Market structure: how to read it correctly

Understanding market structure gives context to price movement, revealing trends, highs and lows to guide smarter entries, exits and risk management.

Price keeps reaching higher highs, yet higher lows fail to develop, hinting at a loss of trend strength.

Increased volume near support often points to accumulation rather than distribution.

Buyers drive price higher during an uptrend, but fading strength allows sellers to regain control.

The basics: trends, swings, and market direction

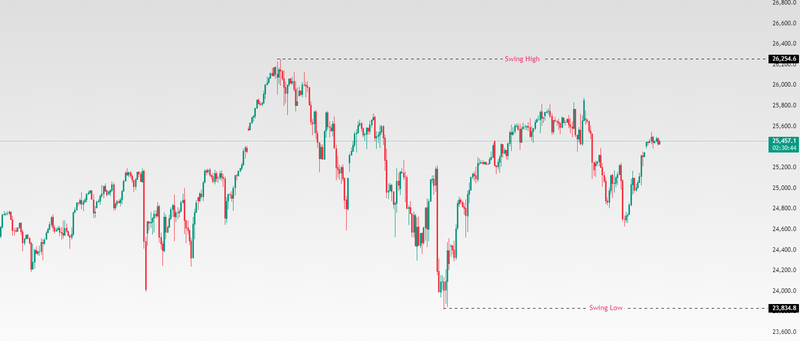

Market structure is built around three main elements: trends, swing highs and lows, and consolidation. An uptrend occurs when the market makes higher highs and higher lows. Each low is above the previous low, and each high exceeds the previous high. Conversely, a downtrend is defined by lower highs and lower lows. Recognizing these patterns allows traders to align trades with the prevailing market force. Swing highs and swing lows are key markers. A swing high is the peak before a downward movement, while a swing low is the trough before an upward move. By identifying these swings, traders can see whether a market is trending or moving sideways. For instance, if prices make higher highs but fail to form higher lows, it may indicate that the trend is losing momentum—a subtle warning for consolidation or reversal. Consolidation occurs when prices move sideways between support and resistance without establishing a new trend. This phase is often used by institutional investors to accumulate or distribute positions before the next large move.

Source: Trading View

Support and Resistance

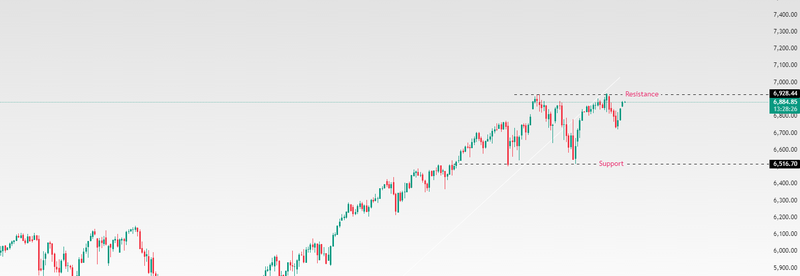

Support and resistance are zones were buying or selling pressure historically emerges. Support is where buyers tend to step in, preventing further price declines, while resistance is where sellers curb upward movement. These zones are not exact points but areas where the market reacts. For example, if the S&P 500 repeatedly finds buyers near 6,516, this acts as support, while struggles to break 6,928 represents resistance. Traders combine these zones with swing points to anticipate market reactions, set stop losses, and plan entries. Volume is a critical component: high volume at support may indicate accumulation, while weak volume near resistance suggests a potential breakout may fail.

Source: Trading View

Early signs of a shift

You don’t wait for a full reversal candle to start noticing a shift. Early warning signs include Failure to make new highs or lows: If an uptrend cannot push to a new high, momentum is fading. Wide swings and unpredictable moves show that buyers and sellers are struggling for control. Declining volume in an uptrend shows buyers are leaving; rising volume on a break confirms interest in a new direction. Example: In an uptrend, price moves to 1.41393 (last high) but falls back to 1.37281 instead of reaching 1.42000, this hints a structure shift may be forming.

Source: Trading View

Understanding the psychology behind shifts

In uptrend buyers dominate, pushing prices higher. When strength fades, sellers step in, creating a shift. Downtrend sellers dominate, pushing prices lower. Buyers gradually enter, signaling a shift. Trend Following once a shift is confirmed, align trades with the new trend. Risk Management, place stops near previous swing highs/lows to protect against false breaks. Scaling Trades, enter small at the suspected shift, then add more once confirmed. Market structure shifts are about observation and patience. They reveal changes in control between buyers and sellers and indicate whether a trend is weakening, pausing, or reversing. By mastering this concept, traders move from reactive guessing to proactive decision-making.

FQAs

What is a market structure shift in trading?

A market structure shift happens when the current trend of an asset changes direction or loses momentum. It is usually identified by breaks in swing highs or lows, signaling a potential reversal or consolidation. Traders use it to adjust positions, manage risk, and anticipate future price movements.

How do I identify a market structure shift?

You can spot a market structure shift by watching price behavior: look for broken swing highs/lows, trendline breaks, rising or falling volume, and changes in momentum indicators like RSI or MACD. Confirming the shift often requires waiting for a close beyond a previous swing point.

What is the difference between a trend reversal and a consolidation in market structure?

A trend reversal indicates a complete change in the direction of the trend (uptrend to downtrend or vice versa). Consolidation is when the market pauses and moves sideways before deciding its next move. Both represent a shift in control between buyers and sellers.

Why are market structure shifts important for traders?

Shifts reveal changes in the balance of power between buyers and sellers. Understanding them helps traders enter trades in the right direction, set stop-loss levels, and avoid being caught in false breakouts. It’s a foundational tool for technical analysis.

Can market structure shifts predict reversals?

While shifts indicate a potential change, they do not guarantee a reversal. They signal a change in trend behavior and help traders prepare, but confirmation through additional tools (volume, momentum indicators, or pattern recognition) is recommended.