Russell 2000 breaks out as investors rotate into risk assets

The Russell 2000 Index, a key benchmark for U.S. small-cap stocks, has been making significant moves lately, hitting fresh highs and drawing renewed attention from market watchers. Unlike the large-cap bias of indexes like the S&P 500, Russell 2000 tends to outperform when investors rotate into higher-risk, higher-reward assets, a dynamic that closely mirrors behavior in risk markets including cryptocurrency.

Small-cap rallies can struggle if Treasury yields rise.

Pattern between Russell 2000 breakouts and Bitcoin’s past bull runs.

Russell 2000 is making new highs despite investor concerns about monetary policy.

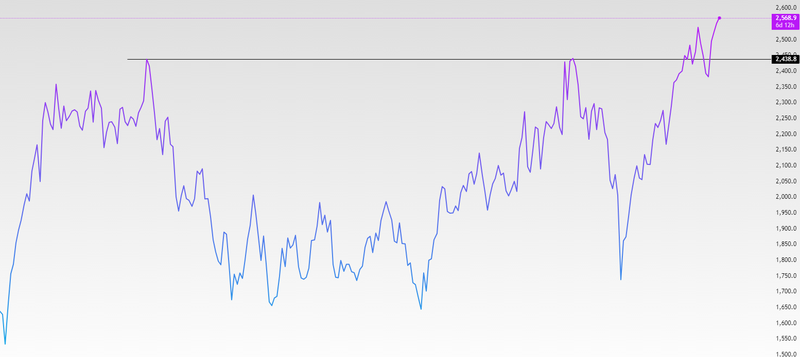

Russell bullish breakout

Analysts caution that small-cap rallies can struggle if Treasury yields rise significantly, as higher yields can erode future earnings valuations especially for less profitable or highly levered small companies. A rising cost of capital or uncertainty around monetary policy could dampen momentum in the Russell 2000 in 2026. Additionally, while breakout patterns are technically bullish, markets can be prone to pullbacks or consolidation before continuing higher. Investors will be watching key support levels and economic data for signs that sentiment remains intact or begins to shift. Russell 2000’s strength highlights a rotation into risk assets that extend beyond traditional large-cap benchmarks. It underscores confidence that broader parts of the economy and corporate sector can deliver growth, even as some sectors (like tech) experience volatility.

Source: Trading View

Small caps are leading the market rotation

The Russell 2000’s rally is also part of a broader market advance. Major U.S. indexes are trading near record highs, supported by expectations that interest rates are close to peaking and by confidence in U.S. economic resilience. While some high-growth tech stocks have faced pressure, the S&P 500 and Dow Jones have continued to rise, pointing to rotation rather than weakness. That rotation has been clear, with investors shifting out of large-cap tech and into value stocks and small caps. After lagging for years while mega-cap and AI-driven stocks surged, small caps became relatively undervalued. As soon as markets began to price the idea that monetary policy is no longer tightening and that eventual easing lies ahead, interest in small caps picked up. Even if rate cuts are delayed, the change in direction has been enough to drive buying. The Russell 2000 is also more sensitive to the U.S. economy than global trends. Many of its companies generate most of their revenue domestically, benefiting from steady consumer demand and fiscal support. As recession fears ease and shift from “imminent” to more distant, investors have become more willing to take risk, a backdrop that has historically favored small-cap stocks.

Russell outperforming S&P 500

Russell 2000 up 14.41% YoY, it is now outperforming both the S&P 500 (+13%) and the Dow Jones Industrial Average (+11.4%). This relative strength is important because it shows that market leadership is broadening beyond mega-cap stocks, rather than being concentrated only on a handful of large names. The outperformance suggests that investors are rotating into small-cap stocks, not just chasing index momentum. When small caps lead on a year-over-year basis, it often reflects improving risk appetite and growing confidence in the domestic economic outlook. Since Russell 2000 companies are more sensitive to U.S. growth, credit conditions, and future rate expectations, this performance implies that investors believe the worst of monetary tightening is likely behind them. At the same time, the S&P 500’s 13% gain and the Dow’s 11.4% advance show that the broader market is still healthy, but the fact that the Russell 2000 is outperforming both highlights a shift in leadership rather than a narrow rally. Historically, sustained small-cap outperformance often appears when markets begin pricing in slower inflation, stable yields, and eventual policy support, even if rate cuts are not immediate. In practical terms, these YoY returns reinforce the idea that the current rally is evolving from a defensive, mega-cap-led phase into a more balanced and cyclical phase. If this trend continues, it could signal further upside for small caps relative to large caps, provided economic data remains stable and financial conditions do not tighten again sharply.

Source: ycharts