What Is a Micro Lot and How Does It Affect Your Trading?

Want to know what is a micro lot in forex trading? In this article, we answer this question and explore the ways by which a micro lot can affect the way you trade.

What Are Lots in Foreign Exchange Trading?

When traders place orders for currency pairs in the global foreign exchange market, they must specify a trade size. Trade size is expressed as lots, and each one pertains to a standardised quantity of units of the base currency – the first currency in a currency pair, so USD in the currency pair United States dollar (USD) and British sterling pound (GBP).

While you can buy shares in various quantities, currencies are traded in fixed sizes. You cannot purchase or sell a random quantity of it but must open a contract for one of the market’s customary lot sizes.

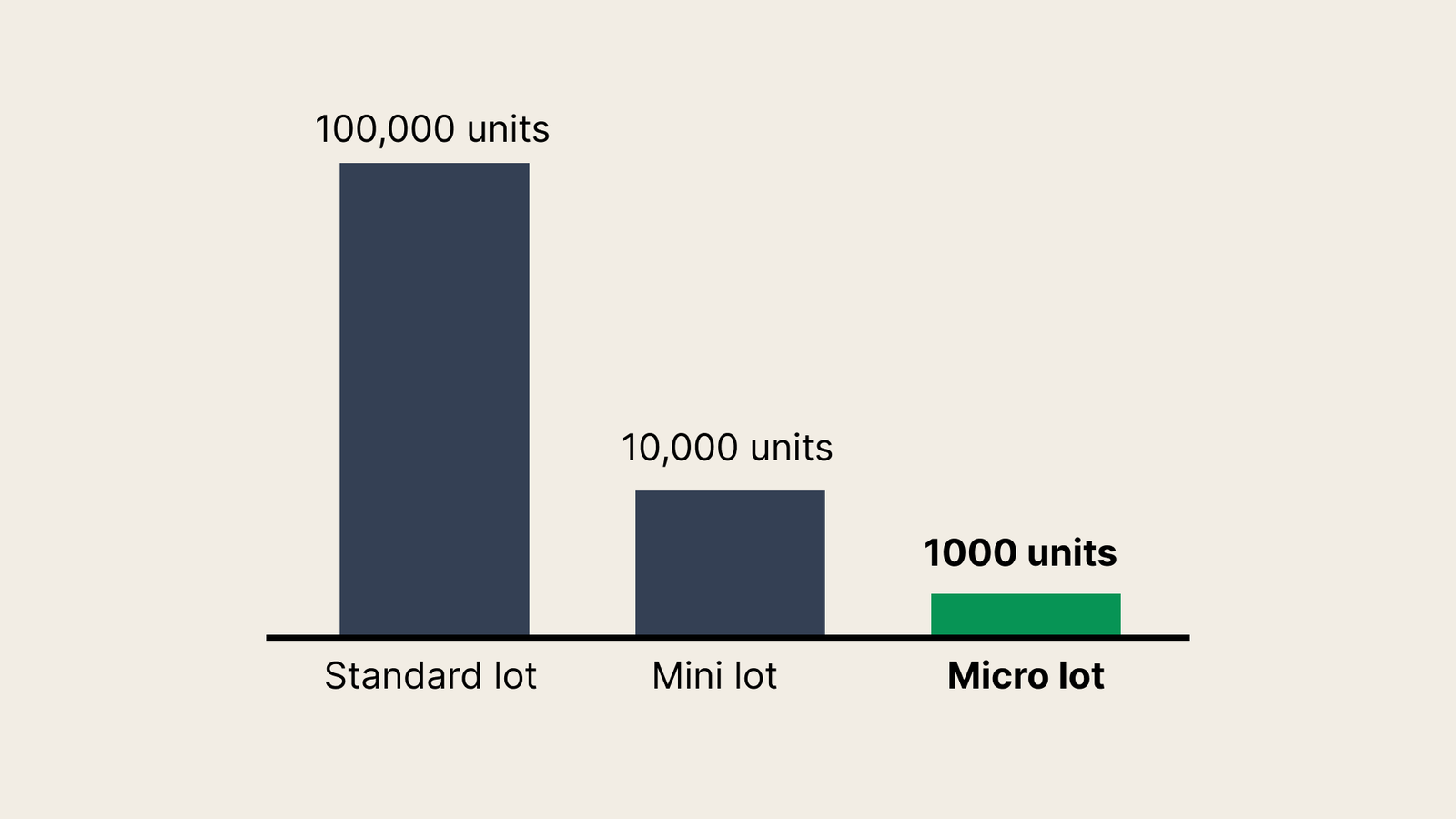

The following are the four standardised or established lot sizes in currency trading:

- Standard lot: A standard lot is a contract for 100,000 units of the base currency. Conventionally, this is what a broker or trader means when they say ‘lot’.

- Mini lot: A mini lot is one-tenth the size of a standard lot (i.e., 10,000 units).

- Micro lot: The micro lot size is one-tenth that of a mini lot and one-hundredth the size of a standard lot (i.e., 1,000 units).

- Nano lot: A nano lot is one-tenth the size of a micro lot (i.e., 100 units).

Note that brokers may or may not offer all of the above lot sizes. Equiti does not offer nano lots for trading.

What Is a Micro Lot and How Much Is It?

Just what is a micro lot in forex trading? A micro lot is a bundle of 1,000 units of the base currency. Thus, placing a buy order for a micro lot of the USD and Japanese Yen (JPY) pair means opening a contract for 1,000 units of the U.S. dollar.

How much is a micro lot? Since a micro lot is 1,000 units of the base currency, it’s easy to calculate its value. A USD/JPY micro lot is 1,000 units of the U.S. dollar or $1,000. Likewise, a micro lot of the Euro-U.S. dollar pair (i.e., EUR/USD) is 1,000 units of a euro or EUR 1,000.

Why Trade Micro Lots: Micro Lot Implications on Trading Strategy

There are several reasons traders open contracts for micro lots.

Risk Management

The small micro lot size limits your risk. You stand to lose less with every pip in micro lots than in bigger lots.

- What Is a Pip?

Pip is ‘percentage in point’, and it is the smallest standardised price movement in most major currency pairs. To be precise, pip marks the change in the value of the counter or quote currency (i.e., the second currency in a currency pair). In EUR/USD, the counter currency is USD. In GBP/EUR, it is EUR.

The price of currency pairs always increases or decreases in discrete steps, and every step is known as a pip. One pip is the smallest amount the price of a currency pair can move, and it is equivalent to 0.0001 in most currencies but 0.01 in currencies priced up to two decimal places, such as Japanese yen (JPY), Czech koruna (CZK) and Hungarian forint (HUF).

- Pip Value in Micro Lot Trading

The pip value is the amount you stand to gain or lose with every pip or step change in price, adjusted for your trade size. It is calculated by multiplying the pip size and your position or lot size.

Example: If a USD/CAD micro lot has a value of 1.3739 and the market moves against your position by 50 pips, you lose CAD 5 ($3.6393) in a micro lot. The same 50-pip movement against your standard lot position means a loss of CAD 500 ($363.9275).

Therefore, trading micro lots exposes you to only 1% of the risk inherent in standard lots.

Granular Control

Refine or fine-tune your risk management strategy with micro lots. Suppose you have a personal risk limit of $6 and a 15-pip stop loss. You can trade four micro lots, in this case. Each one can lose you $1.5, so four micro lots mean a risk exposure of $6. You cannot do this with a mini lot and a standard lot, where 15 pips are equivalent to potential losses of $15 and $150, respectively.

Framework and Platform Testing

Test the waters through micro lot trading. You can open micro lot positions in tens of currency pairs to evaluate a trading framework. You can experiment with a new workflow, a trading platform or an AI forex trading bot without significant risk.

Position Scaling

Gain exposure in currency pairs you feel are ripe for an upset but aren’t moving as expected. If the charts indicate the price is going up, but there are a few contrary signals, you may place 25 micro lots initially. Once your position solidifies and you become more confident, you can scale up by adding another 25 or more micro lots.

Forex Trading Familiarisation

Get accustomed to the foreign exchange market if you’re a novice forex trader. Micro lot trading can be a good way to gain hands-on practice on various forex trading concepts, such as:

- Pips (and pipettes)

- Currency pair types (e.g., major, minor, exotic)

- Margin level in forex

- Leverage

- Spreads

- Commission

You can also learn about the different order types:

- Market order

- Limit order

- Stop-loss order

- Take-profit order

- Trailing stops

You can practice technical analysis, too, so you can gauge market sentiment:

- Support and resistance

- Trendlines

- Channels

- Candlestick patterns (e.g., morning star pattern)

- Moving averages

Finally, practising with micro lots will help you understand the impact of geopolitical, economic, and other factors on currency markets.

Resilience

Use micro lot trading to develop trading discipline. The stakes are smaller, so it may be easier to stick to your process, thresholds and ceilings. This will stand you in good stead when you start trading bigger lots.

Downsides of Micro Lot Trading

Monitoring, controlling and maintaining 100 small positions is more taxing and time-consuming than managing one standard lot. The costs can also add up, especially if your platform charges a per-trade fee, so make sure you understand your broker’s commission structure, particularly the spreads. You must be able to compute exactly how much every micro lot trade costs you in broker commissions.

Strategic Micro Lot Trading

A micro lot corresponds to 1,000 units of the base currency in a currency pair. It is 1% the size and risk of a standard lot.

If you are new to the forex market, are risk-averse, want granular control over your exposure, have a small capital, or want to test the waters for a forex trading framework, workflow, theory, or platform, trade micro lots.

Equiti is a global broker licensed by the Financial Services Authority of Seychelles. You can trade contracts for difference (CFDs) in various trading products, such as shares, exchange-traded funds (ETFs), futures, indices, and currency pairs.

Open an account now to trade more than 60 currency pairs with zero commission, no sign-up fees, and tight spreads.