US dollar index reflects market uncertainty amid resilient jobs report

The US Dollar Index (DXY) closed the trading session with a "Doji" candlestick pattern, typically indicative of indecision within the market. Although January’s US employment data revealed notable resilience, market participants remain cautious, seeking further evidence of a sustained labour market recovery following a period of steady deterioration over the last four years.

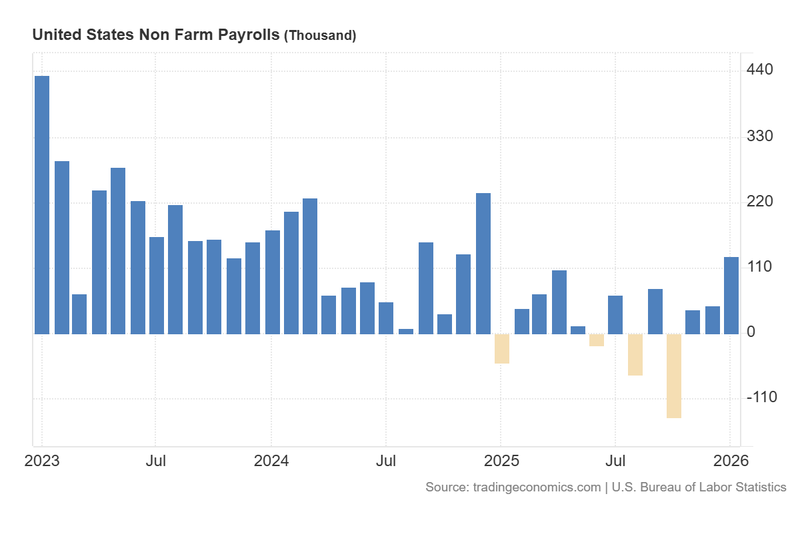

January data surpassed expectations, with Non Farm Payrolls (NFP) accelerating significantly while the unemployment rate edged lower.

Despite the robust employment figures, CME FedWatch probabilities continue to price in two 25-basis-point rate cuts for 2026.

The DXY remains within a medium-term bearish channel; however, neutral momentum indicators suggest short-term uncertainty remains the dominant force.

Dollar index exhibits uncertainty amid surprising strength in the US labour sector

The US Dollar Index (DXY) formed a "Doji" technical pattern at the close, reflecting a state of equilibrium and uncertainty among market participants. This formation followed a report from the US Bureau of Labour Statistics (BLS) showing that January’s Non Farm Payrolls increased by 130,000—well above the consensus forecast of 70,000 and the previous month’s revised figure of 50,000. Additionally, the unemployment rate unexpectedly declined from 4.4% to 4.3%. These figures surprised investors, particularly after last week's ADP private payroll data suggested a potential cooling in the sector.

While this latest release represents the strongest monthly gain in approximately a year, analysts argue that consistent subsequent readings will be required to confirm a definitive turning point in labour market weakness. Consequently, the market continues to anticipate that the Federal Reserve will implement further monetary easing this year. According to the CME FedWatch Tool, traders are currently pricing in 25-basis-point cuts for the June and October meetings. However, the conviction remains split, with the probability of cuts versus a "hold" stance remaining relatively narrow—standing at approximately 48% versus 41% for June.

Figure 1. United States Non Farm Payrolls (2023–2026). Source: Data from the US Bureau of Labour Statistics; Figure obtained from Trading Economics.

Technical analysis of the dollar index (DXY)

From a technical perspective, the Dollar Index remains entrenched in a long-term bearish trajectory. The following observations outline the current market structure:

- Trend Context: Over the medium term, the index maintains a classic bearish structure characterised by a sequence of "lower highs" and "lower lows." The DXY is currently trading below its primary 50, 100, and 200-day Simple Moving Averages (SMAs), reinforcing the prevailing downward bias.

- Resistance Levels: To the upside, the 98.50 level constitutes a significant technical hurdle, where it converges with the 100 and 200-period SMAs. A decisive breakout above this zone would shift focus to the 100 points psychological barrier. A sustained move above the 100 level would indicate a major structural shift toward a higher trading range.

- Support Levels: On the downside, immediate support is identified at 96.50 points. Should this floor be invalidated, the next critical level is 95.50, aligning with the lower boundary of the medium-term descending channel. A breach of 95.50 would likely precipitate a more profound market correction.

- Momentum and Volume: Both the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) are currently signalling neutral behaviour. This lack of directional conviction suggests that fundamental catalysts and price action structure will be the primary determinants of the dollar's performance in the coming weeks.

Figure 2. Dollar Index DXY (2024–2026). Source: Data from the Intercontinental Exchange (ICE); own analysis conducted via TradingView.