ECB's standstill amid economic crosswinds

The European Central Bank maintained its interest rates at historically high levels during its March meeting

ECB freezes rates at a 22-year peak amid economic challenges.

Inflation expectations slightly lowered for the coming years.

2024's economic growth projection downgraded, signaling caution.

Possible rate cut hinted by Bundesbank President before summer.

EURUSD faces crucial resistance, with traders on alert.

The European Central Bank (ECB) has opted to maintain its key interest rates at historically high levels during its latest meeting in March, marking a pivotal moment in the Eurozone's economic trajectory. With the main refinancing operations rate holding steady at a 22-year peak of 4.5% and the deposit facility rate remaining at an unparalleled 4%, the ECB's decision underscores a strategic balancing act between mitigating recession risks and addressing persistent inflationary pressures.

Inflation and growth forecasts

The ECB's latest projections reveal a nuanced outlook for the Eurozone economy, adjusting inflation expectations to an average of 2.3% in 2024, a slight dip from previous forecasts. This trend is anticipated to stabilize towards the bank's target, with inflation pegged at 2.0% in 2025 and 1.9% in 2026. On the growth front, the ECB presents a cautious stance, revising its 2024 growth projection downward to 0.6% amidst ongoing economic headwinds. Yet, there's a silver lining as the economy is expected to gain momentum, with projected expansions of 1.5% in 2025 and 1.6% in 2026, hinting at a gradual path to recovery.

Prospects of rate cuts

In an intriguing development, Bundesbank President Joachim Nagel has shed light on the potential for an interest rate reduction ahead of the summer break. According to Nagel, "The probability is increasing that we could see an interest-rate cut before the summer break," emphasizing the data-dependent nature of future monetary policy decisions. This sentiment introduces a layer of optimism within the financial community, as the ECB's upcoming policy meetings in April, June, and July become focal points for potential shifts in strategy.

The last mile of monetary tightening

Nagel's commentary also reflects on the challenges inherent in the final stages of monetary policy adjustment, urging a steady hand in the face of potential early victories against inflation. The German economy, in particular, is spotlighted for its sluggish growth, with Nagel advocating for robust policy measures to reignite economic momentum.

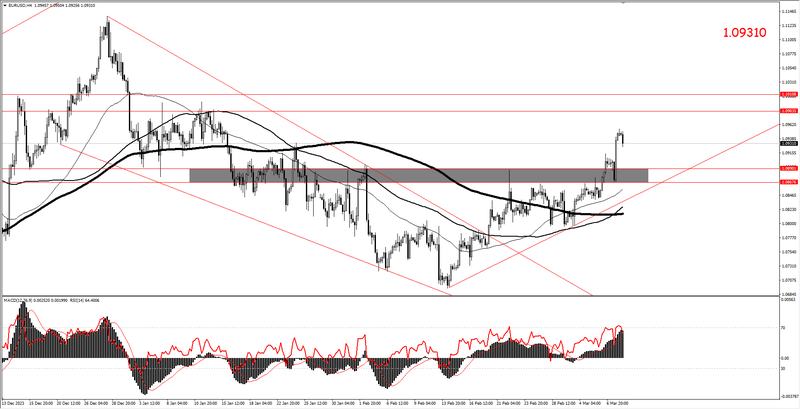

EURUSD technical outlook

The Euro's trajectory against the US dollar offers a technical perspective on market sentiment, with the EURUSD pair confronting resistance at the 1.0965 mark. A successful staying below this threshold could trigger a retest of the 1.0890 level, setting the stage for potential upward movements towards 1.0980 – 1.1010, contingent on sustaining support above the 1.0890 – 1.0860 zone.