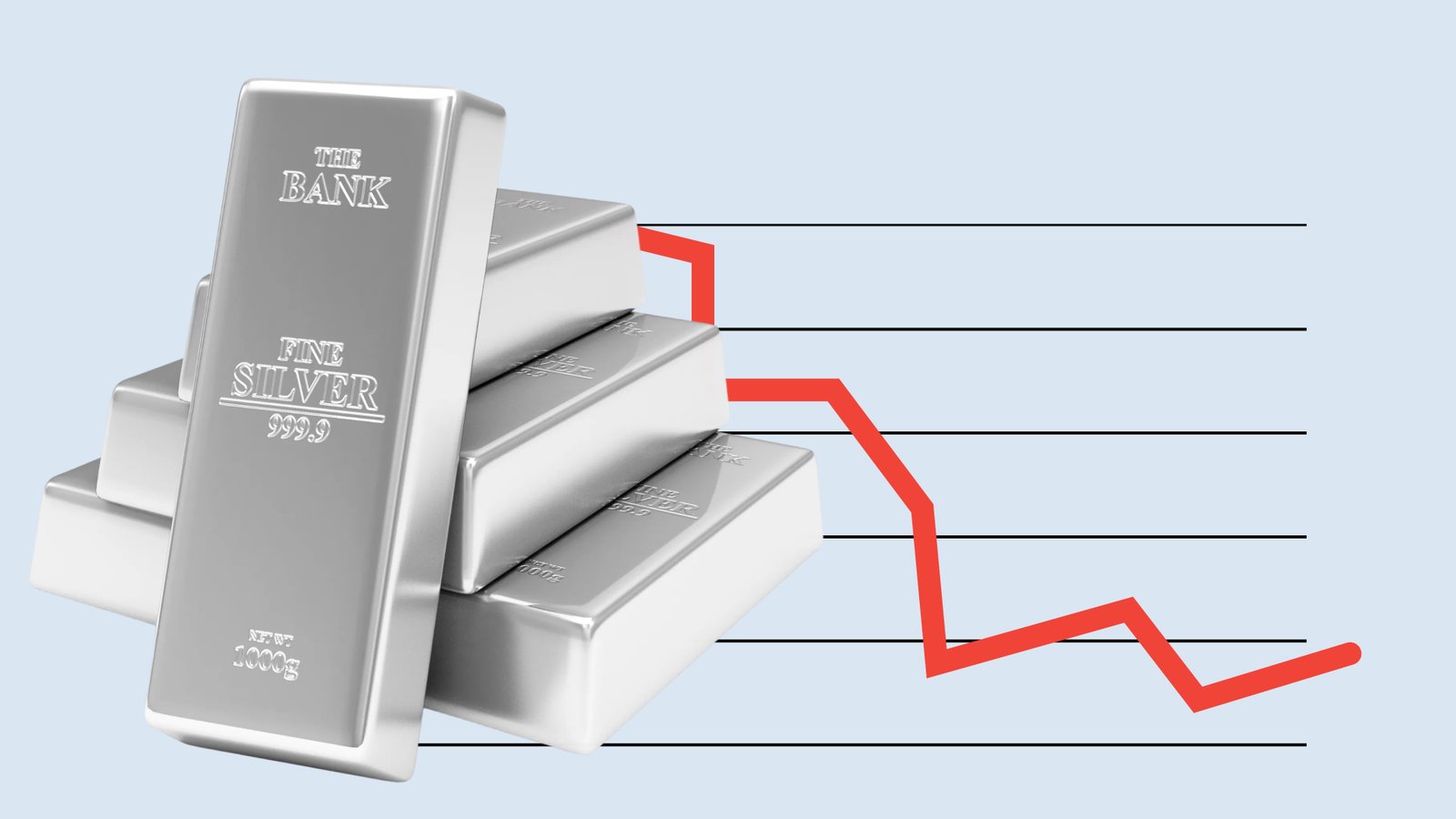

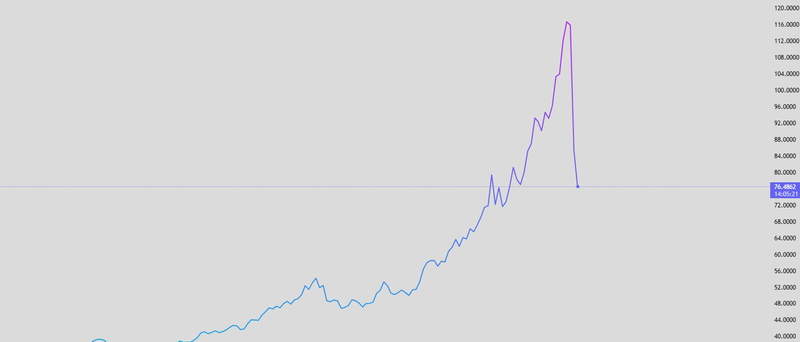

Silver corrects 28%, profit taking and repricing in focus

Silver occupies an uncomfortable middle ground in the market. It is neither a pure monetary hedge like gold nor a straightforward industrial commodity. This dual identity amplifies volatility during transitional phases. When risk appetite fades, silver initially benefits from its precious-metal status. When liquidity tightens, it is treated as a high-beta asset and sold alongside risk.

Silver entered this phase with elevated speculative positioning after a sharp multi-month advance.

Long-term industrial demand, particularly from energy transition and electronics remains intact.

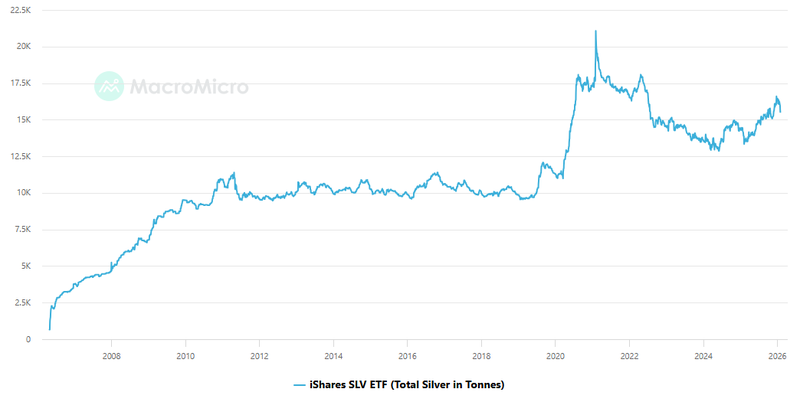

SLV dropped from 17,248,67 tonnes to 13,046.06 tonnes.

Silver is not collapsing, nor is it consolidating comfortably. It is undergoing repricing.

Positioning and profit-taking

Silver entered this phase with unusually high speculative positioning following a sharp multi-month rally. Investors and traders who had chased gains during this strong run were now sitting on significant profits, making the market prone to corrections. As broader financial markets corrected and margin requirements increased, silver became a convenient source of liquidity for investors looking to cover losses or rebalance portfolios. The selling pressure has been significant, with silver down roughly 28% from its recent highs, highlighting how quickly speculative positioning can reverse in volatile markets.

Importantly, this decline is not necessarily a reflection of weakening fundamentals in the silver market. Instead, it is largely driven by position reduction and cash generation. This behavior is common late in strong rallies: the assets that outperform in bullish cycles are often the first to be trimmed when uncertainty or volatility rises. In other words, silver is temporarily paying the price for its earlier performance, not for a structural decline in demand or supply.

Source: Trading View

Industrial demand vs. market cycles

Long-term industrial demand for silver particularly from the energy transition (like solar panels and electric vehicles) and electronics sectors remains robust. Silver is an essential input for many high-tech and clean energy applications, and that structural demand is unlikely to change in the near term.

However, markets rarely reflect long-term fundamentals in a straight line. During corrective or risk-off phases, macro flows, margin calls, and liquidity rotations often dominate price action. This means that even though industrial demand is intact, the short-term silver price may fluctuate or retrace significantly. The current pullback does not invalidate the industrial narrative; instead, it delays the market’s recognition of these structural drivers until broader financial conditions stabilize.

Silver ETFs face heavy outflows

The iShares Silver Trust (SLV), one of the largest silver-backed funds, experienced heavy withdrawals, with total outflows reported at around $844.6 million—a 1.4% decline in shares outstanding. Weekly data also indicated additional outflows of $297.78 million. Meanwhile, the total silver holdings tracked by SLV dropped from 17,248.67 tonnes to 13,046.06 tonnes.

This wave of redemptions highlights how investors are using silver ETFs as a source of liquidity rather than as a long-term hedge. After an extended period of strong gains, investors are taking profits and rebalancing portfolios, especially in response to broader market volatility and margin requirements.

It’s important to note that these outflows are not necessarily a reflection of weakening industrial or long-term demand for silver. The decline is largely tied to speculative positioning being unwound and temporary market dislocations caused by rising dollar strength and risk-off sentiment.

Source: MacroMicro

Silver in the current market phase

Silver is not collapsing, nor is it consolidating comfortably. It is undergoing a necessary repricing, forced to reconcile historically stretched positioning with a market that has shifted from aggressive expansion to cautious preservation. The volatility reflects a combination of profit-taking, a strong dollar, and temporary liquidity needs rather than a breakdown in supply-demand fundamentals.

Until volatility subsides and the dollar’s momentum eases, silver is likely to remain reactive, moving in response to macro forces rather than developing a clear directional trend. When market conditions stabilize, history shows that silver tends to reassert itself decisively, often with sharp moves that reward patient positioning. Investors should view the current pullback as a phase of consolidation and recalibration, not as a structural threat to silver’s longer-term bullish story.