Guide to position trading – How to hold trades longer for bigger gains

Position trading is the calm cousin among trading styles. While day traders chase short-term volatility, position traders focus on broader market trends, holding positions for weeks or months to achieve significant returns. If you value patience, long-term perspectives, and strategic analysis, position trading could be your ideal approach.

Position trading involves holding trades from several weeks to months, ignoring daily market noise.

It integrates fundamental analysis with higher-time-frame technical analysis to guide trade decisions.

Wider stop-losses and lower leverage protect against volatility and sudden news impacts.

The approach thrives on large trend moves, disciplined risk management, and reduced trading expenses.

What is Position Trading?

Position trading involves initiating a trade based on a clear long-term thesis and holding the position until the anticipated outcome occurs, typically over several weeks or months. Unlike day traders, who respond to immediate events, position traders focus on long-term economic, sectoral, or asset trends.

How position trading differs from other trading styles:

- Scalping: Trades last seconds to minutes, aiming for tiny price movements.

- Day Trading: Positions close by the end of each trading day, exploiting daily market volatility.

- Swing Trading: Trades span 2–10 days, focusing on intermediate market moves.

- Position Trading: Targets long-term macroeconomic or asset trends, tolerating interim volatility to benefit from larger moves.

Advantages of holding trades longer

Larger profit potential

Capturing significant market movements like a 10% shift in gold or the S&P 500 over months can significantly outperform numerous small daily trades.

Lower stress and less screen time

Reduced need for constant market monitoring, often limited to detailed weekly analysis and quick daily check-ins.

Lower trading costs

Fewer trades mean lower transaction fees, savings that significantly compound over time.

Stronger alignment with fundamentals

Position trading allows time for fundamentals like corporate earnings, central bank policies, and geopolitical events to fully play out.

The three pillars of successful position trading

Macro and fundamental analysis

Fundamental insights such as inflation trends, monetary policy shifts, or supply-chain disruptions anchor the long-term trade thesis.

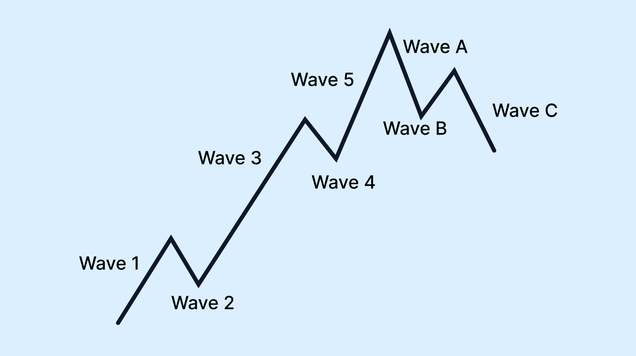

Higher-time-frame technical analysis

Weekly and monthly charts are essential to identify major trends, significant support and resistance levels, and potential breakout points. Tools like moving-average crossovers, 52-week highs, and multi-year trendline breaks are key indicators.

Risk management and money management

Wide stop-losses manage volatility effectively but require smaller position sizes. Experienced traders usually risk only 0.5% to 1% of their account equity per trade and diversify across various unrelated trades.

Step-by-step playbook for building position trades

Scan the macro environment

Identify current economic conditions, interest rates trends, or geopolitical factors that influence asset classes.

Analyze weekly charts

Pinpoint major highs and lows, significant moving averages like the 50- or 200-week SMA/EMA.

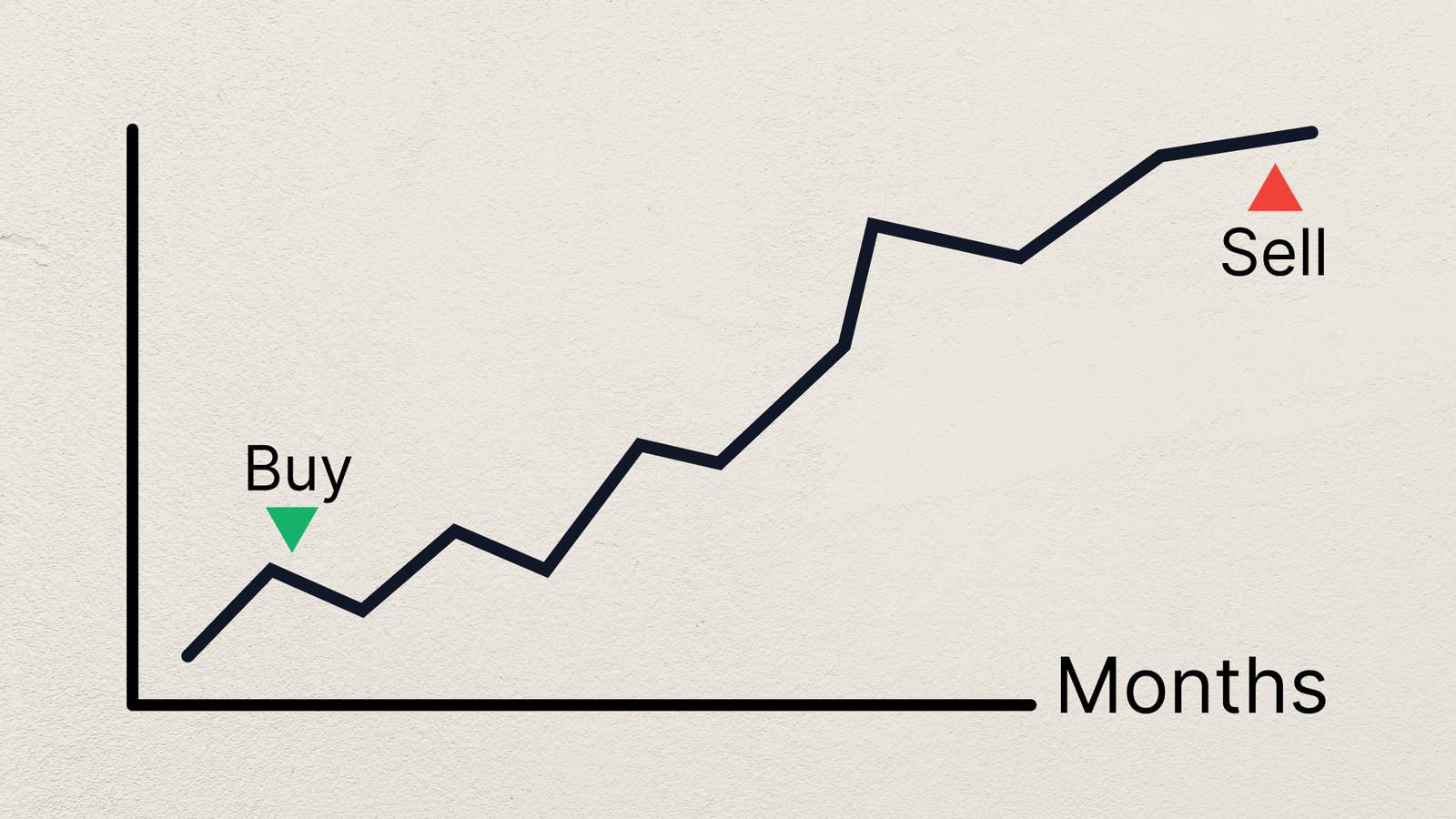

Define entry signals

Look for weekly chart signals such as breakouts above a consolidation range, wedge pattern breakouts, or moving average crossovers.

Set stop-loss orders

Place stops beyond structural invalidation points, typically below recent swing lows (for long trades), incorporating an Average True Range (ATR) buffer.

Establish exit strategies

- Target-based approach: Project a measured move from prior consolidation.

- Trailing stop approach: Utilize weekly moving averages or the Parabolic SAR to manage exits.

- Fundamenta shift: Close positions if the underlying macroeconomic scenario changes significantly.

Determine position size

Calculate using risk management rules, allocating appropriate capital based on stop-loss distances and account risk tolerance.

Regular monitoring (without micromanaging)

Brief daily checks for unexpected events; detailed weekly reviews to assess the trade's progress.

Key Tools and Indicators for Position Traders

- Moving averages (50 & 200 SMA/EMA): Determine broad market trends.

- Fibonacci retracements and extensions: Identify potential support, resistance, and price targets.

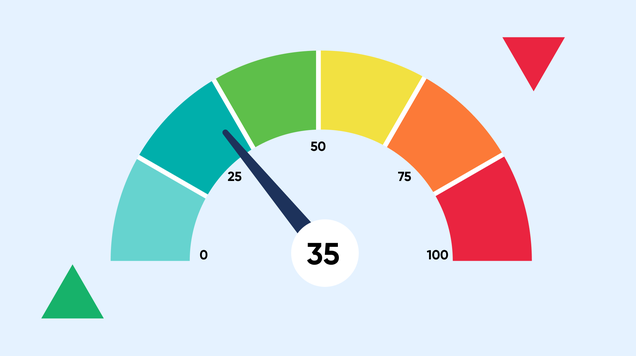

- Weekly RSI or MACD indicators: Detect momentum changes early.

- Commitment of Traders (COT) reports: Understand large trader positions in futures markets.

- Economic calendar: Helps avoid initiating positions during major scheduled economic events.

Common position trading mistakes (and how to avoid them)

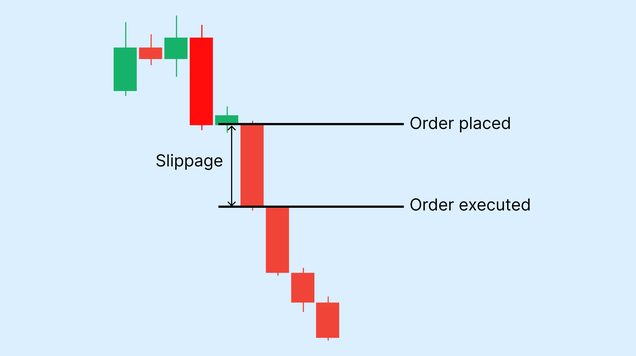

- Over-leverage: Use modest leverage to sustain wider stops.

- Ignoring interim events: Stay informed of major news and fundamental shifts.

- Inappropriate stop adjustments: Maintain original invalidation points and respect your initial plan.

- Attachment to trade thesis: Regularly reassess the fundamental validity of your position.

Mindset and psychology for position traders

Successful position traders cultivate patience, emotional resilience, and commitment to detailed research. Periodic market corrections should be viewed as potential buying opportunities within an ongoing trend rather than triggers for panic.

As many traders employ a hybrid strategy: maintaining a core long-term position while also taking short-term trades to capitalize on temporary market movements.

Position trading emphasizes strategic insight, patience, and disciplined risk management to capitalize on long-term market trends. By combining fundamental analysis, technical charting on higher time frames, and disciplined risk management, traders can effectively harness major market movements without constant market surveillance. Spend less time watching every market tick and more time focusing on high-quality research and analysis, enabling significant long-term profitability.