Scalping vs day trading: the key differences explained

Used in markets like forex, stocks and crypto, scalping and day trading both target intraday moves, yet vary greatly in risk, execution and trader focus.

The key difference between scalping and day trading lies in trade duration and frequency throughout the trading session.

Day trading typically targets larger price moves, enabling wider stop losses and more adaptable trade management.

Scalping relies on high-speed execution, order flow analysis, level 2 data and ultra-short timeframes like one-minute charts.

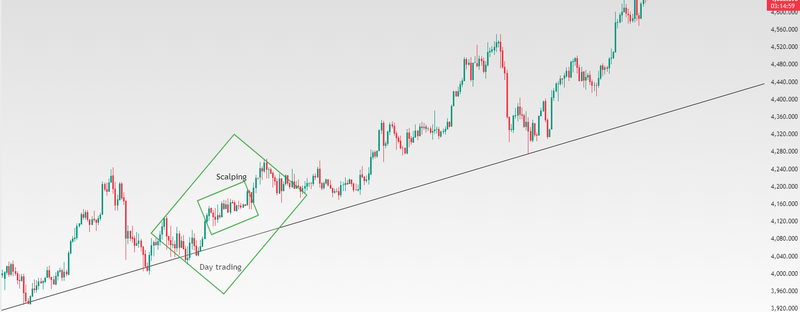

Trading style and time horizon

The most important difference between scalping and day trading lies in the trade duration, frequency, and execution style. Scalping focuses on capturing very small price movements over extremely short time frames, often lasting from just a few seconds to several minutes. Scalpers aim to exploit brief inefficiencies in price, liquidity, or order flow, entering and exiting positions quickly before market conditions change. Because profit targets are small, scalpers may execute dozens or even hundreds of trades in a single session, relying heavily on fast order execution, tight bid-ask spreads, and strict risk control. Even minor delays or slippage can significantly impact results, making speed, discipline, and consistency essential.

Day trading, by contrast, involves holding positions for longer periods within the same trading day, typically ranging from several minutes to several hours. Day traders seek to capture larger intraday price swings, often driven by technical breakouts, trend continuation patterns, or news-related volatility. As a result, they place fewer trades, sometimes only a handful per day but aim for higher reward-to-risk ratios on each setup. All positions are closed before the market closes to avoid overnight risk, yet the overall pace is more deliberate than scalping. Day traders spend more time analyzing market structure, waiting for confirmation, and managing trades as they develop, rather than reacting instantly to short-term price fluctuations.

Source: Trading View

Risk, capital, and psychology

Risk management plays a fundamentally different role in scalping and day trading due to differences in trade size, duration, and frequency. Scalping relies on very small profit targets, often just a few ticks or cents, which requires tight stop-losses and a high volume of trades to accumulate meaningful returns. While the risk per individual trade is typically small, the cumulative risk can become significant if discipline slips or market conditions deteriorate. Transaction costs, commissions, and slippage play a critical role in scalping, as frequent entries and exits can quickly erode profits. For this reason, scalping often demands larger trading capital, access to low-commission brokers, tight spreads, and fast execution to maintain a positive expectancy.

Day trading, by contrast, aims for larger profit targets per trade, allowing traders to use wider stop-loss levels and manage positions more strategically. Because fewer trades are taken, traders have more flexibility to wait for higher-quality setups and adjust risk based on market structure. However, the larger position size and wider stops mean that individuals losing trades can have a more noticeable impact on account equity if risk is not carefully controlled. Effective position-sizing and predefined risk limits are essential to prevent drawdowns from escalating.

From a psychological perspective, the demands of each strategy differ significantly. Scalping requires intense concentration, rapid decision-making, and emotional control, as traders must react instantly to short-term price changes and avoid hesitation or overtrading. Mental fatigue can quickly set in, increasing the risk of mistakes. Day trading, on the other hand, tests a trader’s patience and confidence, as positions may fluctuate for extended periods before reaching their target. Traders must remain calm during temporary drawdowns and trust their analysis without reacting impulsively to short-term noise. Ultimately, success in either approach depends not only on strategy but also on aligning risk management and psychology with the trader’s personality and discipline.

Tools, skills, and market conditions

Scalping relies heavily on high-speed execution and real-time market data, as success depends on entering and exiting trades within seconds or minutes. Scalpers often use Level II order books, time-and-sales data, and order flow analysis to identify short-term imbalances between buyers and sellers. These tools help detect fleeting opportunities where liquidity momentarily shifts. Very short-term charts such as five-minute charts, or even one-minute timeframes are essential for timing entries with precision. Because profit margins are small, scalpers benefit most from highly liquid markets with tight bid-ask spreads, including major forex pairs, index futures, and large-cap stocks, where price movement is smooth and execution costs are minimal.

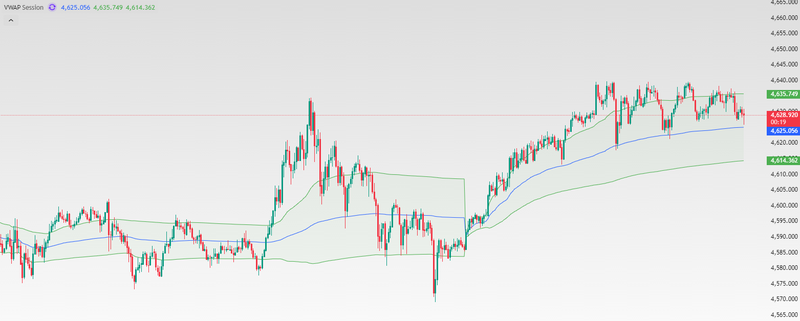

Day traders typically rely on a broader analytical framework that combines technical indicators, chart patterns, and fundamental or news-based catalysts. Commonly used timeframes include one-hour, four-hour, and fifteen-minute charts, which help traders identify intraday trends, breakouts, and support or resistance levels. Indicators such as moving averages, volume analysis, VWAP, and momentum oscillators are often used to confirm trade setups.

In addition, day traders pay close attention to macroeconomic data releases, earnings announcements, and central bank communications, as these events can generate sustained volatility and directional moves. Day trading tends to perform best in markets with clear intraday trends, expanding volatility, or strong news-driven momentum, where prices have room to develop beyond short-term fluctuations.

Source: Trading View

FAQs

Is scalping more profitable than day trading?

Scalping can be profitable, but it is not easy. It requires precision, discipline, and low trading costs. Day trading may offer larger profits per trade but with fewer opportunities.

Which strategy is better for beginners?

Day trading is generally more suitable for beginners because it allows more time to analyze trades and manage risk, whereas scalping demands advanced execution skills.

Do scalpers and day traders use the same indicators?

Some indicators overlap, such as moving averages and volume, but scalpers focus more on order flow and price action, while day traders use trend and momentum indicators.

How much capital is needed for scalping or day trading?

Scalping often requires higher capital due to frequent trades and margin requirements, while day trading can be started with smaller capital depending on the market and broker.

Can I combine scalping and day trading?

Yes. Many traders use scalping for quick trade while holding one or two day-trade positions during the same session, as long as risk is managed properly.