S&P 500 faces liquidity rotation and profit-taking

US equities ended the session mixed as selling pressure returned to large technology names. The S&P 500 slipped modestly, while the Nasdaq underperformed as investors locked in profits after a strong run in AI-linked stocks.

Microsoft fell 10% after reporting slower cloud growth and sharply higher AI infrastructure spending.

Net income growth slowed to 3%, down from 5.4% previously.

The stock price-to-earnings ratio is now about 9% below its average over the past four quarters.

The Vanguard S&P 500 ETF (VOO) recorded net outflows of around $1.2 billion.

S&P 500 mixed as tech stocks retreat

The sharpest move came from Microsoft, which fell 10% after reporting slower cloud growth and sharply higher AI infrastructure spending. While revenue continued to expand, the earnings release raised fresh questions about near-term margins, triggering a wave of profit-taking across software and AI-exposed names.

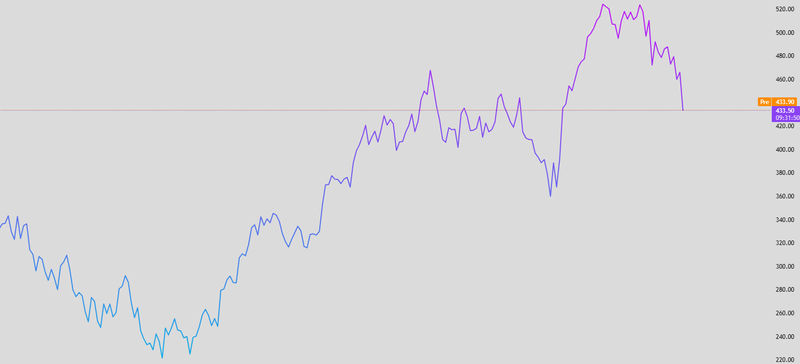

Source: Trading View

Microsoft earnings and P/E

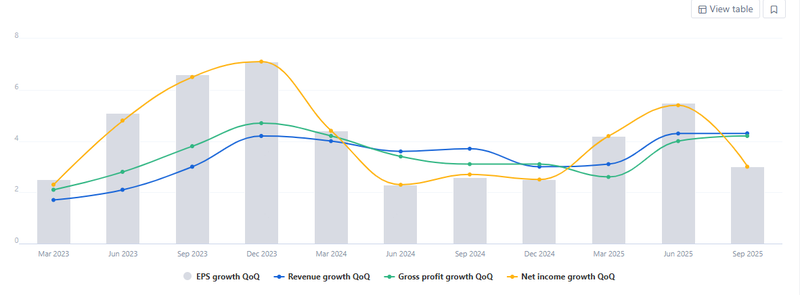

Microsoft’s results underscored this change in tone. The company is still growing, but at a more measured pace than investors had grown accustomed to. Revenue growth remained stable, supported by enterprise demand and continued cloud adoption, while gross profit expanded thanks to scale and pricing discipline.

The concern came from the bottom line. Net income growth slowed to 3%, down from 5.4% previously, reflecting higher costs tied to AI infrastructure, data centers, and capacity expansion. Importantly, this was not a demand problem. Microsoft is choosing to spend aggressively to secure its long-term position in AI and cloud services.

Markets, however, are forward-looking. When earnings growth slows even for strategic reasons valuation expectations tend to adjust quickly.

Source: Full ratio

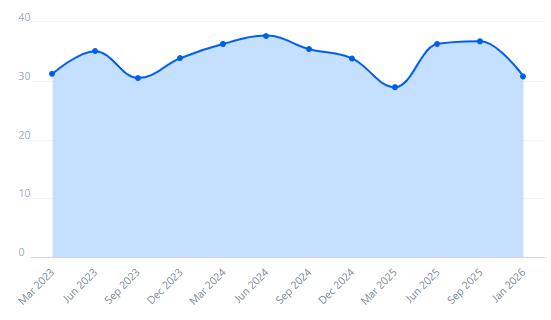

P/E points to a cooling premium

That adjustment is already visible in Microsoft’s valuation. The stock price-to-earnings ratio is now about 9% below its average over the past four quarters and roughly 5% below its five-year quarterly average.

This mild de-rating reflects a market that is resetting expectations, not abandoning the story. Microsoft is transitioning from a phase of pure margin expansion to one dominated by heavy investment. The lower P/E suggests investors are demanding clearer evidence that today’s spending will translate into tomorrow’s profits.

Rather than signaling trouble, the valuation reset may ultimately make the stock more durable, reducing downside risk if earnings growth stabilizes.

Source: Full ratio

Liquidity rotation, profit-taking, and market psychology

Beneath the surface, market behavior points to rotation rather than outright risk aversion. US Treasuries saw modest demand, particularly at the long end of the curve, as investors added some protection against near-term equity volatility. The 10-year yield edged lower, reflecting cautious positioning rather than a flight to safety.

This kind of rotation is typical in maturing market cycles. Growth and AI stocks led much of the 2025 rally, but participation is now broadening as capital moves toward value, industrials, and cash-flow-generating sectors. Elevated interest rates and geopolitical uncertainty are reinforcing the preference for earnings visibility over speculative upside.

If this pattern holds, the S&P 500 may remain volatile in the short term but increasingly stable at the index level as leadership rotates rather than collapses.

Profit-taking and market psychology

Thursday’s session showed how quickly sentiment can shift once investors start protecting gains. Profit-taking dominated even though the broader economic backdrop remains solid. The market is moving away from momentum-driven positioning and back toward fundamentals, margins, and balance sheet strength.

Microsoft’s cloud warning served as a reminder that even dominant companies face cost pressures in an AI-heavy environment. At the same time, strong performances from Meta, IBM, and Caterpillar showed that stocks delivering clear earnings visibility and operational discipline can still attract capital.

The current market is less about chasing narratives and more about separating durable growth from expensive growth.

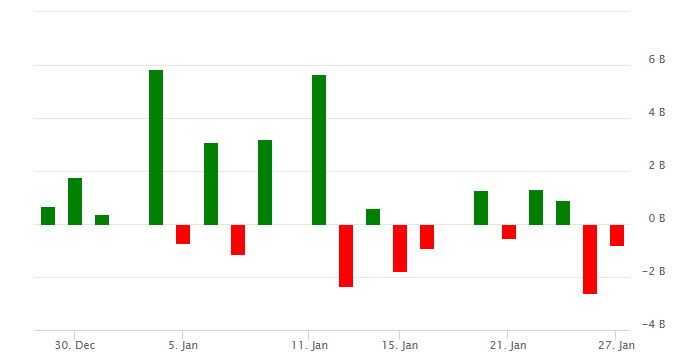

ETF flows reveal where liquidity is rotating

This rotation is clearly visible in ETF flows. Over the past week, the Vanguard S&P 500 ETF (VOO) recorded net outflows of around $1.2 billion, with selling concentrated in technology-heavy exposures. In contrast, value-oriented and dividend-focused segments within the index have held steady or attracted modest inflows.

This tells an important story. Investors are not abandoning equities altogether. Instead, they are trimming high-beta, high-valuation positions while maintaining core S&P 500 exposure. For institutions, ETFs like VOO have become a tactical tool — a way to reduce risk without stepping fully to the sidelines.

Source: ETFdb

ETF flows send important signal

If ETF outflows from growth segments continue while capital rotates into value and defensive sectors, the most likely outcome is a period of consolidation rather than a sharp sell-off. The S&P 500 may trade sideways, with sector leadership shifting away from mega-cap tech toward areas tied more closely to real-economy demand.

Earnings guidance will remain the key catalyst. Further disappointment from large technology firms could extend rotation, while stable results from industrials, healthcare, and dividend-paying companies would reinforce the idea that the market is entering a more balanced, less speculative phase.