromise product already a concession to export controls. If even these chips face uncertainty, Nvidia’s China revenue becomes less predictable than markets assume. Second, the impact of the supply chain is real. Components like printed circuit boards for H200 chips are custom-built and cannot be repurposed. A prolonged delay risks inventory write-offs, supplier strain, and margin pressure.

Beijing risk

Longer term, Beijing’s push for domestic semiconductor self-sufficiency adds another layer of risk. Even if Nvidia resumes shipments, China’s strategic direction suggests reliance on foreign AI chips will gradually decline.

Markets have largely ignored this so far, focusing instead on earnings momentum. That may work until it doesn’t.

Profits, margins, and the sustainability question

latest earnings show more than just top-line growth, they reveal a company extracting exceptional profitability from the AI boom. Revenue surged 65% year on year and 13% quarter on quarter, but what stands out is how efficiently that growth is translating into profits. Net income climbed 57% from a year ago and 15% from the previous quarter, while operating income rose 55% year on year and 15% quarter on quarter. This tells us Nvidia is not simply selling more chips; it is selling them at very attractive margins.

Gross profit growth reinforces that picture. A 53% year-on-year increase, alongside a 14% quarterly rise, signals strong pricing power and limited near-term competition at the high end of AI accelerators. For now, customers appear willing to absorb premium prices in exchange for access to scarce compute, allowing Nvidia to expand margins even as volumes scale up.

Source: Full ratio

Sustainability question

The key question for markets is how long this profitability can last. Margins at these levels assume sustained urgency in AI spending and limited alternatives. If customers begin optimizing usage, delaying deployments, or shifting toward in-house or lower-cost solutions, margin expansion could slow before revenue does. That would not derail Nvidia’s growth story, but it could change how the market values it.

In short, Nvidia’s earnings quality remains exceptional, but expectations are now anchored to peak conditions. Going forward, investors will watch not just revenue growth, but whether margins stabilize, expand further, or quietly begin to compress as the AI buildout matures.