Silver outperforming gold

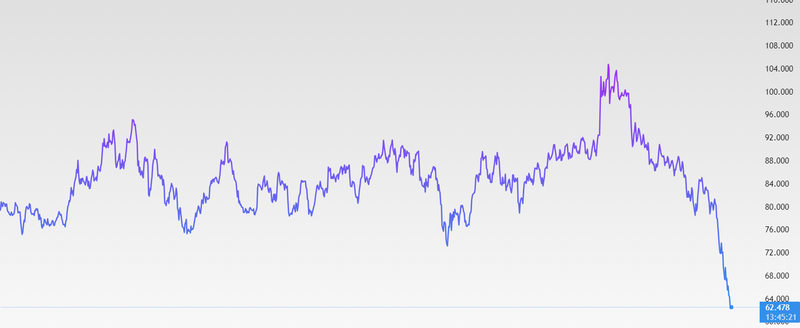

Silver has been one of the standout financial stories of 2025, breaking past significant price levels and drawing attention from investors worldwide. On December 23, 2025, silver climbed above $70 per ounce, hitting fresh record highs as strong investment and industrial demand collided with tight supply conditions and rising expectations for U.S. interest rate cuts.

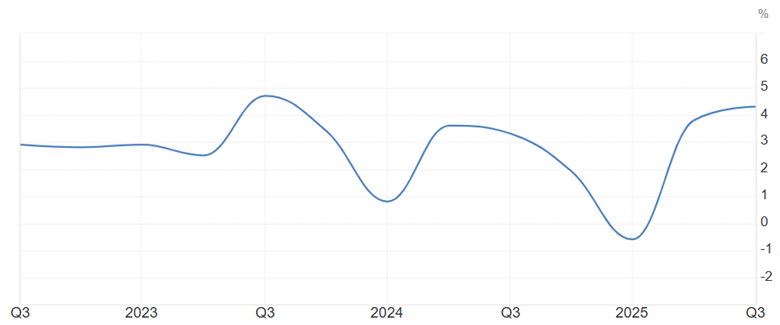

Strong 4.3% annualized GDP growth in the third quarter.

ETF holds to about 1.13 billion ounces, valued at over $40 billion at elevated silver prices.

Silver has surged over 140–150% YTD.

U.S. economic data and rate expectations lifting silver

Silver’s recent price strength has been strongly tied to shifts in U.S. economic signals and expectations about Federal Reserve policy. Mixed data from the U.S. economy has encouraged traders to believe that the Fed may begin cutting rates in 2026. While the U.S. economy showed resilience such as a strong 4.3% annualized GDP growth in the third quarter, other indicators painted a softer picture. Consumer confidence weakened in December and factory production showed little change in November, suggesting that growth may be slowing beneath the surface. These mixed signals have made markets more optimistic about future Fed rate cuts, and lower rates tend to benefit precious metals like silver by reducing the opportunity cost of holding non-yielding assets and weakening the U.S. dollar, which makes silver cheaper for holders of other currencies. The persistent view that the Fed will pivot toward easier policy next year has helped fuel buying in silver, as investors look to hedge against slower growth and shifting monetary conditions. At the same time, geopolitical tensions and safe-haven demand such as concerns over U.S. sanctions and supply disruptions have added to the metal’s appeal as a store of value in uncertain times.

Source: U.S. Bureau of Economic Analysis

ETFs and investment flows have amplified the upside

A major catalyst for silver rise has been recording inflows into silver-backed ETFs and other investment vehicles. Based on data from the Silver Institute and market tracking groups, global investment demand for silver via ETFs and funds surged dramatically in 2025. By mid-year, 95 million ounces of silver had flowed into ETFs globally, already surpassing total inflows for all of 2024. These flows helped push total ETF holdings to about 1.13 billion ounces, valued at over $40 billion at elevated silver prices. This level of investment demand is significant because ETF purchases generally require physical silver to be added to vault stocks, removing metal from available supply and tightening overall market conditions. In some regions, ETF positions have increased by more than 500 tonnes in just six months, and trading volume has jumped as well. The strong appetite from both institutional and retail investors reflects a broader shift in sentiment. Silver’s inclusion on the U.S. critical minerals list added a structural demand narrative, encouraging long-term holders and strategic investors to allocate more capital to silver as an essential commodity, not just a precious metal.

Source: Trading View

Silver 2025 gains have outpaced gold

One of the most remarkable aspects of silver’s performance this year has been its outperformance relative to gold. While gold itself hit record highs near $4,500 per ounce and rose sharply on safe-haven and macroeconomic demand, silver’s percentage gains were even greater. According to multiple market reports, silver has surged over 140–150% year-to-date, significantly outpacing gold’s roughly 70% rise in 2025. This divergence reflects silver’s dual role in the global economy. Unlike gold, which is almost entirely valued as a store of wealth, silver also has large industrial demand. It is an essential component in solar panels, electric vehicles, 5G infrastructure, semiconductors, and emerging technologies. Estimates suggest that industrial demand for silver exceed 680 million ounces annually, helping to tighten the physical market and support higher prices. At the same time, structural supply deficits have persisted for several years. Most silver production comes as a by-product of other metal mining, meaning it cannot quickly expand in response to price. In 2025, the silver market continued its fifth consecutive year of supply deficit, with global supply failing to keep up with demand. This combination of robust industrial demand, strategic investment flows, and tight supply has given silver a powerful price foundation, allowing it to outperform even the prized safe-haven asset, gold, in percentage terms through the year. In late 2025, the gold-to-silver ratio dropped sharply to levels not seen in many years. This happened because silver prices have been rising much faster than gold. While gold has posted strong gains of around 70% this year, silver has surged by more than 140–150%. As a result, fewer ounces of silver are now needed to buy one ounce of gold. This shift shows clear strength in silver compared with gold and highlights how strongly investors are favoring silver in the current market environment.

Source: Trading View