Mastering trade execution: a guide to limit, market, and stop orders

Your guide to selecting the appropriate order type

Selecting the right order type is a critical step toward achieving trading goals.

Limit orders control the price at which a trade is executed.

Stop orders trigger a trade once the market reaches a certain price level, potentially helping to limit losses or capture gains.

A guide into the fundamentals of trade execution, focusing on three essential order types: limit, market, and stop orders. Understanding these order types is highly important for effective trade management, risk control, and opportunity exploitation.

Investors often opt for other order types than the most common market order, to automate their trading strategies and sticking to predetermined entry and exit points.

Limit orders enable precise price control, allowing traders to specify the maximum or minimum price at which they are willing to buy or sell an asset. Whilst stop orders provide a safeguard against adverse market movements by triggering trades once a certain price level is reached, thereby managing risk effectively.

Selecting the appropriate order type hinges on various factors, including trading objectives, market analysis, and risk tolerance. Whether prioritizing price precision, swift execution, or risk mitigation, traders must strategically deploy limit, market, and stop orders to align with their goal.

Here's an overview of each order type:

Market Order

A market order reflects an immediate execution at the best available price. Unlike limit orders, which specify a price at which the trade should be executed, a market order prioritizes speed of execution over price.

Limit Order

A limit order is an instruction given to a broker to execute a trade at a specified price or better. When you place a limit order, you are essentially setting the maximum price at which you are willing to buy or the minimum price at which you are willing to sell.

Once the market price reaches your specified limit price, the order is executed. If the market does not reach your specified price, the order remains open until it is cancelled or expires.

Buy limit order: A buy limit order is placed below the current market price, indicating that you want to buy the asset at a lower price than what it's currently trading at.

Sell limit order: A sell limit order is placed above the current market price, indicating that you want to sell the asset at a higher price than what it's currently trading at.

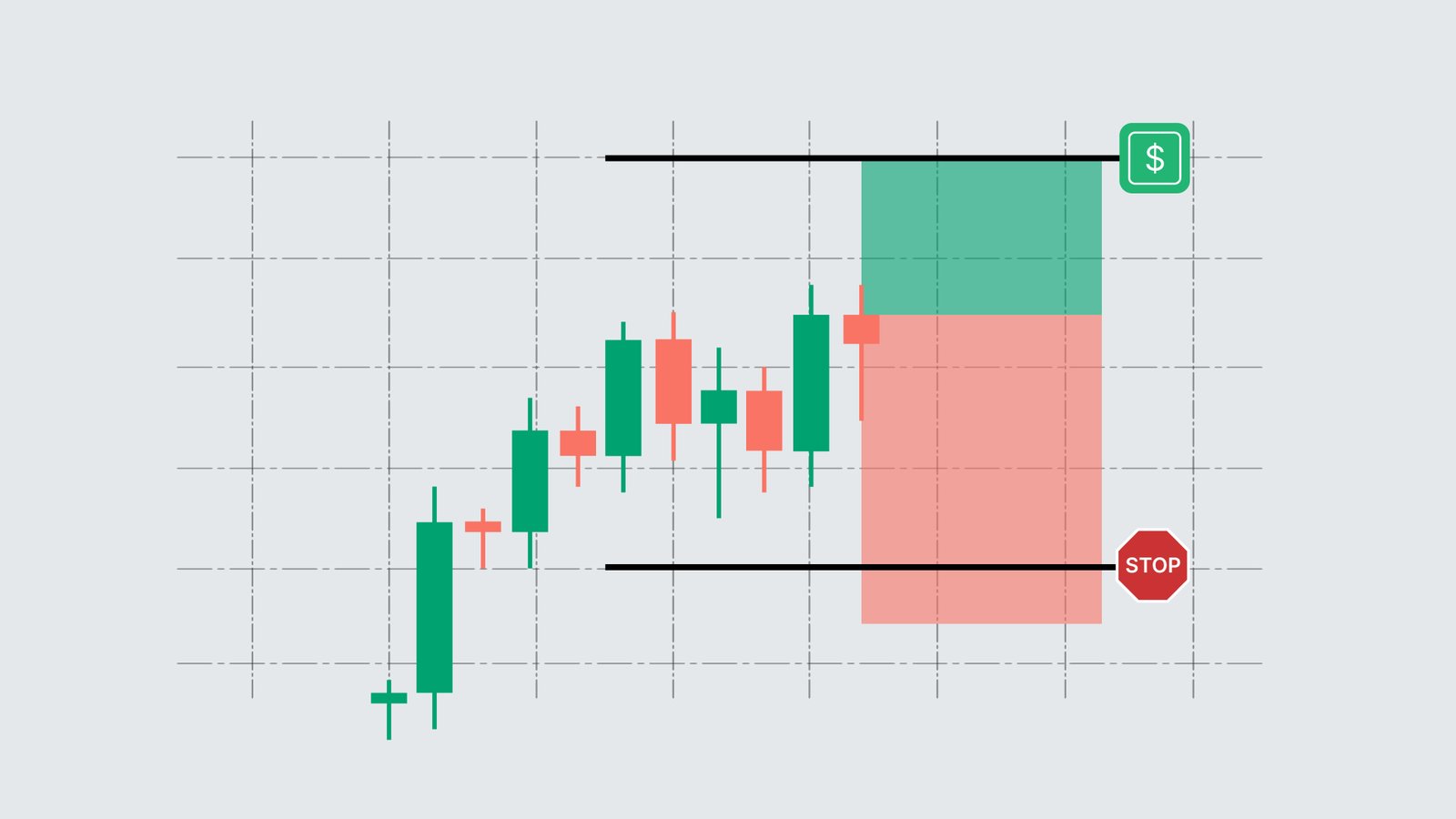

Stop Order

A stop order, also known as a stop-loss order, is designed to limit potential losses by automatically triggering a market order to buy or sell an asset once it reaches a specified price level, known as the stop price. Stop orders are commonly used to exit a trade if the market moves against the trader's position.

Buy stop order: A buy stop order is placed above the current market price. It is triggered when the market price rises to or above the stop price, indicating that you want to buy the asset once it starts moving in an upward direction.

Sell stop order: A sell stop order is placed below the current market price. It is triggered when the market price falls to or below the stop price, indicating that you want to sell the asset once it starts moving in a downward direction.

The key difference between a buy limit and a buy stop order lies in their execution conditions:

Buy limit order: This type of order is placed below the current market price. It's used when a trader wants to buy a security at a price lower than the current market price. It guarantees that the trade will only be executed at the specified limit price or better.

Buy stop order: You set a price to buy above the current market price. It triggers a purchase once the price rises to or above that level, anticipating a continued rise in price. It's like saying, "Buy if the price goes higher than it is now."

In essence, with a buy limit order, you're looking to buy at a lower price than what it currently is, ensuring a good deal. With a buy stop order, you're looking to buy once the price starts rising, aiming to catch an upward trend.