Wall street between AI bets and bubble risks

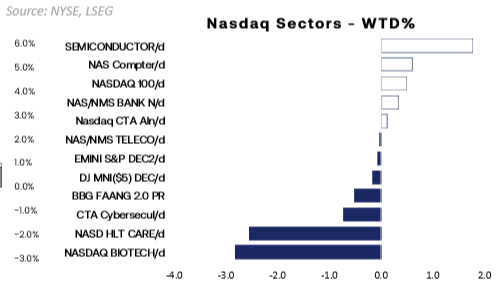

Nasdaq continues to draw strength from mega caps and tech-heavy AI bets, the recent surge in AI investments cloud infrastructure, semiconductors, AI chips, has powered major gains in tech indices. But beneath the surface lies growing concern.

Nasdaq is less guaranteed winner and more high-risk.

The AI boom has not lifted all technology companies equally.

Bubble fears are beginning to re-enter market discussions.

Nasdaq at a crossroads

Nasdaq continues to reflect the powerful influence of artificial intelligence on global equity markets. Over the past year, enthusiasm around AI-driven growth has lifted the index to repeated record highs, fueled by heavy investment in AI. Mega-cap technology stocks have led the rally, supported by expectations that AI will reshape productivity, corporate earnings, and long-term economic growth. Beneath the surface of this rally, market tone is becoming more cautious. While revenue growth from AI services is accelerating across the sector, valuations have expanded even faster in many cases. As interest rates remain elevated and liquidity conditions tighten, investors are increasingly questioning how much future growth is already priced into Nasdaq stocks.

Growing gap between companies

The AI boom has not lifted all technology companies equally, firms with direct exposure to enterprise AI adoption continue to attract strong capital inflows. Earnings visibility, pricing power, and scale remain key advantages for market leaders. At the same time, a growing number of tech companies are being priced more on future potential than current profitability, debt levels have risen sharply, while free cash flow remains under pressure. This divergence widens the gap between companies with sustainable AI business models and those exposed to execution risk. As a result, Nasdaq is no longer moving as a single, unified trade. Instead, it is becoming a market of dispersion, where select names continue to outperform while others face sharp corrections when expectations slip even slightly.

Source: NYSE, LSEG

AI rally becoming a bubble?

Bubble fears are beginning to enter market discussions. Clear warning signs are emerging aggressive projections of future demand, rising leverage to fund expansion, and stocks moving sharply on narrative rather than earnings delivery. However, unlike previous tech bubbles, today AI sector is supported by real and fast-growing revenue streams. The challenge is that not all companies will be able to convert that demand into profitable and sustainable business models. This creates a high-risk, high-reward environment. Nasdaq may still benefit from continued AI adoption across industries, but volatility is likely to increase as investors become more selective. Higher long-term yields raise the discount rate applied to future earnings, which directly pressures high-growth technology stocks. Even companies with strong fundamentals are becoming more sensitive to bond-market moves, as investors reassess how much they are willing to pay for growth that may take years to fully materialize.