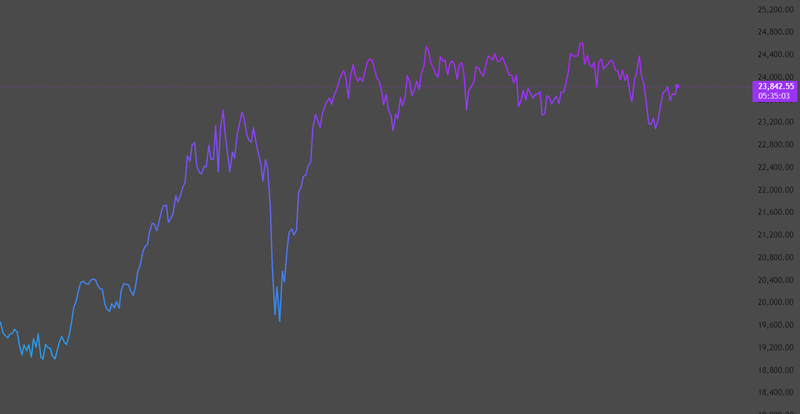

Slow ECB signals add pressure to the DAX

DAX index is entering a decisive phase as investors attempt to balance fragile domestic economic conditions against global market forces that continue to shape risk appetite. While parts of the index remain supported by large export-driven companies and selective technology exposure, the backdrop for Europe’s largest economy remains soft. Growth is weak.

Order books across industrial sectors remain thin, export volumes are uneven.

Monetary policy continues to cast a long shadow over European equity markets.

Growth has not collapsed, but it has failed to regain convincing momentum.

DAX at a crossroads

DAX has benefited from the strong performance of a handful of heavyweight stocks with global revenue exposure. Companies in software, industrial automation, and advanced manufacturing have helped lift the index even as Germany’s domestic growth has stalled. This growing gap between index performance and the real economy has created a disconnect that makes investors cautious about trusting the strength of the index at the current stage. High energy costs from previous years and weak external demand, particularly from China, have continued to weigh on industrial confidence, even though inflation has eased from its peak.

DAX can still perform, but only selectively

Monetary policy continues to cast pressure over European equity markets. Although inflation across the euro area has moderated, the ECB has signalled that there is no urgency to accelerate the rate-cutting process. Rising long-term bond yields have added another layer of pressure. Higher yields increase the discount rate applied to future earnings, directly weighing on equity valuations, especially for growth-oriented stocks that dominate parts of the DAX. As a result, the divergence between market leaders and the rest of the index has widened. A small group of companies continues to attract investor interest, while many mid-cap stocks remain under pressure. These mid-cap firms are more exposed to domestic demand, financing conditions, and fluctuations in industrial output than large-cap exporters. The DAX is no longer moving as a unified market; instead, it is becoming increasingly selective.

Source: Trading View

U.S. Pressure on European Assets

A stronger U.S. dollar and higher U.S. yields have tightened global financial conditions. This dynamic often drains liquidity from international equity markets and places additional pressure on European risk assets. Growth in Europe has not collapsed, but it has failed to regain convincing momentum. Inflation has cooled, yet financial conditions remain tight. A small number of strong companies continues to support the index, but the broader corporate sector remains under strain. Investors are now focused on several key developments that will shape the DAX into 2026. Manufacturing PMI readings, export data, and industrial production figures will be critical in determining whether the recent weakness in activity stabilizes or deepens. The DAX is likely to remain volatile, highly sensitive to macroeconomic data, and vulnerable to shifts in global risk sentiment.