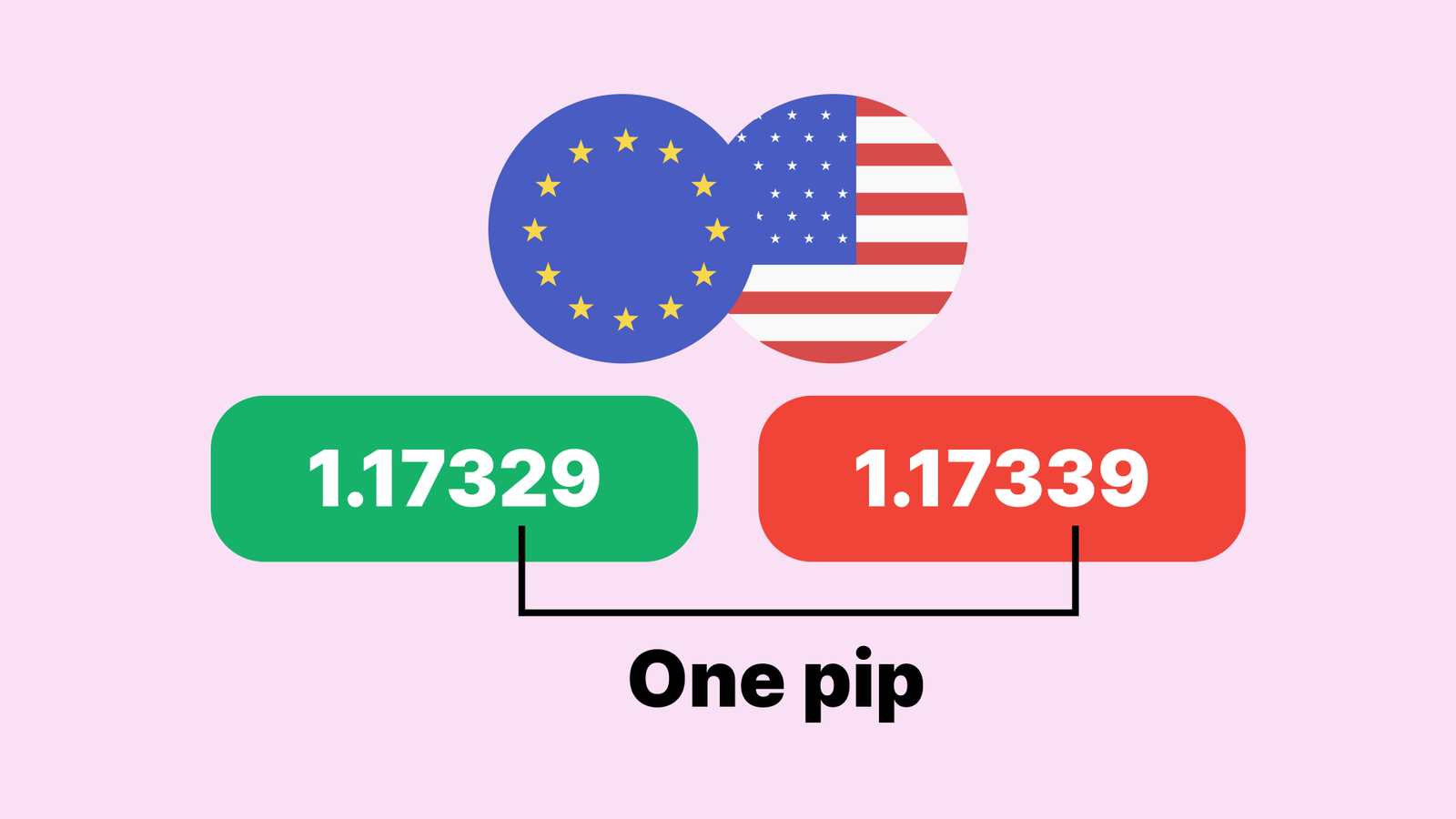

A quick guide to pips in forex trading

A pip is the standard unit that measures price movement in a currency pair. Understanding pips meaning, how pips in forex are counted, and how to convert pips into money is the foundation of sizing trades, setting stops, and controlling risk.

A pip is the standard step in a forex quote.

Most pairs: 1 pip = 0.0001; JPY pairs: 1 pip = 0.01.

Pip value depends on pair, price, lot size, and account currency.

Convert pips to dollars before placing any trade.

Pip meaning—What are pips in trading, in plain English

In forex, pips (short for “points in percentage”) are tiny increments that quotes move by. On most pairs such as EUR/USD or GBP/USD, 1 pip = 0.0001. On yen pairs like USD/JPY, 1 pip = 0.01. Many platforms also show an extra decimal (a pipette), which is one-tenth of a pip. Using pips lets every trader describe moves, stops, and profit targets in the same language.

How to count pips without guessing

Read the “pip place” in the quote and measure the change.

EUR/USD 1.1000 → 1.1055 = 55 pips (because 0.0055 ÷ 0.0001 = 55).

USD/JPY 150.00 → 150.85 = 85 pips (because 0.85 ÷ 0.01 = 85).

When you see an extra 5th decimal (or 3rd on JPY), remember: that last digit is a pipette (0.1 pip), not a full pip.

How to calculate pips in forex—turning pips into money

To manage risk, you must translate pips into your account currency. The value per pip changes with the pair, the current price, and your lot size (standard = 100,000 units; mini = 10,000; micro = 1,000).

If USD is the quote currency (EUR/USD, GBP/USD) and your account is in USD:

- Standard lot ≈ $10 per pip

- Mini lot ≈ $1 per pip

- Micro lot ≈ $0.10 per pip

This rule of thumb works because the pip size (0.0001) is already in USD.

For JPY pairs in a USD account (USD/JPY, EUR/JPY):

Pip value must be converted back from JPY to USD, so it varies with the price.

Example at USD/JPY = 150.00:

Standard lot (100,000 base units): 1 pip ≈ $6.67

Mini lot: $0.667

Micro lot: $0.0667

If USD/JPY were 100.00, a standard-lot pip would be about $10; at 160.00 it’s about $6.25.

For pairs where USD is the base (USD/CAD, USD/CHF) in a USD account:

Pip value ≈ (10 ÷ price) dollars per pip (standard lot).

Example at USD/CAD = 1.3600 → $7.35 per pip (standard lot).

If your account is not in USD:

Work out the pip value in the quote currency first, then convert to your account currency at the live rate.

1 pip is equal to how many dollars?

There’s no single answer. It depends on the pair, the price, and the lot size you trade. Quick references most traders use:

- EUR/USD or GBP/USD (USD as quote): ~$10 per pip (standard), $1 (mini), $0.10 (micro).

- USD/JPY near 150: ~$6.67 per pip (standard), $0.667 (mini), $0.0667 (micro).

- USD/CAD at 1.36: ~$7.35 per pip (standard), $0.735 (mini), $0.0735 (micro).

Always check the current price—pip value changes as exchange rates move.

Pips = |New Price − Old Price| ÷ Pip Size

Pip Size (most pairs) = 0.0001

Pip Size (JPY pairs) = 0.01

P/L (in account currency) = Pips × Pip Value × Number of Lots

EUR/USD or GBP/USD in USD account:

Pip Value per Standard Lot ≈ $10

Pip Value per Mini Lot ≈ $1

Pip Value per Micro Lot ≈ $0.10

USD/JPY in USD account:

Pip Value (USD) = (0.01 × Lot Size in Base Units) ÷ USD/JPY Price

USD/CAD or USD/CHF in USD account (standard lot):

Pip Value (USD) = 10 ÷ Exchange Rate

Position Size (lots) = (Account Equity × Risk %) ÷ (Stop Distance in Pips × Pip Value per Lot)

Why pip value comes before the trade button

Pip value is the backbone of position sizing. Suppose your account is $5,000 and you risk 1% ($50) per trade. Your setup on EUR/USD uses a 25-pip stop. A mini lot is $1 per pip, so 25 pips × $1 = $25 risk per mini lot. You can hold two mini lots to keep risk near $50. If you forget this math, you’re guessing with your capital.

Examples that tie it all together

Example 1 — EUR/USD long (USD account).

Entry 1.1000, stop 1.0975 → 25 pips risk. With 0.30 lots (three mini lots), each pip ≈ $3. Risk ≈ $75. If target is 1.1050 (50 pips), potential P/L ≈ +$150.

Example 2 — USD/JPY short (USD account).

Price 150.00, pip value (standard lot) ≈ $6.67. You risk 30 pips with 0.50 lots (half standard). Risk ≈ 30 × $6.67 × 0.5 ≈ $100. If price drops 60 pips, P/L ≈ +$200.

Example 3 — USD/CAD long (USD account).

Price 1.3600, pip value (standard lot) ≈ $7.35. You take a 40-pip stop on 0.20 lots. Risk ≈ 40 × $7.35 × 0.2 ≈ $58.80.

Common pitfalls (and easy fixes)

Many beginners confuse pipettes with pips and think a 10-pip move is 100 pips because they counted the extra digit. Others use the same lot size on USD/JPY and EUR/USD, even though pip values are different—leading to unplanned risk. A third mistake is skipping the currency conversion when the account isn’t in USD. The fix is simple: know the pip size for the pair, compute the pip value in your account currency, then size the position from your risk limit.

A simple workflow you can repeat

Start by identifying the pair’s pip size. Estimate the pip value in your account currency using the formulas above. Decide your risk per trade (for example, 0.5%–1% of equity). Measure your stop distance in pips. Plug those numbers into the position-size formula, round to the nearest sensible lot size, and only then place the order. This turns every trade from a guess into a controlled decision.

FAQs

What is a pip?

The standard unit of price movement in a forex pair—0.0001 for most pairs and 0.01 for JPY pairs.

How much is a pip in forex?

It depends on the pair, current price, lot size, and account currency. Use the formulas above to get the exact number.

Why does my pip value change over time?

Because exchange rates move, and some pairs require converting the pip value into your account currency.