How to trade gold in forex: An essential beginner’s guide to XAU/USD

In today’s financial world, gold is one of the most actively traded instruments in the forex and CFD markets, offering opportunities for both short-term traders and long-term investors.

Unlike buying physical gold, forex traders speculate on price movements using leverage.

Gold reacts strongly to global macroeconomic conditions.

Gold often behaves very differently from currencies like EUR/USD or GBP/USD and is much more volatile.

How trading gold in forex works

Gold has always held a special place in global markets. For centuries, it has served as a store of value, a hedge against uncertainty, and a symbol of wealth. You can trade metals just like you trade a forex pair. XAU/USD, for example, is a pair made up of gold against the USD dollar. It works in the same way as any other currency market, buying means purchasing XAU (gold) by selling USD and gives you a long position. Selling, on the other hand, means buying USD in exchange for gold, and gives you a short position.

When traders refer to trading gold in the forex market, they are usually referring to XAU/USD, which represents the price of one ounce of gold quoted in US dollars. If XAU/USD is trading at 4,260, it means that one ounce of gold is worth $4,260. Unlike buying physical gold, forex traders do not own the metal itself. Instead, they trade gold through leveraged instruments such as Contracts for Difference (CFDs). This allows traders to profit from both rising and falling prices. However, while leverage can maximize profits, it also magnifies losses, making proper risk management essential.

What moves the price of gold?

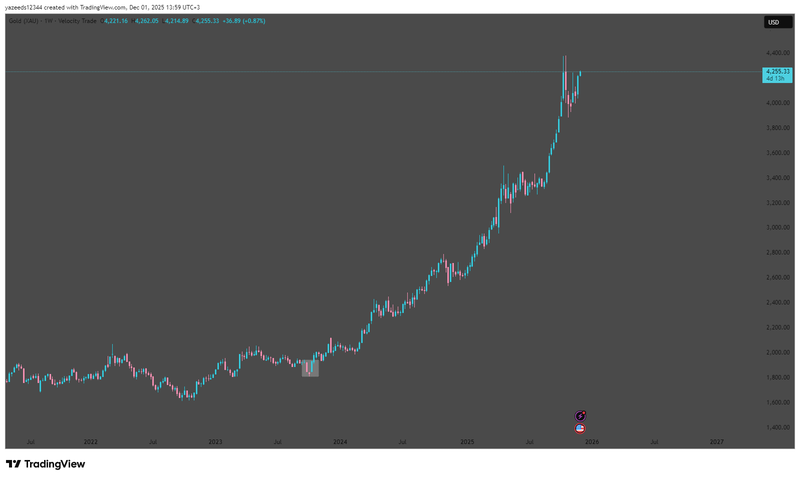

Gold reacts strongly to global macroeconomic conditions and is influenced by several key factors. One of the most important drivers is the US dollar. Gold and the dollar usually move in opposite directions. When the dollar weakens, gold often rises, and when the dollar strengthens, gold tends to fall. This happens because gold is priced globally in US dollars, making it cheaper for international buyers when the dollar declines. Interest rates and central bank policies also play a crucial role. Gold does not generate interest or yield, so when real interest rates are high, gold becomes less attractive compared to bonds and savings instruments. When interest rates fall or central banks signal a more dovish stance, gold often benefits. Decisions made by the US Federal Reserve are among the most powerful drivers of gold prices. Another major factor is geopolitical tension. Wars, political conflicts, and global instability tend to push investors toward safe-haven assets such as gold. This safe-haven demand can trigger sharp and rapid price rallies. For example, during the Israel–Gaza conflict, gold surged from around $1,816 to nearly $4,378 in a short period.

Source: Trading View

Gold compared to other instruments

Gold behaves very differently from traditional forex pairs like EUR/USD or GBP/USD. It is far more volatile, trades in wider daily ranges, and reacts aggressively to economic data and breaking news. A single US inflation report or a Federal Reserve speech can move gold by $20 to $40 within minutes. This high volatility is what makes gold one of the most widely traded instruments in the world. It attracts day traders who seek fast price movements, swing traders who target multi-day trends, and hedgers who use gold to protect their portfolios during periods of uncertainty. However, the same volatility that creates strong trading opportunities also increases risk, meaning traders must approach gold with discipline, proper position sizing, and strict risk management.