How to identify and trade fakeouts – A complete trader’s guide

Few chart scenarios are more frustrating than the fakeout—that moment when price spikes through a level you’ve been watching, only to reverse and speed in the opposite direction. Mastering the art of spotting false breakouts (and profiting from them) can turn market deception into a steady edge.

A fakeout is a brief push beyond support, resistance, or a trend line that quickly collapses.

Smart money often triggers fakeouts to harvest liquidity resting above obvious highs or below clean lows.

Confirm true breakouts with volume expansion, multi-time-frame structure, and post-break retests.

Two core tactics exist: fade the failed break or wait for the retest, then join the genuine move.

What is a fakeout?

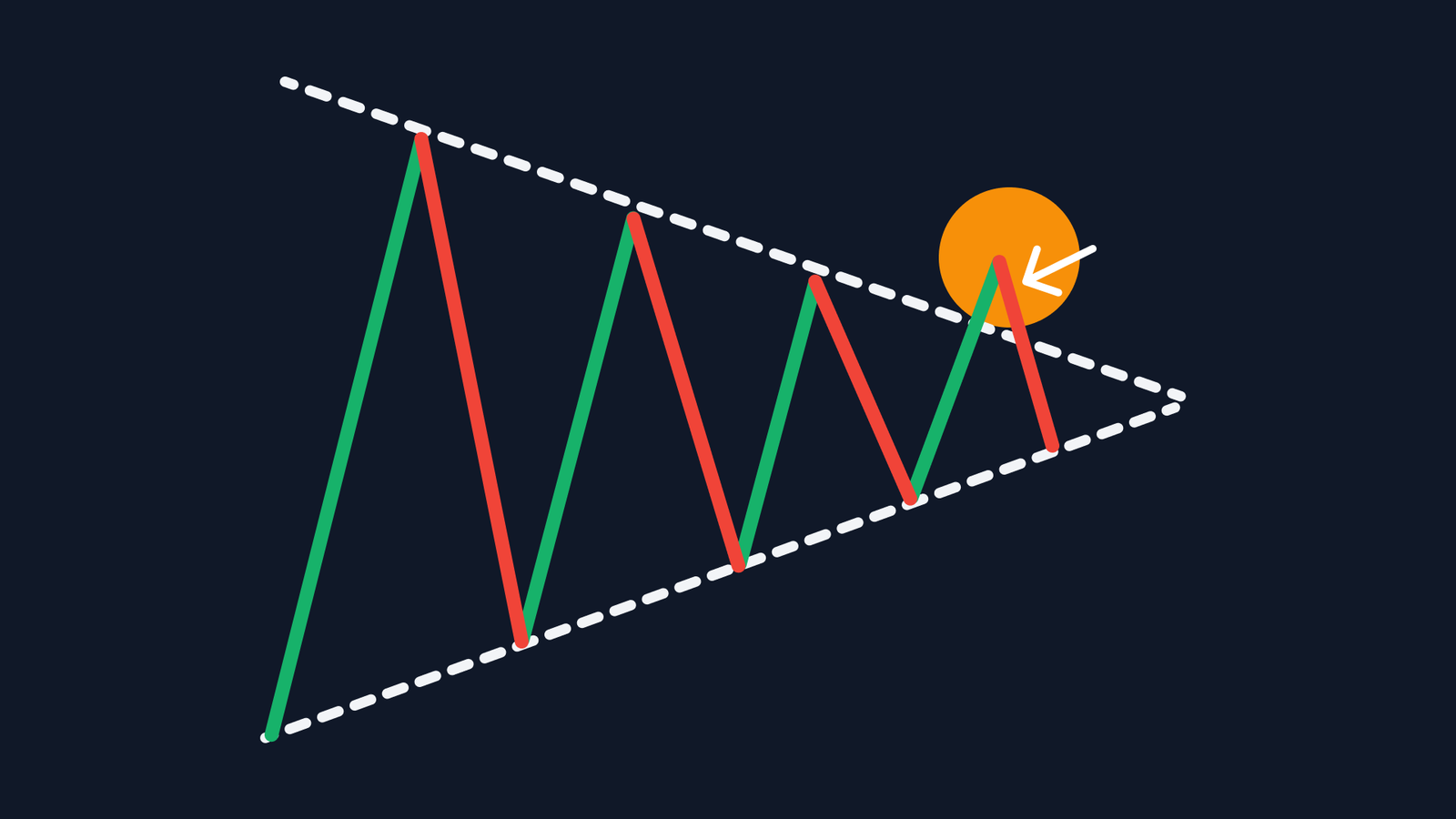

A fakeout (or false breakout) occurs when price breaches a key technical level—think horizontal resistance, a triangle edge, or prior swing high—then quickly snaps back inside the range. Traders who chased the breakout are now trapped, forced to exit, which fuels the reversal. In equities you’ll often see a breakout on low volume that fails by the close; in forex, a news-spike grabs stops during illiquid sessions, then retraces as liquidity returns.

Why fakeouts happen – the market mechanics

Large players—banks, funds, algorithmic desks—cannot fill size without counterparties. Liquidity pools naturally gather at obvious technical levels because retail traders place stop orders there. By nudging price a few ticks beyond resistance, institutions trigger those stops (creating a surge of buy orders) and sell into that liquidity. Once their orders are filled, they release the pressure, price falls back, and the breakout is “fake.” Understanding this motivation helps you anticipate where traps might spring.

Early warning signs that a breakout may be false

3.1 Volume divergence

A genuine breakout in stocks or futures is usually accompanied by a volume surge. If price pushes above resistance on muted or falling volume, odds of failure rise.

3.2 Weak retest behavior

After a true breakout, price often drifts back to the broken level, holds, and accelerates. If the retest slices straight through, the breakout was likely bogus.

3.3 Momentum disagreement

Check RSI, MACD, or a simple rate-of-change. If momentum flattens or diverges while price makes a new high, buying fuel is drying up.

3.4 Time-of-day context

Forex fakeouts cluster around low-liquidity windows (end of New-York session, pre-Tokyo). Equity breakouts that occur in the first ten minutes of cash open without confirmation often reverse by midday.

3.5 News-driven spikes

If the breakout candle is tied to a headline and fades within the same session, treat it with suspicion.

Building a fakeout detection checklist

- Plot the level everyone sees – prior highs/lows, range tops, symmetrical-triangle edges.

- Wait – don’t trade the first push; observe volume and closing behavior.

- Watch lower time frames – look for rejection wicks, engulfing candles, or order-flow flips.

- Ask: was there a catalyst? Sudden moves without fresh fundamental news often unwind fast.

- Confirm on a second close – two successive bars above resistance on rising volume reduce fakeout risk.

Two core trading tactics

5.1 Fading the fakeout

Once price pierces resistance, prints a long upper shadow, and closes back inside the range, enter the opposite direction.

- Entry Short on the close back below resistance (or long on a failed downside break).

- Stop-loss A few ticks/pips beyond the extreme of the fakeout spike.

- Target Mid-range for partial profit; opposing range boundary for full target.

5.2 Trading the retest

If you’re not comfortable fading, let the market prove itself. After the fakeout peaks, price often retests the level from the other side—creating a cleaner setup.

- Entry On rejection of that retest (e.g., bearish pin bar at former resistance).

- Stop-loss Above the retest high.

- Target Measure the prior range height and project downward (or upward for failed breakdowns).

Both approaches require disciplined position sizing—risk no more than 1 % of equity per idea.

Common mistakes to avoid

- Buying the first break blindly – always demand confirmation or a retest.

- Ignoring the broader trend – a range breakout against a dominant higher-time-frame trend has lower odds.

- Setting stops inside noise – place them beyond the fakeout wick to survive normal volatility.

- Revenge trading fakeouts – one loss does not mean the next breakout will fail; trade the evidence, not frustration.

Integrating fakeout logic into a strategy

- Combinewith support-resistance mapping, order-block analysis, or Smart Money Concept.

- Back-test on liquid pairs and indices; fakeouts are rarer on illiquid micro-caps where one buyer can sustain a breakout.

- Track metrics: % of breakouts that fail by instrument and session. Over time you’ll know which markets are “trappy.”

Frequently Asked Questions

Why do fakeouts seem to happen right before big moves?

They clear out stop orders, allowing smart money to enter at better prices with reduced friction.

Are fakeouts more common in forex or stocks?

They’re common everywhere, but decentralized forex—with round-the-clock liquidity pockets—offers prime hunting ground.

Can indicators catch fakeouts automatically?

Not perfectly. Some traders code breakout filters using volume and ATR thresholds, but discretion and context still matter.

Should I avoid all breakouts because of fakeouts?

No. Breakouts that pass the confirmation checklist—volume surge, retest hold, momentum alignment—remain powerful setups. Trade evidence, not fear.