Price slippage explained: why it matters in trading

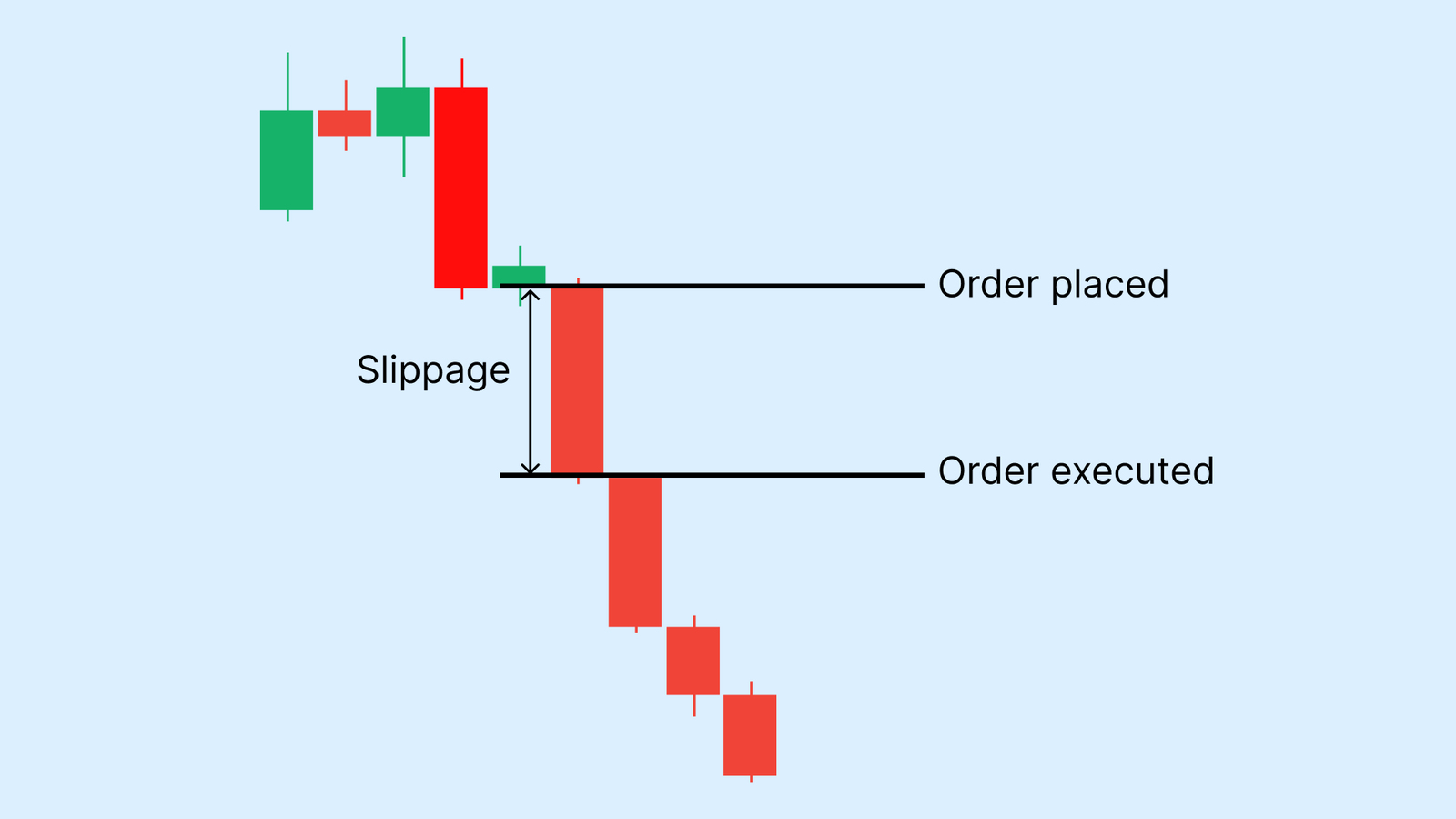

Slippage occurs when a trade is filled at a different price than requested, which can benefit or harm traders depending on market conditions and execution.

Slippage arises when execution differs from the intended price, often caused by rapid price movement, low liquidity or delayed order processing.

When the order book cannot meet demand at a set price, the matching engine sources liquidity at deeper levels, resulting in slippage.

Traders can limit slippage by trading during usually liquid hours, avoiding high-impact news, applying stop-limit orders and only trading with regulated brokers.

What is price slippage?

Price slippage is a phenomenon within trading dynamics where the price requested in an order differs from the final execution price. This discrepancy can either benefit or disadvantage the trader depending on the position taken (buy or sell), as well as the magnitude of the variation (the distance between the requested price and the executed price).

Slippage can be negative if the execution price adversely affects the trader's position (buying at a higher price or selling at a lower price), or positive if the execution price benefits the trader (buying at a lower price or selling at a higher price). Slippage can alter the expected risk-reward profile of a trade, affect stop-loss effectiveness, change anticipated drawdowns and, in aggregate, materially influence portfolio performance.

Generally, slippage occurs due to the confluence of factors such as volatility, liquidity, and latency. Volatility tends to be the most significant driver; economic or geopolitical news often causes an abrupt imbalance in supply and demand, disrupting the market microstructure and creating execution gaps.

Liquidity is also a critical determinant: When the resting liquidity at the quoted price is insufficient to fill an order, the matching process consumes liquidity at more distant price levels, producing slippage. Low-liquidity instruments and off-peak trading hours exacerbate this risk. Finally, latency—the speed of order processing—can be a decisive factor if the financial intermediary lacks the technological infrastructure for optimal execution.

Why does price slippage occur?

When a market order is submitted, it consumes liquidity starting at the best available price level in the order book. If the available volume at the top of the book is insufficient to fill the entire order, the matching engine continues executing the remaining quantity at deeper price levels. This process of walking the order book leads to slippage, since portions of the order are filled at progressively less favourable prices.

Liquidity in the order book is supplied by limit orders placed at different price levels. During periods of high volatility, liquidity may become fragmented or thin as market makers widen spreads or reduce quote sizes. Stop-loss and take-profit orders can further impact liquidity once triggered, since many of them convert into market orders that consume rather than provide liquidity, amplifying slippage.

Differences in price slippage across markets

Slippage can vary significantly depending on the market structure in which trades are executed.

In centralised markets, such as stock exchanges or futures derivatives exchanges, strict rules and regulations compel intermediaries to seek the execution of the best available prices (Best Execution). Therefore, the slippage phenomenon in these environments is generated purely by the organic dynamics of volatility and liquidity.

However, in Over-The-Counter (OTC) markets, the causal factors of slippage may vary. For instance, brokers utilising ECN (Electronic Communication Network) or STP (Straight Through Processing) models route orders directly to an interbank liquidity pool; thus, slippage depends similarly on the combined behaviour of volatility and liquidity. Conversely, brokers operating Market Maker models act as the counterparty to the trade. This structure can introduce the risk of artificial slippage or latency manipulation if the broker engages in malpractice due to a lack of regulatory oversight.

How to calculate price slippage

There are mathematical formulas to estimate the magnitude of slippage, ranging from basic calculations to complex algorithms used by institutional investors for precision. The basic percentage formula for calculating slippage is as follows:

- Slippage (%) = [ (Execution Price - Expected Price) / Expected Price ] * 100

It is important to note that determining whether slippage is favourable or unfavourable depends on the direction of the position (long/buy or short/sell). For example, if a trader requests a buy entry at $100, but due to slippage the position is executed at $105, the result is negative slippage, as the purchase was executed at a premium of 5 per cent relative to the desired price. The trader would then require the market price to rise to $105 merely to break even on the entry.

Risk management tools to mitigate price slippage

The following are tools and best practices that assist in reducing the probability of being impacted by slippage:

- Trading during periods of low volatility: The economic calendar and financial reporting schedules allow traders to manage their exposure times. To minimise the probability of slippage, one should avoid days and hours when major economic news or financial reports are released, as market volatility typically spikes during these windows.

- Trading in markets and times of high liquidity: High liquidity increases the likelihood of minimal slippage because a large number of orders exist to absorb trades without necessitating a search for greater depth. Highly liquid markets include mega-cap equities or major currency pairs. Furthermore, converging market hours—such as the overlap between the London close and the New York open—tend to be windows where liquidity is maximised.

- Select regulated brokers: It is imperative for the trader to verify that their financial intermediary or broker operates under a robust regulatory framework and possesses global prestige. This minimises the risk of capital loss resulting from malpractice by the intermediary institution, such as latency manipulation.

- Use stop-limit orders: Various brokers offer the facility of stop-limit orders. In a stop-limit order, the stop level triggers the order when the asset price reaches a predefined point; subsequently, the limit price ensures the position is only closed at the specific price set by the trader (or a better one), thereby preventing execution at unfavourable levels.

Conclusion

Price slippage is an inherent imbalance in the mechanics of financial markets, resulting from the interaction between volatility, available liquidity, and execution technology. Although often perceived solely as a hidden cost, a profound understanding of slippage is vital for trader professionalisation and market analysis.

It is not a phenomenon that can be eliminated entirely, but it can be managed effectively through rigorous intermediary selection and proper operational planning. Mastering slippage management allows a trader to preserve the integrity of their strategy, ensuring that entry and exit points respect established risk parameters and protecting capital from the natural inefficiencies of the market microstructure.

FAQ: price slippage

What are the root causes of slippage?

Slippage is caused by the interaction of three primary factors: volatility, liquidity, and latency. Volatility, often triggered by economic news, generates abrupt imbalances between supply and demand. Liquidity is decisive; if there are insufficient orders at the desired price, the system seeks distant prices to fill the order. Finally, technological latency can delay execution, causing the price to change in the milliseconds before the order reaches the market.

How does slippage vary between centralised and decentralised markets?

In centralised markets (exchanges), slippage is driven purely by supply and demand dynamics. In decentralised (OTC) markets, it varies depending on the broker's model. ECN/STP models reflect real interbank liquidity, behaving similarly to centralised markets. However, in Market Maker models, where the broker acts as the counterparty, there is a potential risk of artificial slippage if the entity is not strictly regulated.

Is there a mathematical formula to quantify the impact of slippage?

There are several quantitative methods to measure execution efficiency. A commonly used percentage formula is:

Slippage (%) = [ (Execution Price - Expected Price) / Expected Price ] * 100

The interpretation of the outcome (favourable or unfavourable) depends on the direction of the trade. For example, in a long (buy) position, if the execution price is higher than expected, the slippage is negative, as it represents an increased entry cost that must be recovered before generating profit.

What risk management strategies minimise slippage exposure?

To minimise slippage, it is essential to manage the timing and type of order. It is recommended to trade during sessions of high liquidity, such as the convergence between European and US markets, and to avoid periods of high scheduled volatility (e.g., macroeconomic news releases). Additionally, the use of stop-limit orders is a key technical tool, as it ensures the position is only executed at the specified price or better, preventing executions at price levels that compromise the risk-reward ratio.