Liquidity sweeps explained: how to identify and trade them

A liquidity sweep is a fast probe beyond an obvious high or low to trigger clustered orders, followed by either a sharp rejection back into the range or clean acceptance beyond the level. Read the mechanics, learn the tells, and turn that volatility into a planned trade.

Sweeps target stop clusters at equal highs/lows.

Rejection favors reversal; acceptance favors continuation.

Map buyside and sellside liquidity before the move.

Use sweeps as confluence with FVGs and order blocks.

What liquidity sweeps are

In price-action and SMC/ICT trading, a liquidity sweep is the market’s way of reaching for fuel. Large participants push price through a well-watched level to trigger pending buy or sell orders—breakout buys, stop losses, and resting limits. That burst of activity provides the liquidity needed to enter or exit size with minimal slippage. After the sweep, price either rejects and snaps back into the prior range (failed break) or accepts and starts building value beyond the level (true break).

Liquidity and its two sides

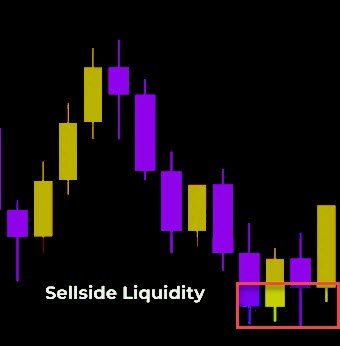

Think of liquidity in terms of where stops cluster. Buyside liquidity (BSL) sits above recent highs, where short sellers tend to park stop losses; sellside liquidity (SSL) sits below recent lows, where long holders park stops. Highs, lows, round numbers, and range edges are natural stop magnets. A sweep of BSL often precedes a bearish reversal; a sweep of SSL often precedes a bullish one—unless the market accepts beyond the level and trends.

How to identify a sweep

Start by marking equal highs/lows, prior day’s high/low, weekly opens/closes, and clean round numbers. As price approaches, watch the close, not just the wick. A typical sweep pierces the level and then closes back inside the prior range (rejection). Volume or tick activity usually spikes on the stab and fades on the recoil. If, instead, candles keep closing beyond the level and pullbacks are shallow, that’s acceptance—the sweep flushed weak hands and the path of least resistance continues.

Bullish and bearish sweeps

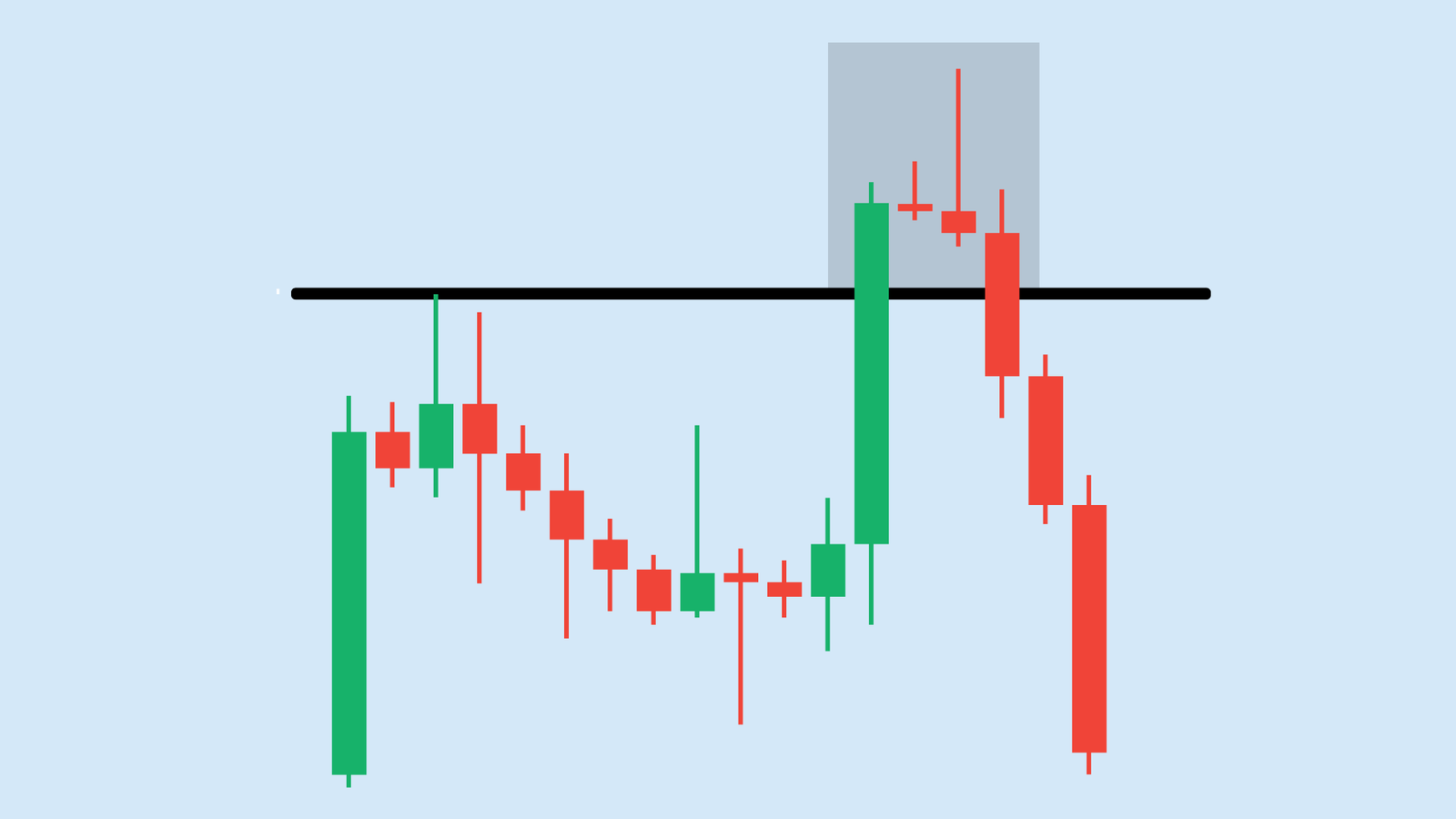

A sellside sweep drives below a recent low (into SSL), triggers stops on longs, and springs back above—bullish bias if the reclaim holds. A buyside sweep runs above recent highs (into BSL), triggers stops on shorts and late breakout buys, then falls back under—bearish bias if the reclaim holds. In both cases, the bias is conditional: rejection = fade the move; acceptance = trade with it.

How to trade liquidity sweeps

Treat sweeps as confluence, not a standalone signal. Align with structure and use precise levels like fair-value gaps (FVGs) and order blocks (OBs) for entries.

Reversal (fade the failure). After a sweep and close back inside the range, look for a confirming candle (engulfing/pin) and enter in the opposite direction. Stop goes just beyond the sweep’s extreme plus a small ATR buffer. First target is the range midpoint; second is the opposing liquidity pool.

Continuation (trade the acceptance). After a sweep and hold beyond the level, look for a retest of the level or a nearby FVG/OB that forms in the new territory. Enter with the prevailing direction, invalidation set at a decisive close back inside the old range. Targets are the next swing liquidity or measured-move projections.

Long trade example

Price sweeps sellside liquidity beneath a tight range, immediately reclaims the level, and forms a bullish FVG on the next impulse. When price retraces into that FVG, a long entry with the stop just under the swept low aligns with the structure. First take-profit at 1R pays for the trade; trail the rest toward the prior range high (the buyside liquidity).

Short trade example

Price tags buyside liquidity above equal highs, stalls, and closes back under the breakout line while printing a bearish order block. A short on a minor pullback to the OB, with a stop just above the sweep high, targets the range midpoint first and the prior sellside liquidity second.

Sweep vs. grab: the key difference

Both ideas describe raids on stops, but the liquidity grab is a single-candle event—one bar pierces the level and snaps back, leaving a long wick (think gravestone/dragonfly-type behavior). A liquidity sweep can involve a brief consolidation beyond the level before returning. If price never returns and keeps closing beyond, label it a sweep that evolved into acceptance.

Time frames and when they matter

There is no “best” time frame. Sweeps show up from 1-minute to monthly charts. Reliability rises when the swept level belongs to a higher time frame (daily/weekly). Intraday entries often trigger on 1–15 minute charts after a higher-time-frame level gets swept.

Common mistakes

Chasing the spike instead of waiting for the decision (rejection or acceptance). Treating mid-range pokes as meaningful sweeps when no real liquidity sat there. Fighting higher-time-frame structure with micro entries. Using sweeps as the only signal rather than pairing them with FVG/OB confluence and session context (London open, NY overlap).

Liquidity sweeps are the auction’s stress tests. They reveal where stops and resting orders live and whether the market wants back into the range or onward into new territory. Map BSL/SSL, let the close tell you reject or accept, and execute with small, pre-defined risk at FVGs and OBs. Do that consistently and sweeps stop feeling like traps—they become a clear, repeatable edge.

FAQs

Can I trade solely with liquidity sweeps?

Use them as confirmation, not as the entire strategy. Combine with FVG/OB levels, time-of-day, and higher-time-frame bias.

What’s the difference between a liquidity sweep and a liquidity grab?

A grab is a one-bar wick through liquidity and back; a sweep can linger beyond the level before returning—or evolve into acceptance.

What’s the best time frame for sweeps?

Any, but higher-time-frame levels produce more reliable signals; drill down to lower frames for precision entries.

Where should I place my stop?

For reversal trades, a few ticks/pips beyond the sweep’s extreme; for acceptance trades, beyond the reclaimed level. Add a small ATR buffer to avoid noise.