UK inflation holds at 3.8% in August, keeping BOE cautious on rate cuts

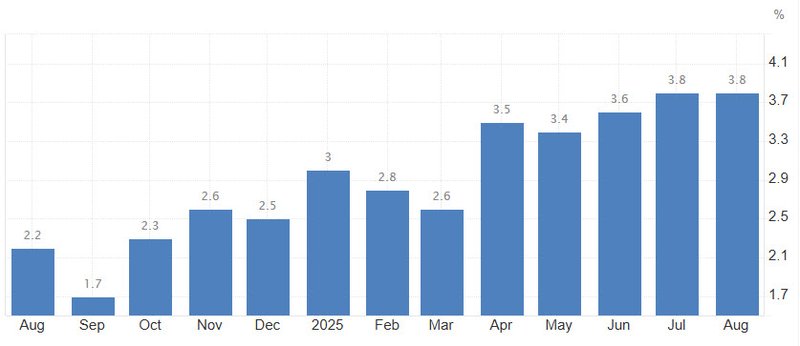

UK consumer prices rose 3.8% year-on-year in August, matching July’s pace and marking the highest inflation since early 2024. Sticky services costs and rising food prices are complicating the Bank of England’s path, with policymakers expected to hold rates at 4% and signal a longer pause in monetary easing.

CPI inflation held at 3.8% y/y in August, in line with forecasts.

Food inflation accelerated to 4.8%, the highest since early 2024.

Services inflation slowed but remained elevated at 4.7%.

BOE expected to keep rates on hold at 4% and extend pause guidance.

UK inflation problem remains worse than U.S. and Eurozone peers.

Inflation proves stubborn at summer peak

The Office for National Statistics reported that UK inflation remained at 3.8% in August, the highest since January and well above the Bank of England’s 2% target. While economists had anticipated this reading, the persistence underscores the challenge of bringing price pressures under control.

Source: Tradingeconomics

The biggest drag came from air fares, which rose far less than last summer. But this was offset by higher motor fuel prices, restaurant and hotel costs, and a continued surge in food inflation, now at 4.8%. Economists noted that special events such as the Oasis reunion tour may even have temporarily lifted hotel prices in certain regions.

Food and services inflation at the core of the problem

Food bills continue to climb across categories, with small increases seen in vegetables, dairy, and fish. The upward pressure is particularly significant because food costs weigh heavily on household perceptions of inflation.

Services inflation slowed marginally to 4.7% but remains uncomfortably high, driven by hospitality, education, and housing-related costs. A BOE-preferred measure of “core services” inflation actually ticked up to 5% once volatile items like airfare and package holidays were stripped out.

Policy outlook: Pause extended

The Monetary Policy Committee meets Thursday and is expected to leave interest rates unchanged at 4%, halting the once-a-quarter pace of cuts seen since mid-2024. With inflation sticky and inflation expectations among households still rising, officials are preparing markets for a longer pause in policy easing.

Markets currently see little chance of further cuts this year and are fully pricing in only one more reduction—by the end of 2026. That contrasts sharply with the U.S., where the Fed is poised to cut this week, and the Eurozone, where inflation has nearly converged with the ECB’s 2% target.

A uniquely British problem

The UK continues to face stronger price pressures than peers. Domestic factors—such as April’s hike in payroll taxes and the minimum wage—have filtered through to business costs, which are increasingly passed on to consumers.

This has left Britain with an “inflation premium” compared to the U.S. and Euro area, threatening to prolong high borrowing costs even as growth slows. The BOE warns that entrenched inflation expectations could fuel wage demands and create a feedback loop of persistent price rises.

The August CPI report confirms that UK inflation is proving harder to tame than in other major economies. With food and services driving price gains and household expectations still elevated, the Bank of England is set to remain on high alert. A cut in borrowing costs this week is off the table, and the timeline for further easing has likely been pushed well into the future.