Behind price movements in the market

Key concepts in trading: Supply, demand, volume, and liquidity

Supply, demand, volume, and liquidity are fundamental concepts that underpin trading strategies and market analysis.

When demand rises, exceeding available supply, prices typically rise, indicating this more bullish sentiment.

When demand falls, leaving an excess of supply, prices typically fall, indicating a more bearish sentiment.

Traders prioritize liquidity when selecting assets to trade, as higher liquidity generally translates to lower trading costs and reduced execution risk.

Market prices are influenced by various factors, from economic indicators to geopolitical events, mastering the interplay between supply and demand is paramount for traders seeking to capitalize on emerging trends to identify trading opportunities. To engage better in the markets we must understand these key terminology concepts.

Why is Supply and demand important?

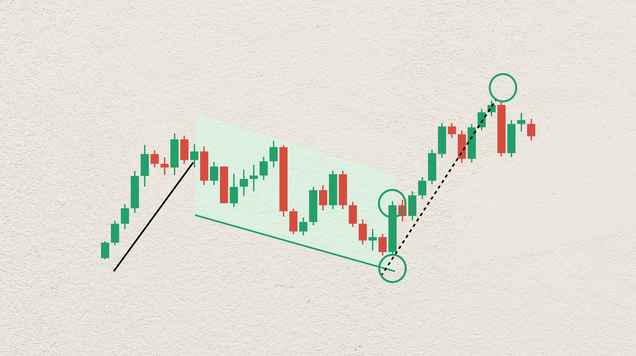

Supply and demand are fundamental economic principles that dictate market prices. Supply refers to the quantity of a product or asset available for sale, while demand represents the desire of buyers to purchase it. When supply exceeds demand, prices tend to fall as sellers compete to attract buyers. Conversely, when demand exceeds supply, prices rise due to increased competition among buyers.

Therefore, understanding supply and demand aspects helps identify potential price trends and anticipate market movements.

Supply and Demand

The law of supply and demand states that the price of an asset will adjust based on the balance between supply (the quantity of a product or asset available for sale) and demand (the desire of buyers to purchase it).

- When demand rises, exceeding available supply, prices typically rise, indicating this more bullish sentiment.

- When demand falls, leaving an excess of supply, prices typically fall, indicating a more bearish sentiment.

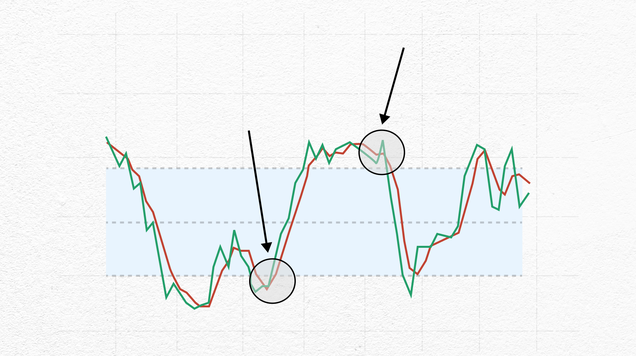

Traders analyze supply and demand dynamics to identify potential buying or selling opportunities and anticipate future price movements.

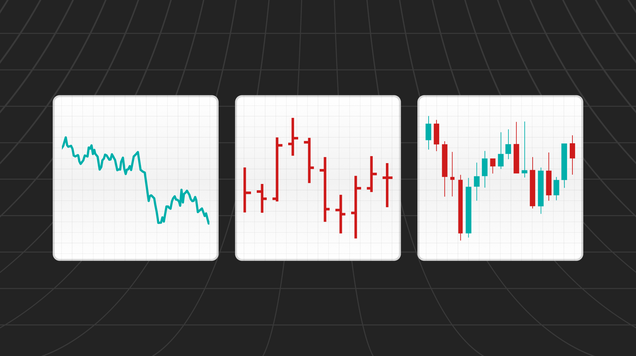

Volume

Volume refers to the total number of shares or contracts traded within a specific time frame, such as a trading day. It provides insights into market activity and the level of investor participation in a particular asset. High trading volume often accompanies significant price movements, indicating strong market interest and liquidity. Conversely, low volume may suggest limited market interest or indecision among traders. Volume analysis helps traders gauge the strength of price trends, confirm market reversals, and identify potential breakout or breakdown points.

Liquidity

Liquidity refers to the ease with which an asset can be bought or sold in the market without significantly impacting its price.

Highly liquid assets have ample trading activity and tight bid-ask spreads, allowing traders to enter and exit positions quickly and at predictable prices. In contrast, illiquid assets have low trading volume and wider bid-ask spreads, making it more challenging to execute trades without affecting market prices.

Liquidity risk arises when trading in illiquid markets, as it may lead to slippage and increased transaction costs. Traders prioritize liquidity when selecting assets to trade, as higher liquidity generally translates to lower trading costs and reduced execution risk.

In summary, supply, demand, volume, and liquidity are fundamental concepts that underpin trading strategies and market analysis. By understanding these key terms and their implications, traders can better understand the market, identify trading opportunities, and manage risk more effectively.