OPEC+ April dilemma

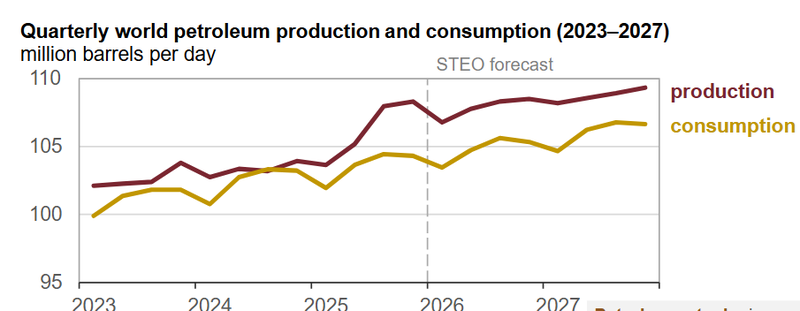

Global petroleum production has steadily climbed since 2023 and is projected to push toward 110 million barrels per day by late 2027. This surge isn't just coming from the Middle East. The Americas specifically the U.S., Brazil, Guyana, and Canada are pumping massive volumes of crude, completely offsetting natural declines elsewhere.

Consumption is projected to hover much lower, struggling to break past 106 to 107 million barrels per day.

OPEC+ is pausing their planned production increases through the first quarter of 2026.

United States has deployed a second aircraft carrier to the region.

Prices are holding above key medium-term support.

EIA’s forecast

Relentless Production, global petroleum production has steadily climbed since 2023 and is projected to push toward 110 million barrels per day by late 2027. This surge isn't just coming from the Middle East. The Americas specifically the U.S., Brazil, Guyana, and Canada are pumping massive volumes of crude, completely offsetting natural declines elsewhere.

Sluggish Consumption, while global demand is still growing (primarily driven by non-OECD countries like India and China), it simply cannot keep pace with the drillers, consumption is projected to hover much lower, struggling to break past 106 to 107 million barrels per day mark through the end of the forecast period, substitution effects, like the rapid adoption of EVs in China and Europe, are flattening the demand curve.

Based on these STEO projections, the world is overproducing by roughly 2.2 million barrels per day. In a normal, friction-less market, that kind of inventory build would likely crash the price of WTI into the $40s.

Source: EIA

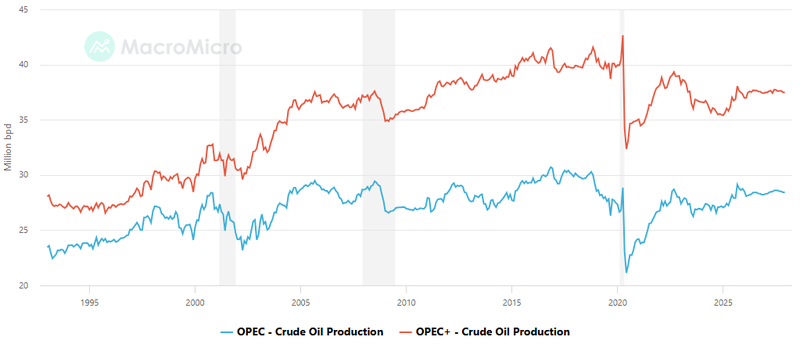

OPEC+ manages supply to protect prices

OPEC+ knows the market is structurally oversupplied. To prevent a price collapse, they have repeatedly kicked the can down the road, pausing their planned production increases through the first quarter of 2026. They are manually holding back supply to keep prices afloat. without production management, the market could face a surplus of 1–1.5 million barrels per day in early 2026. That kind of imbalance would likely push inventories higher and place sustained downward pressure on prices.

To prevent that scenario, OPEC+ has repeatedly delayed its planned output increases and extended voluntary cuts, effectively removing more than 2 million barrels per day from the market. By pausing production hikes through the first quarter of 2026, the group is signaling that price stability matters more than regaining market share in the short term.

This is active supply management. Rather than allowing the market to rebalance naturally through lower prices, OPEC+ is attempting to engineer equilibrium by restricting output. The strategy supports prices in the near term, but it also carries risks: prolonged restraint can encourage further growth from non-OPEC producers, gradually eroding the group’s pricing power over time.

Source: MacroMicro

Hormuz tensions linger

Tehran’s show of force, combined with reports that the United States has deployed a second aircraft carrier to the region, has reinforced the sense that risks are elevated even if open conflict remains unlikely. Traders are not pricing in a supply disruption, but they are reluctant to strip out the geopolitical premium while military assets are visibly concentrated in a critical shipping lane.

At the same time, diplomatic channels remain open. Iran has suggested it may be willing to compromise on parts of its nuclear program in exchange for sanctions relief. A credible diplomatic breakthrough would likely reduce the perceived threat to tanker traffic and ease fears of sudden export losses. That would compress the risk premium that has helped support crude in recent sessions.

Markets have a long memory when it comes to Hormuz. Even without physical disruptions, elevated uncertainty alone can tighten conditions through higher freight costs and insurance premiums.

Technical outlook for WTI

WTI remains in a broad consolidation phase. Prices are holding above key medium-term support near the recent swing lows, suggesting buyers are willing to defend dips. Momentum indicators on the daily chart are neutral to slightly positive, reflecting stabilization rather than strong upside acceleration.

A sustained break above recent resistance levels would likely require either confirmed supply disruption or a material inventory draw. Without that, rallies may struggle to extend far beyond recent highs.

On the downside, a decisive diplomatic breakthrough could trigger a pullback toward support zones as the geopolitical premium fades. If those levels hold, it will reinforce the view that the market is structurally balanced rather than bearish.

For now, WTI is trading less on immediate supply data and more on perceived risk. The base case remains range-bound price action with a mild upward bias as long as tensions simmer but do not escalate.

The decisive move, higher or lower, will likely come not from gradual economic shifts, but from a clear signal out of the Gulf, either a durable diplomatic accord that calms the waters, or a breakdown that puts the Strait of Hormuz back at the center of global energy risk.

Source: Trading View