USD/CAD at a Crossroads

USD/CAD is starting to reflect more than just interest-rate differentials. The political overlay is where USD/CAD becomes more complex. Trump’s threat to impose 100% tariffs on Canadian exports if Ottawa deepens trade ties with China is not just rhetoric it is a direct warning shot.

US political risk, trade policy, and shifting global alliances.

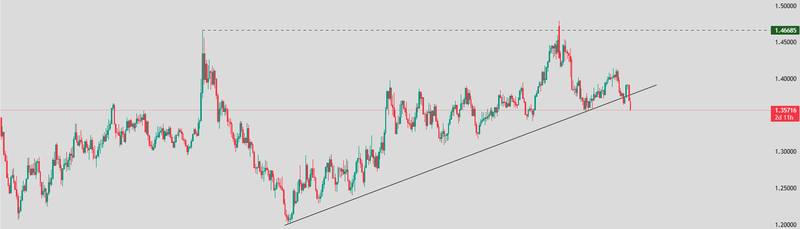

USD/CAD has been hovering near 1.35, its strongest level since June 13, 2025.

Trump’s threat to impose 100% tariffs on Canadian exports.

USD/CAD shifting power balance

USD/CAD is starting to reflect more than just interest-rate differentials. The pair is increasingly trading at the intersection of US political risk, trade policy, and shifting global alliances, and that mix is becoming harder for markets to ignore.

The US dollar has now weakened for a fifth straight session, with the dollar index sliding toward 96, a fresh four-year low. That decline is not driven by economic stress alone, but by a growing perception that Washington is increasingly comfortable with a softer currency. President Trump’s recent remarks dismissing concerns over the dollar’s fall reinforced the idea that competitiveness, not currency strength, is the current priority.

Trade threats complicate the picture

However, the political overlay is where USD/CAD becomes more complex. Trump’s threat to impose 100% tariffs on Canadian exports if Ottawa deepens trade ties with China is not just rhetoric it is a direct warning shot. Canada’s recent agreement with China to lower trade barriers and allow increased Chinese EV imports marks a clear pivot away from strict alignment with US trade policy.

From a market standpoint, this introduces asymmetric risk. On one hand, diversification toward China could support Canadian exports over the medium term, especially if Beijing follows through on reducing tariffs on Canadian canola. On the other hand, US trade retaliation would hit Canada far faster and harder than any incremental gains from China in the short run.

Adding to the uncertainty is speculation about a potential US-Japan currency intervention to support the yen. Any coordinated effort to weaken the dollar indirectly would add further downside pressure to USD/CAD, even as trade tensions push in the opposite direction.

A softer dollar meets a resilient Loonie

In the near term, USD/CAD is likely to trade in a fragile range, with downside pressure driven by US dollar weakness and upside risks tied to trade escalation. From a macro perspective, the bias leans slightly lower as long as the Fed stays dovish and the US administration signals comfort with a weaker dollar.

The Canadian dollar has quietly found support. USD/CAD is hovering near 1.35, its strongest level since June 13, 2025, suggesting that the move is not just dollar-driven but also reflects relative confidence in Canada’s macro position.

From an economist’s perspective, this matters. A weaker US dollar narrows the interest-rate and growth advantage that once favored the greenback. If the Federal Reserve delivers the expected rate held this week and continues to signal two quarter-point cuts before year-end, that advantage could erode further a scenario that naturally favors USD/CAD downside.

Source: Trading View